PRODUCT RELEASES

Product Releases

We are very pleased to present you our new products at Accounto. Our team has been working hard, and (almost) every week we will present you some news. Your feedback is important to us, so let us know. Stay tuned for innovations!

- New features for better experiences.

- Enhancements to boost productivity.

- Bug fixes and performance improvements.

December 2024/January 2025

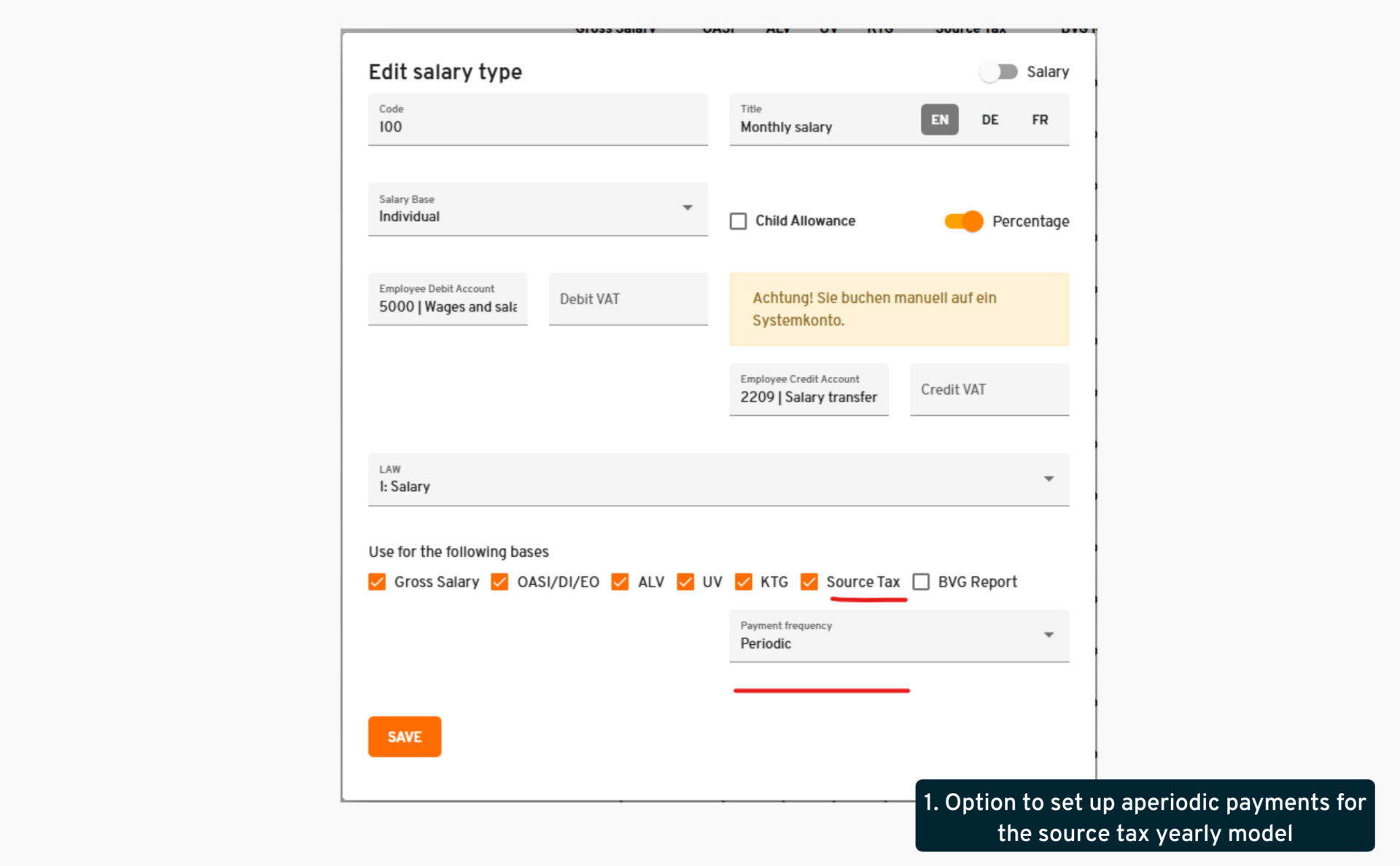

1. Option to set up aperiodic payments for the source tax yearly model

- where: Client view > Payrolling > Settings > Salary types

- changes: A new setting was introduced in the salary type configuration, used for source-taxed salaries within the yearly model. When the “source tax” tickbox is selected on the salary type, a new option appears called “payment frequency”, allowing users to identify the salary type as being either „periodic“ or „aperiodic.“ If a salary is marked as aperiodic (e.g., bonuses), it will no longer be annualized in the source tax calculation when the employee has not worked the full year. Instead, these payments are added after calculating the periodic salary.

- what’s in it for me: This update ensures more accurate source tax calculations for employees with irregular payments, preventing the risk of errors and the need for manual corrections. It also provides clients with flexibility in defining how different salary types should be handled automatically.

