FOR ADVISORS

The online advisor-suite to take your business model to the digital age.

Complete extraction

of receipts

Proactive customer care and management

Easy document

exchange

Scaling

possibilities

Optimal Customer

processes

Guaranteed data

security

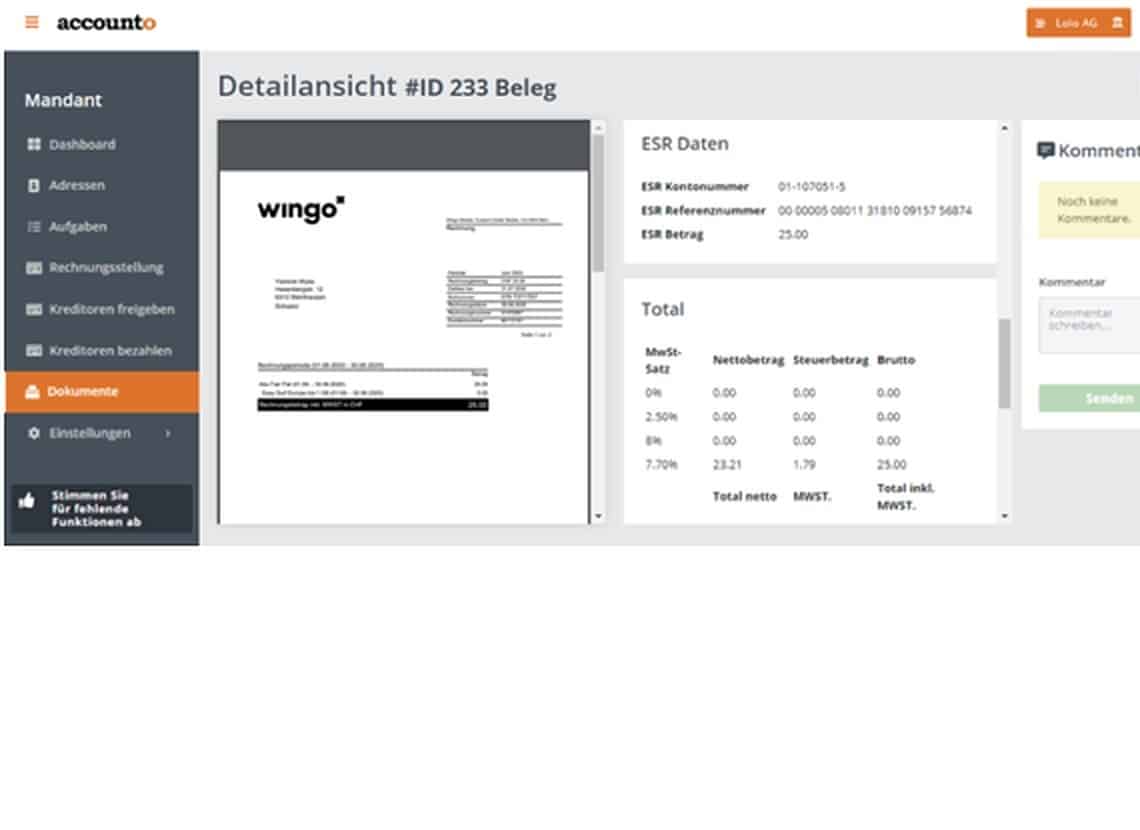

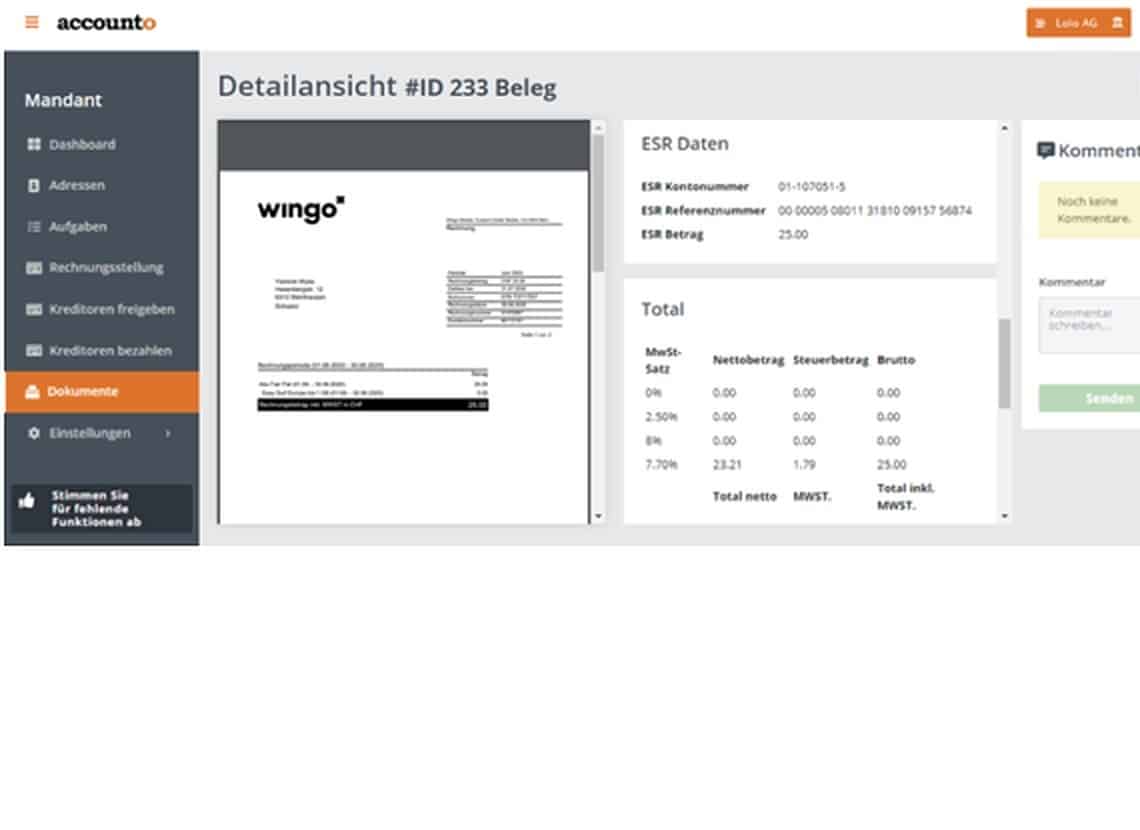

