We have compiled for you the three things your accounting software should offer so that you can relax as you approach year-end closing and can focus completely on your core business.

Although the year-end still seems to be far away, now is the best time to deal with the year-end closing. Now is when you still have the opportunity to greatly simplify your work life/life. Today we will share with you how intelligent accounting software can provide you with true added value and achieve year-end closing for you and your fiduciary with no night shifts.

Upstream closing tasks dominate the turn of the year

Before the fiduciary can start with the year-end closing, many preparatory tasks are needed. In doing that work, many fiduciaries look to «checklists» in order to simplify collaboration with the SME and make the closing process more efficient.

From most checklists it is soon evident how important a role is played by the clean preparation and transmission of business records. From the classic invoice through to the insurance policy, everything should be as structured as possible when it lands on the fiduciary’s desk.

It is easy to see the reason for these demands: If a fiduciary loses too much time because receipts are in disarray, the service charges increase rapidly. As a result, fiduciaries place a high value on a structured delivery of receipts. It is the only way they can offer a fiduciary service at an attractive price.

An accounting software «simplifies» upstream closing tasks

In order to hold down the fiduciary costs for these administrative tasks, many small business owners conscientiously work through their checklists during the holidays. But in truth: Who looks forward to spending time now, or during the holidays, with bank receipts, insurance policies and questions about dividends issued?

For this reason, many fiduciaries try to make the year-end closing procedures more customer-friendly and more digital. The goal is to free the SME from the upstream closing tasks (e.g. receipt delivery) or at least to provide substantial relief. The use of cloud software (makes data exchange between SME and fiduciary easier) is state of the art in this regard.

Without a doubt, cloud solutions provide an initial relief during the year-end closing. Instead of pushing multiple notebooks with documents back and forth, the digital cloud provides continual data transfer between SME and fiduciary.

The cloud alone is insufficient, however, to completely free you as an entrepreneur from time-consuming closing tasks. For that, three additional points are needed.

Point No. 1 – upstream closing tasks must be completely automated

The digital transmission of receipts between the SME and fiduciaries using traditional accounting programs barely reduces the repetitive and time-consuming closing tasks. Once the business documents are saved digitally, that is when the work really starts.

Depending on the application, either the SME or fiduciary must categorize the receipts (incoming invoice, insurance policy, contract, etc.) and then post them manually. The extremely time-consuming work to prepare for the closing still remains with the SME or the fiduciary.

Intelligent fully-automated accounting solutions – like those from Accounto – already completely free the SME as well as the fiduciary from the upstream closing tasks. For example, the software recognizes all business documents (such as invoices, insurance policies and contracts) automatically.

If the receipt (e.g. an incoming invoice) is accompanied by a financial accounting posting, this occurs mechanically with the help of artificial intelligence. That means that neither the SME nor the fiduciary must capture and enter the invoice. Also, the time-consuming account reconciliation (bank, accounts receivables and accounts payable) are fully automated with Accounto, which leads to a further relief in the year-end closing. In numbers: As an SME, thanks to this automation, you save about 85% of the workload.

Point No. 2 – use a platform to wrap up receipt-oriented communication

In connection with the year-end closing, the upstream tasks and in particular, the communication between the SME and fiduciary are a big challenge. Unfortunately, E-Mail ping pong and inconveniently timed telephone calls are not unusual.

Many accounting solutions pay almost no attention to this communication. As an intelligent accounting solution for SMEs and fiduciaries, Accounto goes one step further here.

First, because of the daily posting, at the end of the year there are hardly any inquiries about individual receipts. Second, Accounto makes possible – when necessary – an exchange at receipt level. If a submitted expense report seems strange, the fiduciary can ask you about this specific receipt by using the platform.

The necessary daily communication can be processed completely through accounto: time zone independent, receipt oriented and always auditable – even years later. All receipts, including communication, are stored in the digital document archive. The result: Less need for clarification and fewer misunderstandings, more time for discussions that will bring your business further.

Point No. 3 – Digital task management provides transparency

In the traditional closing procedure, you get physical checklists and at a later time, usually e-mails with the open points concerning the year-end closing. Pendings and queries thus are often not centralized and easy to access and review. Accounto solved this problem with digital task lists.