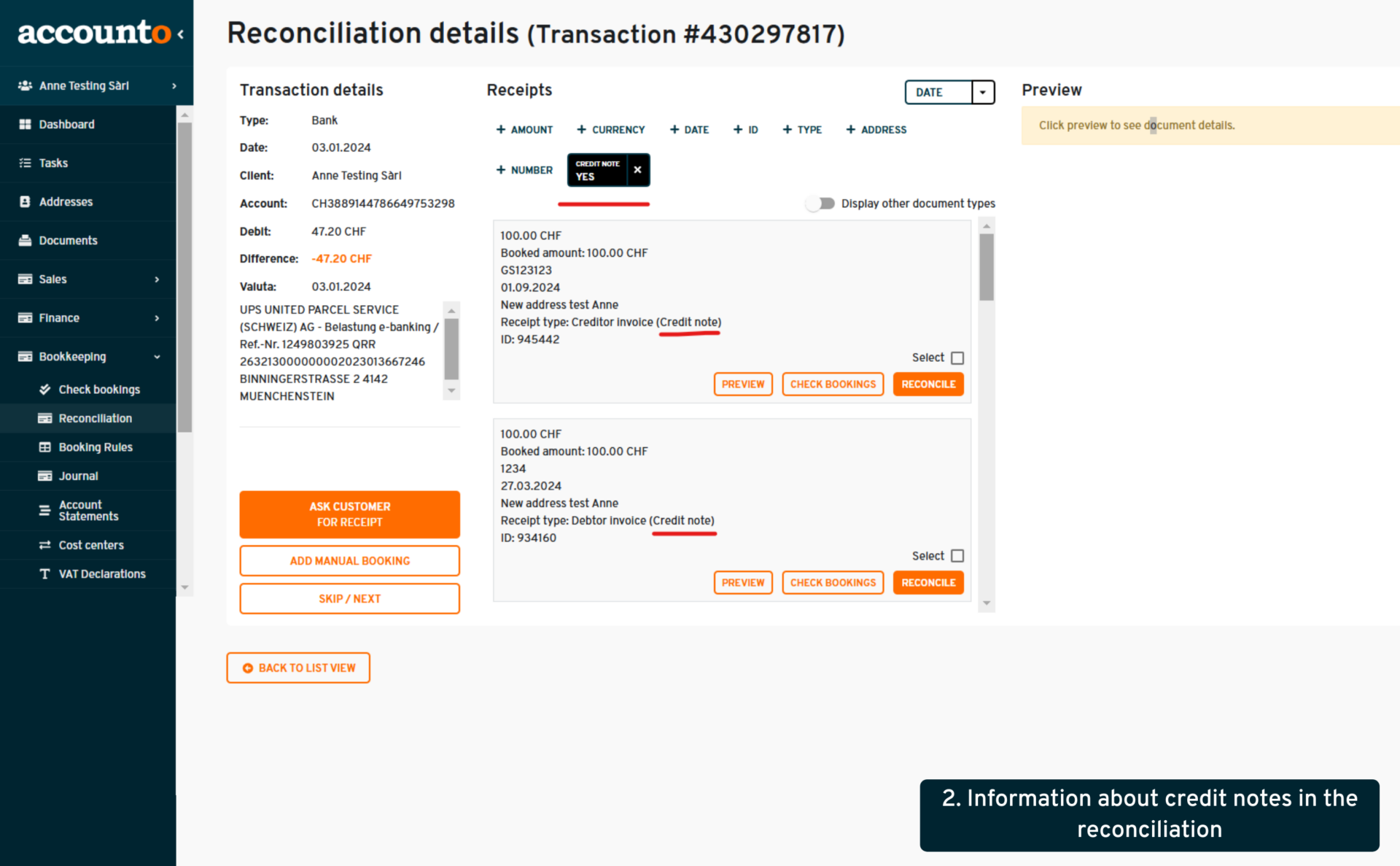

2. Information about credit notes in the reconciliation

- where: Client view > Bookkeeping > Reconciliation

- changes: Previously it wasn’t displayed whether a receipt is a credit note or not, making it difficult to identify and reconcile these documents correctly. So we have added this information to the corresponding documents (next to the receipt type) and have added a filter to search by credit note (yes/no).

- what’s in it for me: Increased clarity and efficiency during reconciliation of credit notes. This function saves time and minimizes errors when managing reconciliation.