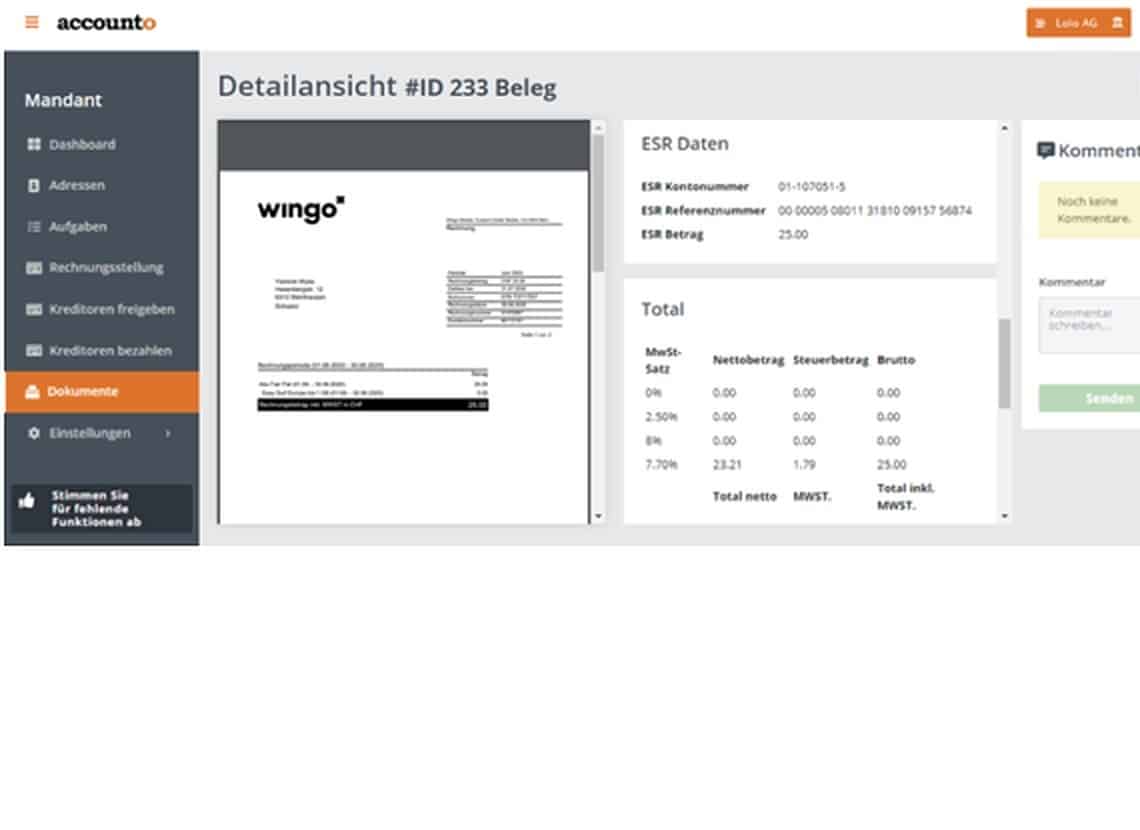

Document recognition

Accounting documents are extracted entirely and in high resolution. No more typing mistakes while manually extracting document data.

Document archive

Accounto takes care of the digital, systematic storage of your receipts. All receipts are digitized on a daily basis and stored in an audit-proof manner.