All pendings can be captured on Accounto, directed to the person responsible and marked with a due date. Of course, it is also possible to exchange specific jobs via the platform.

You always retain an overview and from a central location can administer all pendings concerning your finances. The task lists also lead to reduced e-mail traffic, more clear responsibilities and ultimately, to more transparency.

As of now, year-end closing means consulting time

Certainly, you are asking which tasks you, as SME owner, still must perform for the year-end closing. The answer is simple: none! You as the entrepreneur should focus on your core business. You also profit indirectly from this automation.

Your fiduciary needs less time for the repetitive tasks. The resources liberated thereby can then be invested by the fiduciary in precisely those places that help you to optimize your own business: in-depth analyses (e.g. cash flow statement), optimization recommendations for accounts receivable or inventory management and targeted tax optimizations (e.g. pay v. dividends).

A practical example

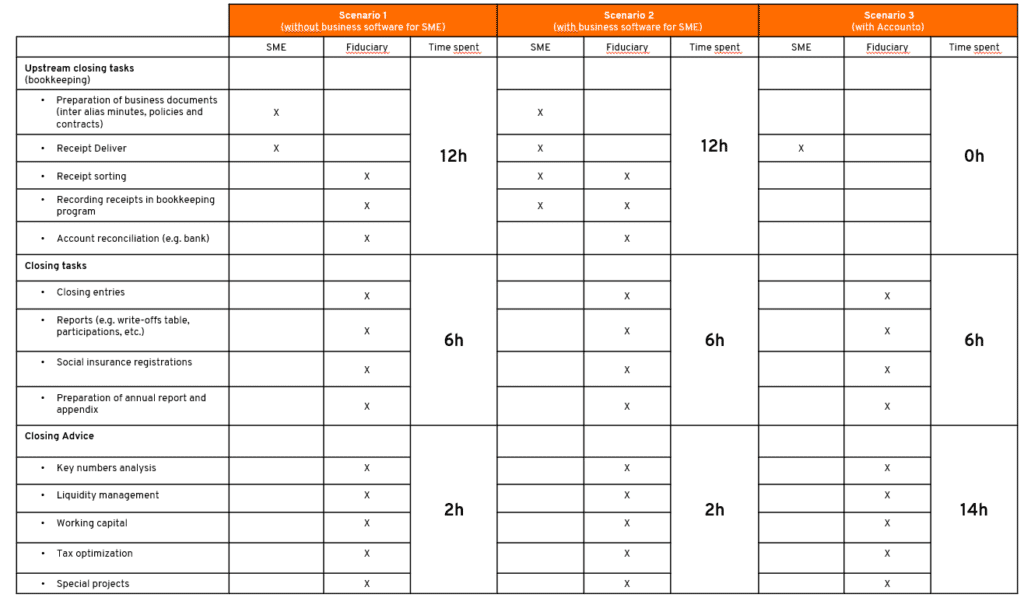

We compare three common scenarios. In each case, a fiduciary prepares the closing.

Scenario 1: The SME uses no business software and works together with a fiduciary.

Scenario 2: The SME uses one classic business software, prepares its own books and also counts on collaboration with a fiduciary.

Scenario 3: The SME does its accounting with Accounto and a fiduciary.

For comparison, we use a limited liability company (two employees and 10 – 20 receipts per month) which receives the following services from a fiduciary:

- Bookkeeping,

- Year-end closing,

- Value-added tax calculation,

- Tax return.

According to the bidding portal Gryps, the fiduciary charges about CHF 2500 for the listed services, which corresponds to an average hourly rate of CHF 120 and an annual workload of about 20 work hours.

As can be seen from the comparison above, when compared with traditional solutions, Accounto eliminates the bookkeeping grunt work (upstream closing tasks). As a result, the fiduciaries can apply their expertise more where it makes sense: advising the individual client.

Simultaneously, you also have the pleasure of having an external CFO, whereby your own expense is reduced to an absolute minimum. The important thing is: You pay the same as before for fiduciary services, but receive substantially more for the money!

Prepare everything worry-free with Accounto and really enjoy the holidays

Do you want to finally have more time for what’s important? Then get to know Accounto free of charge and give yourself a relaxed year-end closing for 2021. You are welcome to invite your current fiduciary to join you.