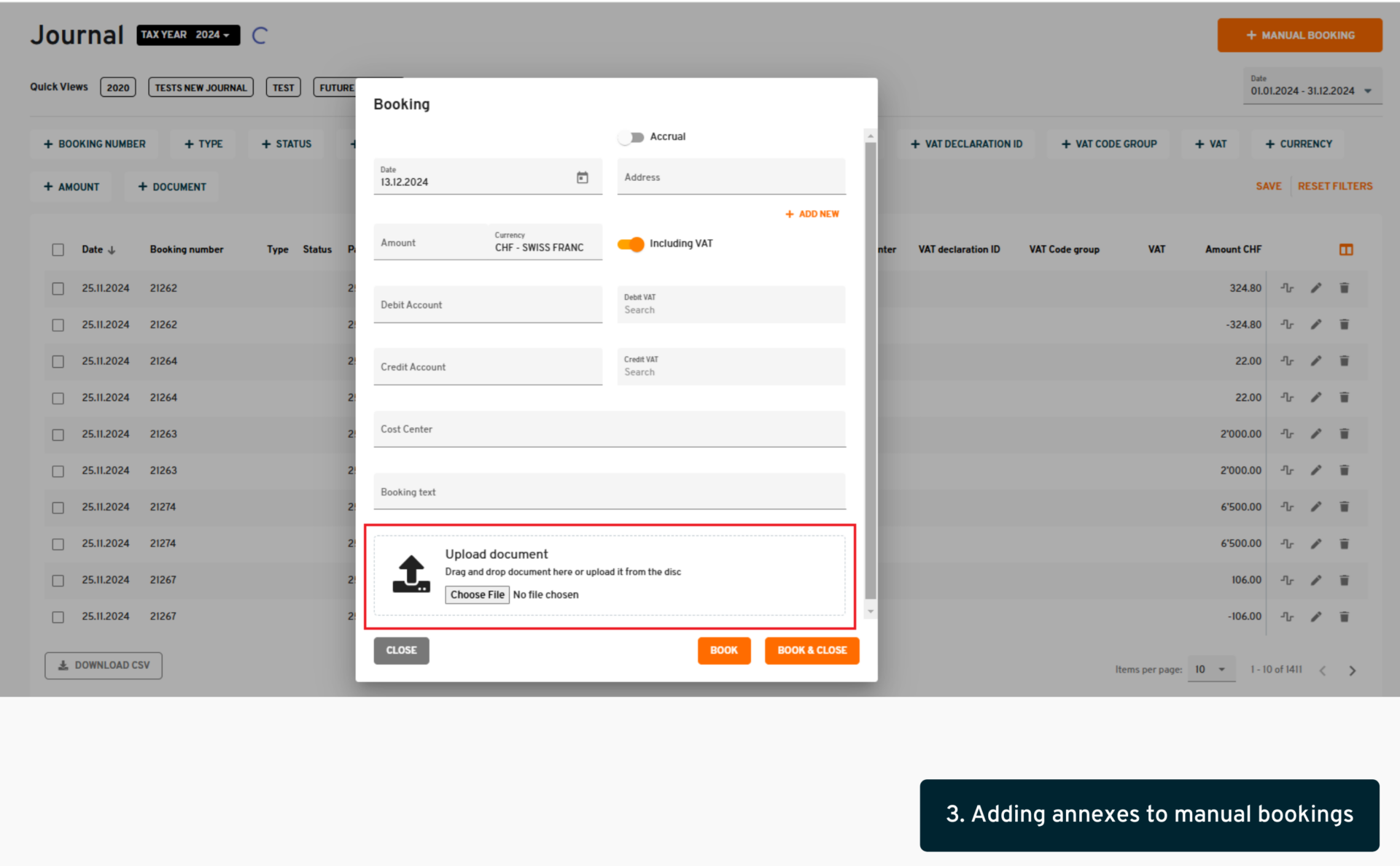

3. Adding annexes to manual bookings

- where: Client view > Bookkeeping > Manual booking & Manual reconciliation

- changes: We now allow adding a document as annex to a manual booking or a transaction’s booking. This function is used within two modules:

In the manual booking modul (in journal / account statements / cost centers), there is an option to add a document to the existing or newly created manual booking. If doing so, the manual booking will become part of the document, and the document will go through extraction but won’t be booked separately (as that original manual booking will be considered the documen’t booking).

In the reconciliation, when manually reconciling a transaction (as manual booking), there is an option to add a document as annex. This will not only link the document to the transaction, set both elements to status “reconciled”, but also link this manual booking to the document (thus please note that the document should in principle not receive an additional booking afterwards, else there would be a double impact on the accounts)

We have implemented a new document „source“ (indicating where it was imported from) called „annex“, visible in the documents list and detailed view

- changes: We now allow adding a document as annex to a manual booking or a transaction’s booking. This function is used within two modules:

- what’s in it for me: Another step towards more flexibility for our clients. This feature will allow you to be much faster when reconciling transactions and in general during closing activities, if documents are found or retrieved „late“ they can be easily annexed without passing through the entire document processing.