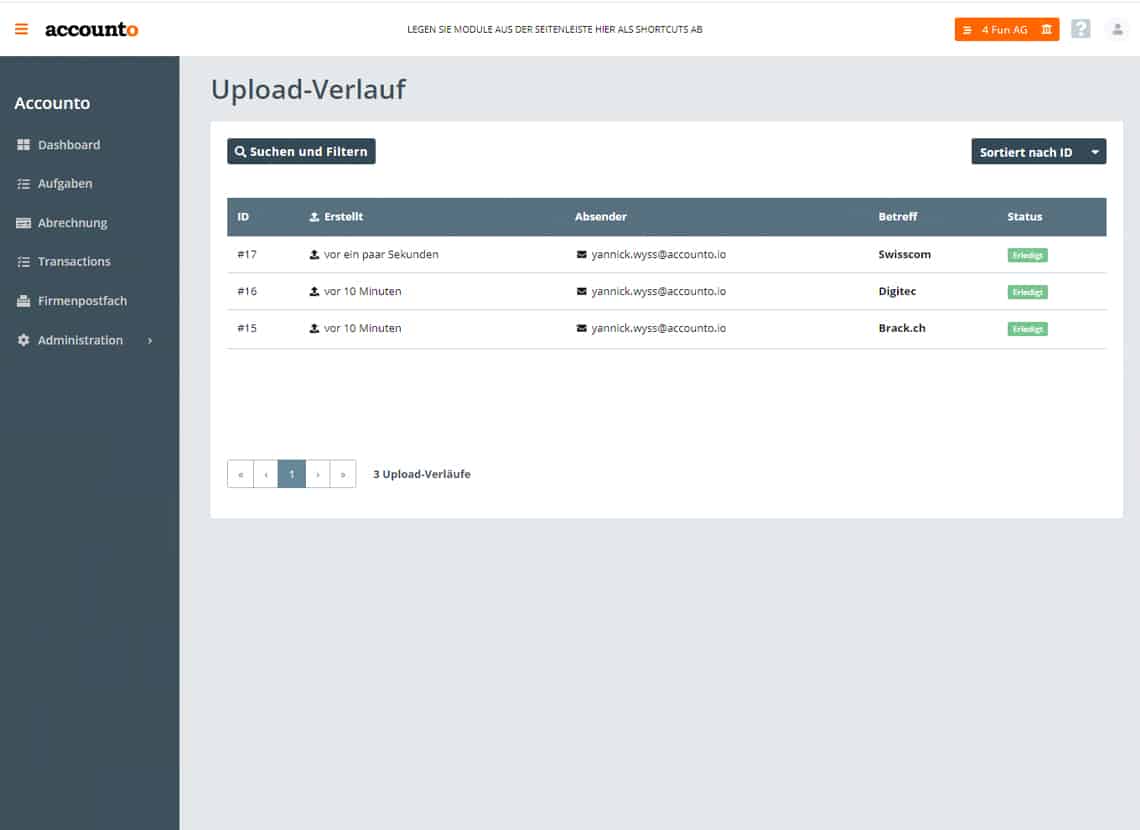

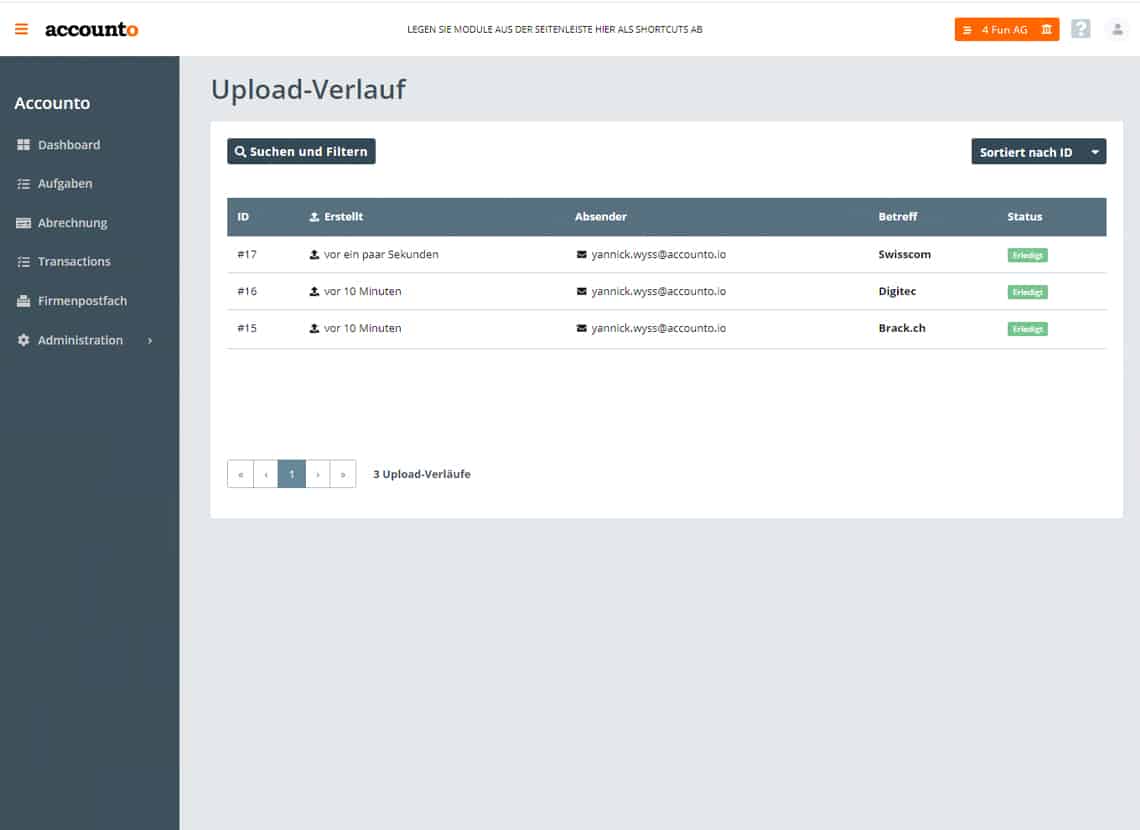

Document exchange

A physical transfer and the tedious sorting of documents is no longer necessary. You will receive your customers’ receipts digitally and can actively request missing receipts via our platform.

Task management

Simplify collaboration with your customers by using digital to-do lists. This way, you can keep track of all work, deadlines and dependencies.

Chances and risk management

The Chances and risk management tool enables you to proactively identify potential opportunities and risks of your customers at an early stage.

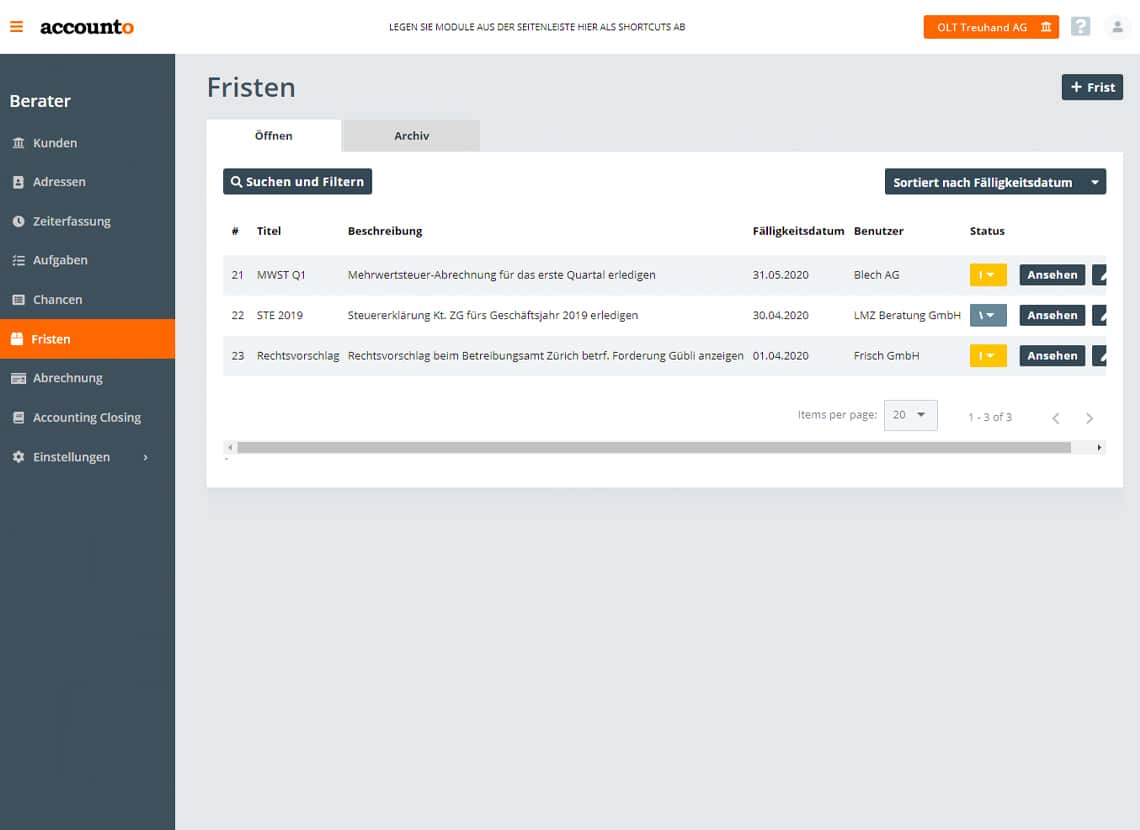

Deadline management

With our deadline management tool, you will never lose track of relevant dates, such as the due date for VAT.