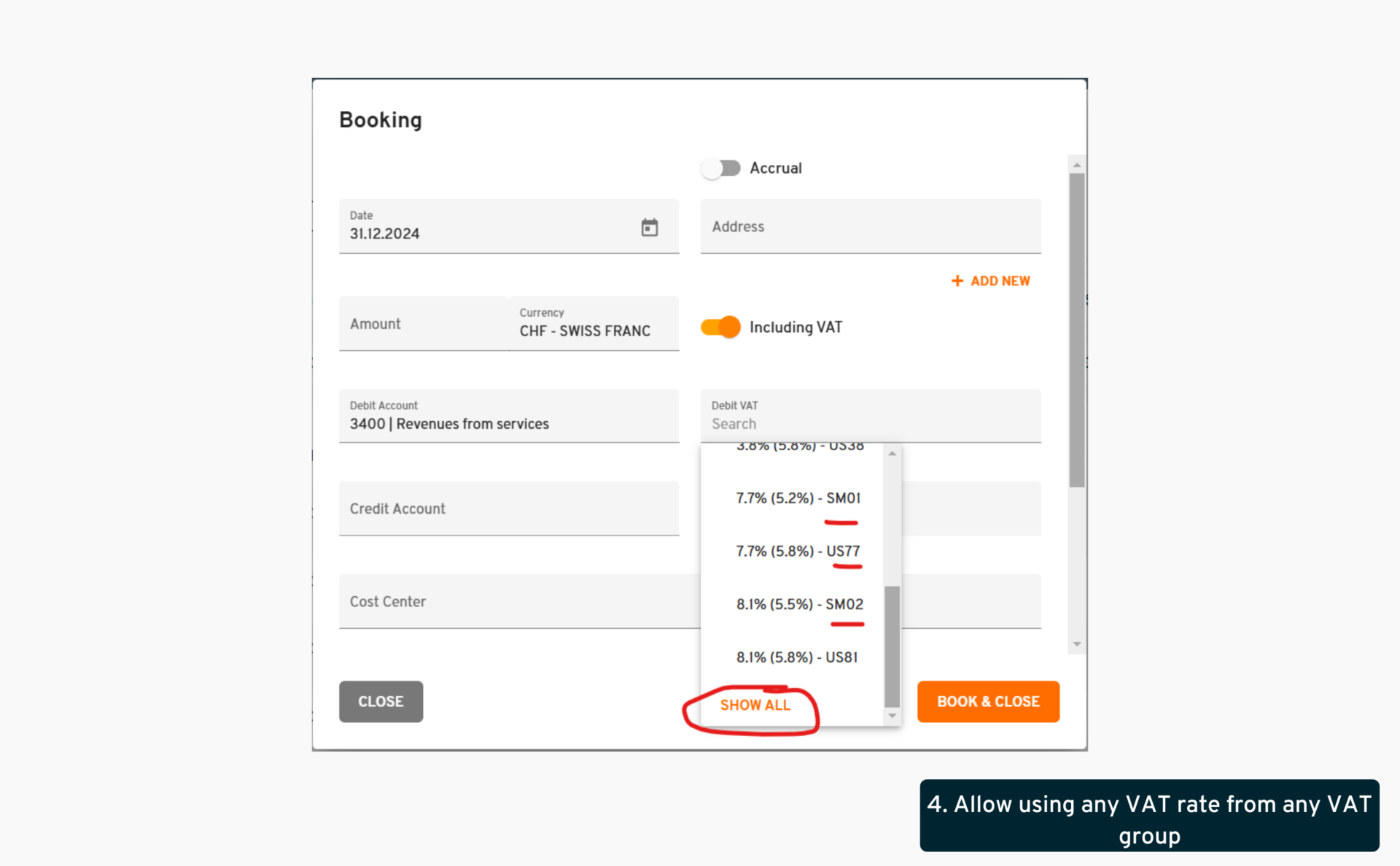

4. Allow using any VAT rate from any VAT group

- where: Throughout the platform (client view)

- changes: A system-wide update was done that allows users to select any VAT rate on a booking, regardless of the VAT group associated with the account. In the VAT fields on booking forms, we still display the standard VAT codes by default but a new option “show all” allows the user to choose from any other non-standard VAT rate. We also implemented a new unique identifier (called “code”) which can be seen in “Edit tenant” and is displayed in the VAT selection dropdown on booking forms, allowing for easier search for the relevant VAT rate.

- what’s in it for me: By being able to select any VAT code we allow our clients the maximum amount of flexibility across our platform, making sure that they can apply their various, and sometimes very specific, use cases whenever needed.

5. Display draft vat declaration ID in journal

- where: Client view > Bookkeeping > Journal / Account statements / Cost centers

- changes: Until now the existing “VAT declaration ID” column displayed in the Journal / Account statements only appeared for bookings contained in a VAT declaration in status “done”. In this additionnal step, we also show the VAT declaration ID when the declaration is in “draft” status, allowing users to review which bookings are included and check the details before finalizing the declaration.

- what’s in it for me: This update provides clients with greater transparency and control over their VAT declarations before submission. This helps prevent errors, improves financial oversight, and enhances the efficiency of the VAT reporting process.

6. CSV export of accounting chart

- where: Client view > Settings > Accounting chart

- changes: In the Accounting chart menu, a new function (button) was added to export a CSV version of the tenant’s accounting chart. The CSV is structured in a way that includes both the categories as well as the accounts in the same file, distinguishing them by the “record type” column, allowing for a clear overview and easy filtering within the CSV. Other relevant information such as default VAT rates and cost centers, balancing function active yes/no, etc. provide full transparency on these accounts’ setup.

- what’s in it for me: This CSV export has been long-awaited by our clients who will benefit from a clearly structured view of their accounting chart, providing more transparency and simplifying the verification and modification process for our users, especially during the onboarding.

7. Tags column and filter in creditors payment view

- where: Client view > Finance > Pay invoices

- changes: A new „Tags“ column and filter was added in the „Pay invoices“ section. This column displays all tags added to the invoices, through the document detailed view or via Mobile app upload. Thus, when filtering by a specific tag, users are able to pay invoices accoring to these tenant-specific categorizations, allowing for increased efficiency in their workflows.

- what’s in it for me: This small addition will enhance our clients‘ ability to quickly identify and filter invoices based on their internal categorization, improving workflow efficiency.