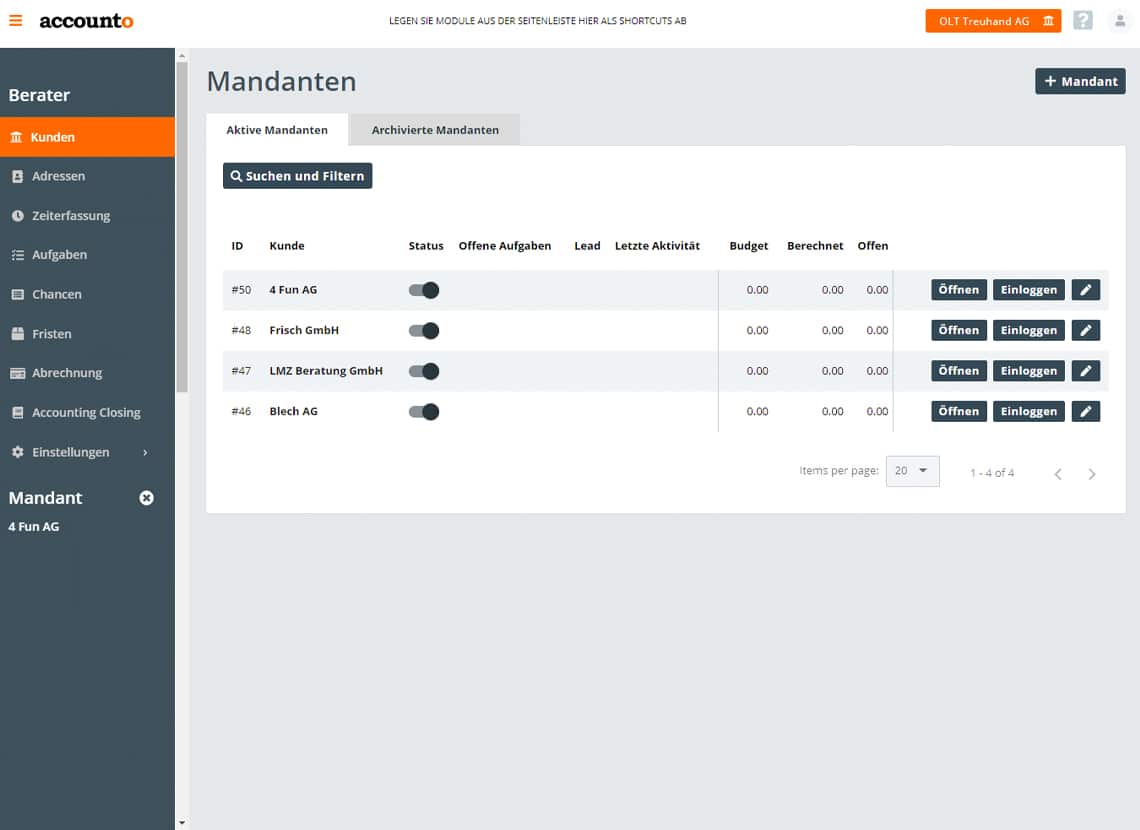

Client administration

Manage your customers digitally in one place. By getting daily updates of your customer base, keeping up with your customers gets much easier.

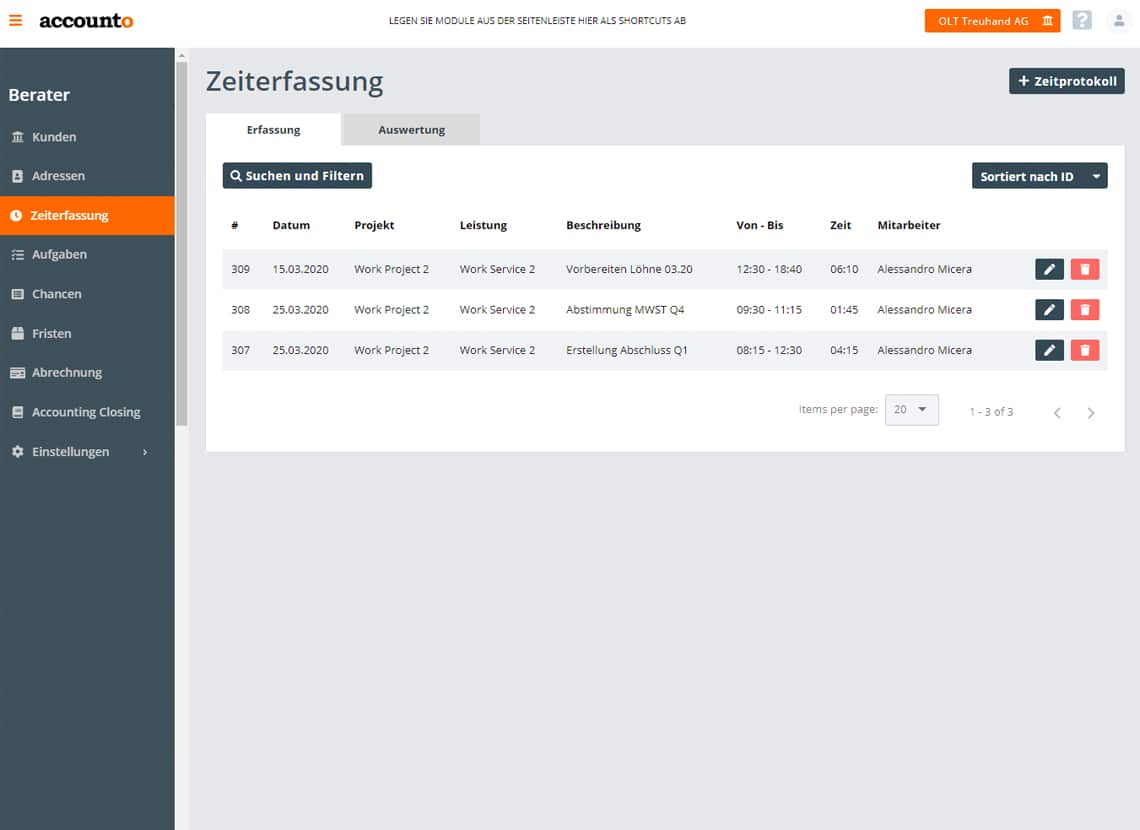

Simplify tracking your time

Record your hours worked for each client and simply create invoices with one click.

Book an Online Meeting

Would you like to know how the accounting solutions of tomorrow can simplify your life today? Simply book an free and non-binding Online-Meeting now! We will introduce you to all of Accounto’s functionalities and can respond to your concerns and questions specifically. A risk-free investment that will definitely pay off – that’s a promise!

For SMEs

Focus on your core business and work together with your advisor for effortless accounting.

Accounto Partner