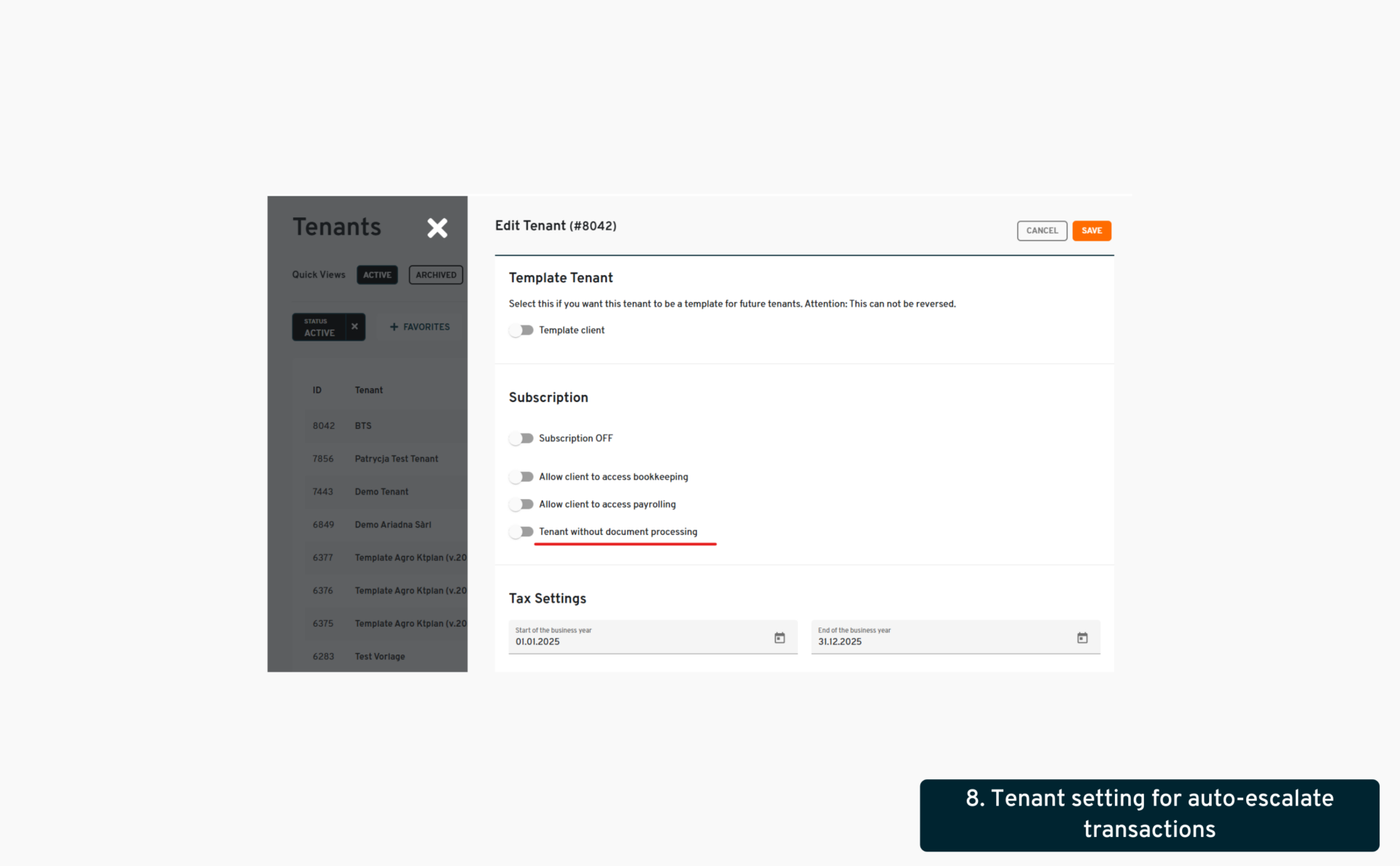

8. Tenant setting for auto-escalate transactions

- where: Advisor / Internal view > Edit tenant

- changes: A new option has been added to set a tenant as “without document processing”, meaning that the tenant’s bank transactions will always be automatically escalated.

- what’s in it for me: With this new option we are ensuring a clear process for clients, thus handling all reconciliations automatically through booking rules, or manually if needed, without the document processing.

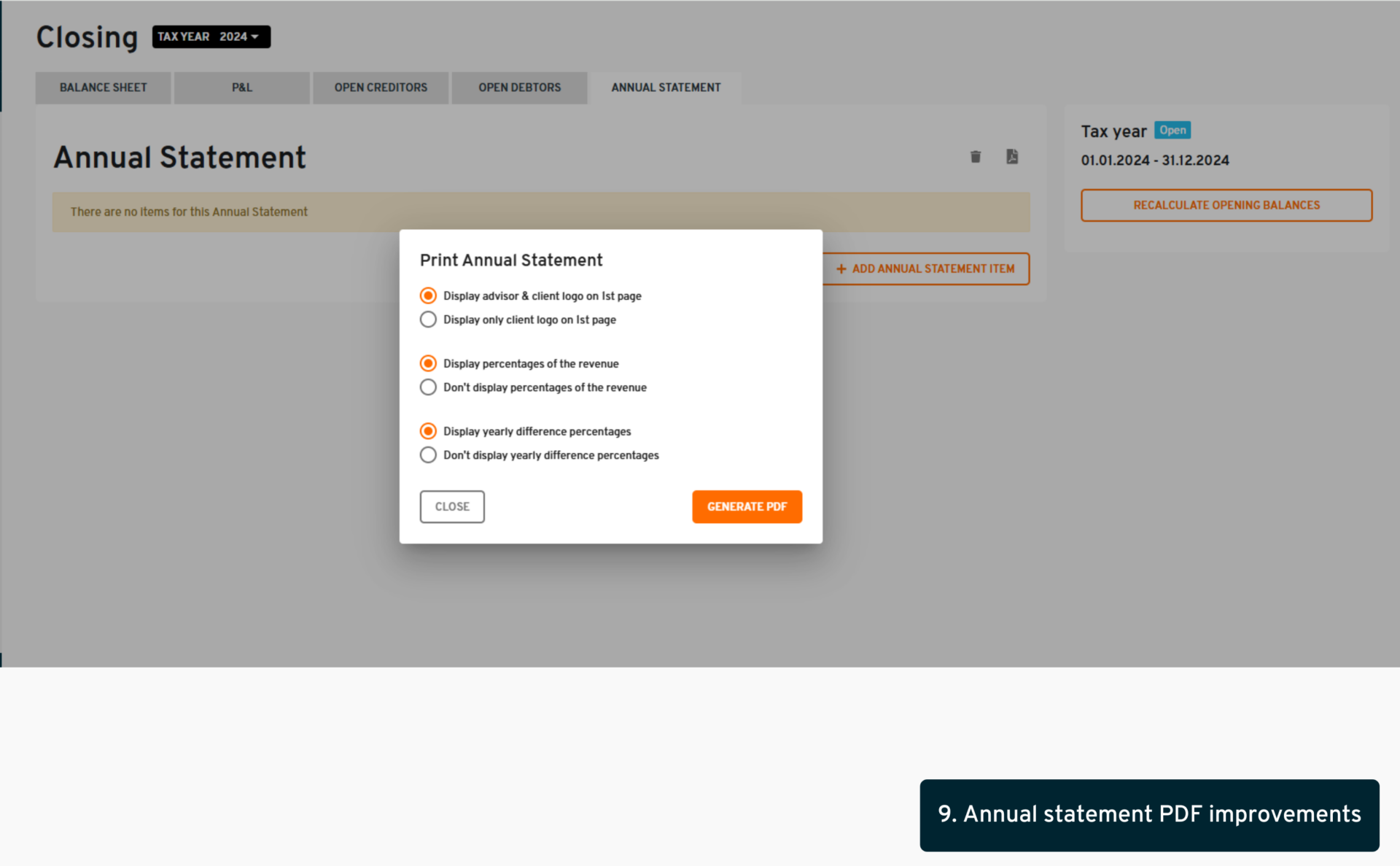

9. Annual statement PDF improvements

- where: Client view > Bookkeeping > Closing > Annual statement

- changes: Several improvements were done to the Annual statement. We have added two more options when generating the PDF, allowing users to choose whether to display the percentages of the revenue and whether to display the yearly difference percentages on the PDF. The naming and positioning of all subtotals and accounts was changed to match the tenant’s accounting chart exactly. Some layout improvements were also made (column widths are now the same for the different years).

- what’s in it for me: This is an additional step towards greater customization and flexibility, while ensuring greater accuracy regarding matching the report with the tenant’s accounting chart.

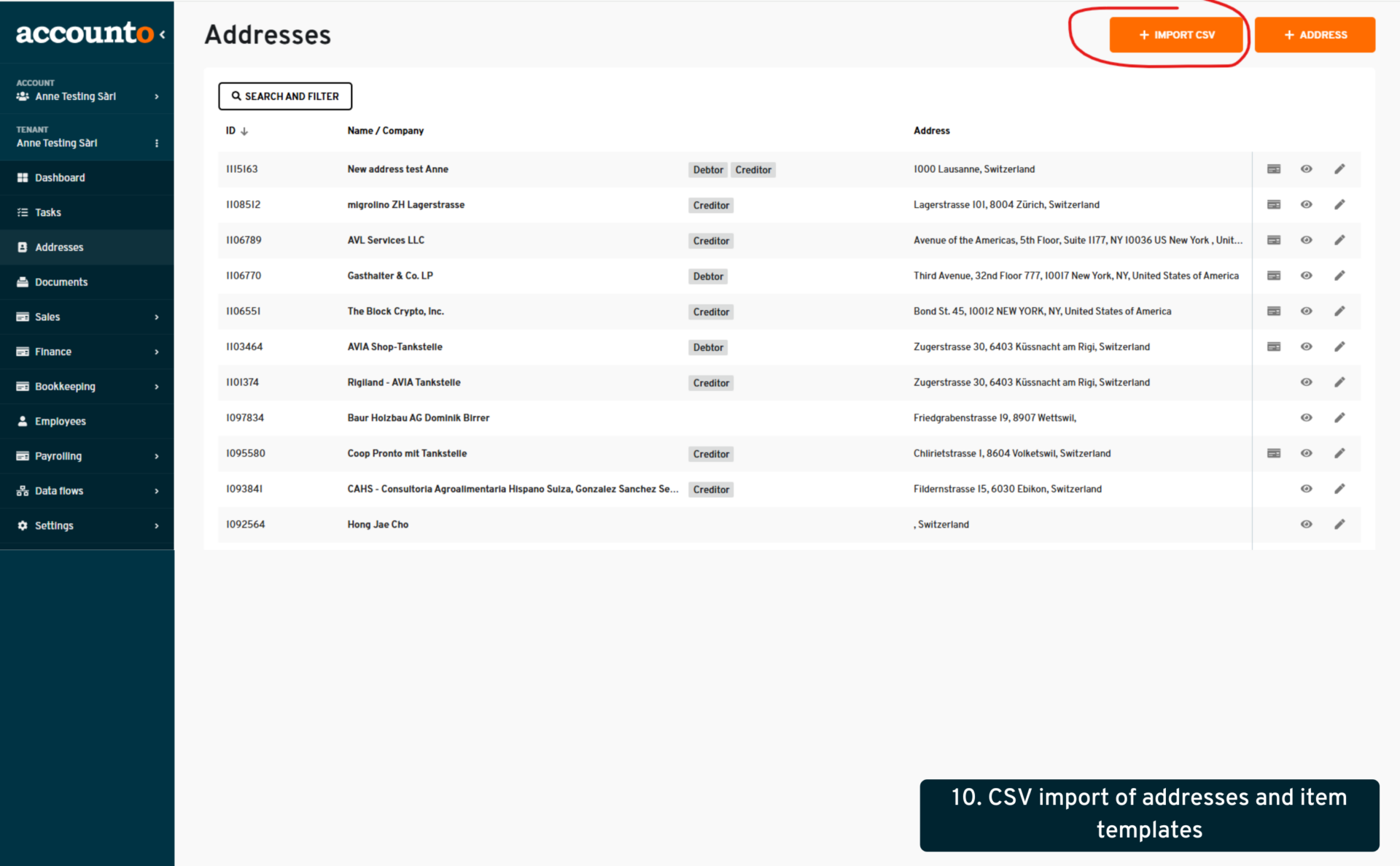

10. CSV import of addresses and item templates

- where: Tenant view > Addresses & Sales > Item templates

- changes: The CSV import feature was implemented this time for the addresses and sales item templates. Users can now import addresses including all relevant fields (company/person details, contact information, and legal type, etc.), in our three languages. Likewise, item templates can be imported incl. all relevant fields (title, description, unit, price, VAT), and tenant-specific units previously created via the settings are also taken into account in the import. The CSV import menu displays the status and possible errors if they arise. If an import is removed, the items/addresses created are immediately deleted.

- what’s in it for me: This feature simplifies onboardings, allowing clients to import addresses and sales item templates in bulk and thus being ready within minutes to start using the Sales module, instead of setting everything up manually or waiting for document extraction. The ability to track imports and validate data ensures a smooth process and usability.

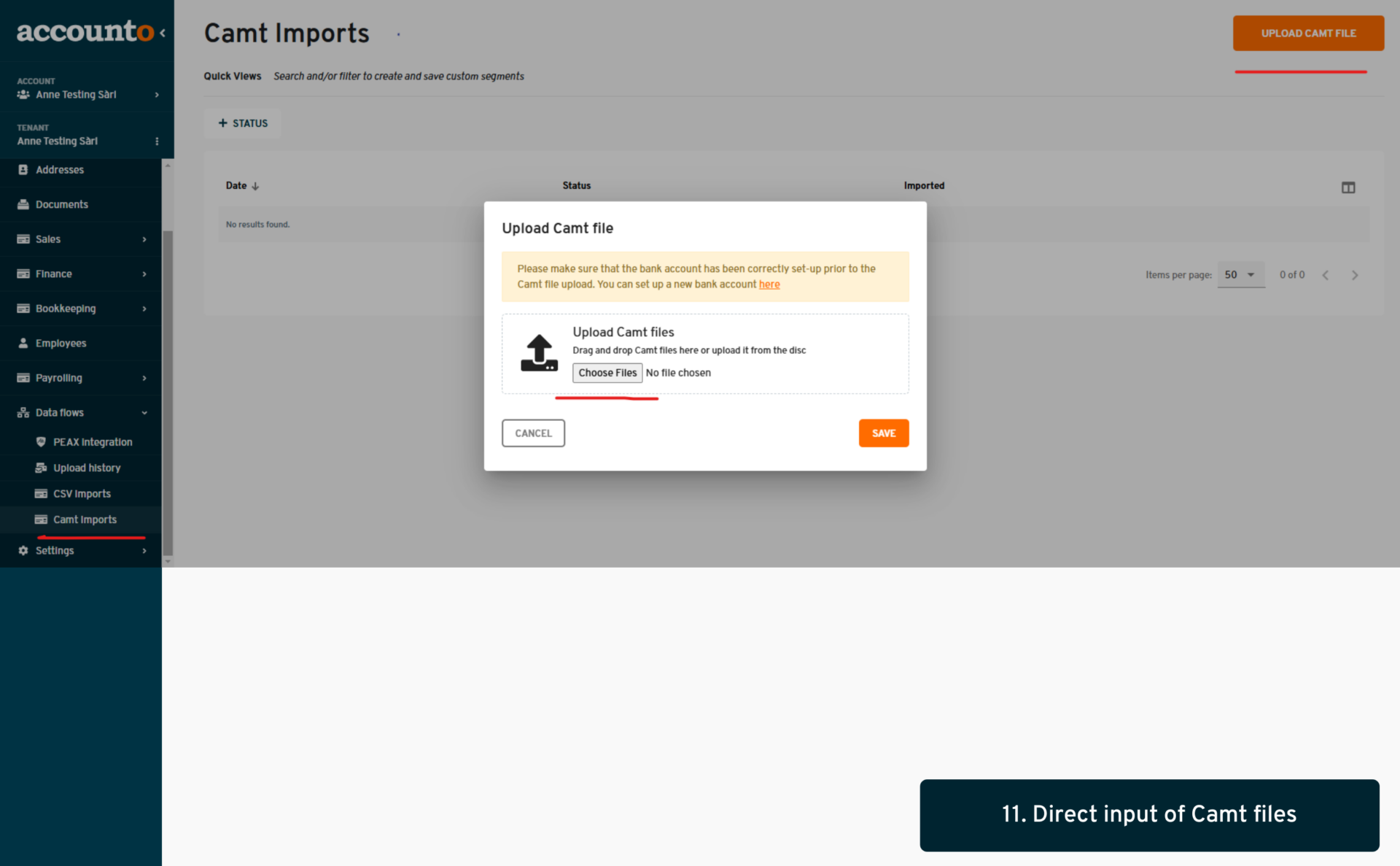

11. Direct input of Camt files

- where: Tenant view > Data flows > Camt Imports (new menu)

- changes: A new menu was created, looking and functionning similarly to the CSV Import menu, but dedicated to the import of camt.053 files. What’s new: Users can now freely upload camt files directly via the button in the interface (no need to send them via email). The rest of the process is the same as for CSV files, the system displays possible errors as well as the status of completion. The number of transactions is displayed (but either all transactions of none are imported, no partial processing). The user can also remove the import, and when doing so all the transactions are removed (unless they are already reconciled, in a closed tax year or VAT-declared, same rules as for CSV import).

- what’s in it for me: This is an important gain in time and efficiency for our clients, given that they can now instantly upload a new camt file into our system without waiting for our Support team to do it, and without waiting for it to be synchronized the next morning, as in this new process the transactions are created right away.

August/September

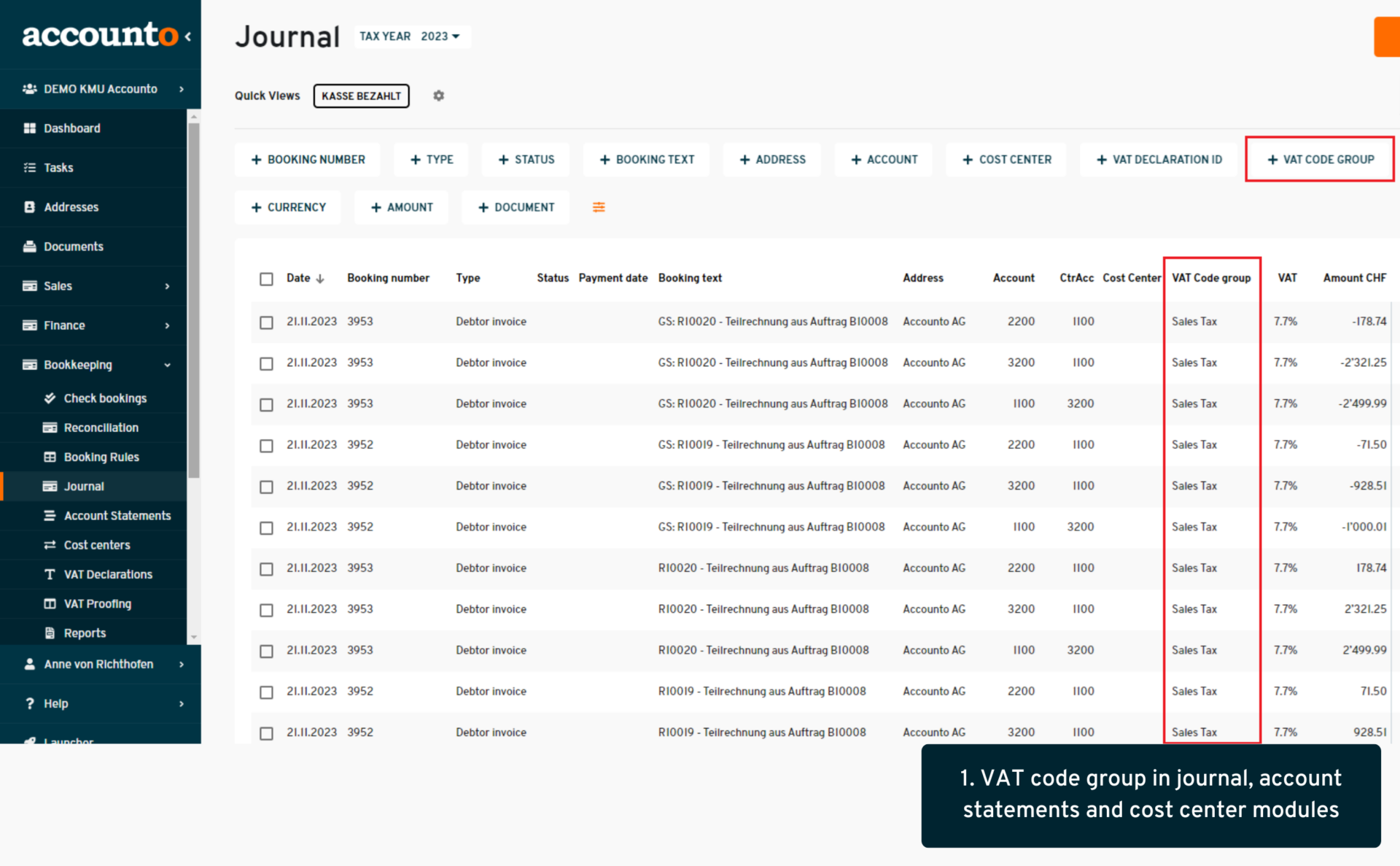

1. VAT code group in journal, account statements and cost center modules

- where: Client view > Bookkeeping > Journal / Account statements / Cost centers

- changes: This new function adds a VAT Code Group column in the Journal, Account statement and Cost centers modules, that appears before the VAT column and can be activated through the ‚Manage Columns‘ button. The feature is currently hidden by default.

- what’s in it for me: This enhancement improves organization of data, supports filtering and sorting functionalities for better analysis and management of VAT information, ensures consistency across imported and exported data in CSV files, and provides greater flexibility and clarity in handling VAT-related data tailored to specific needs.

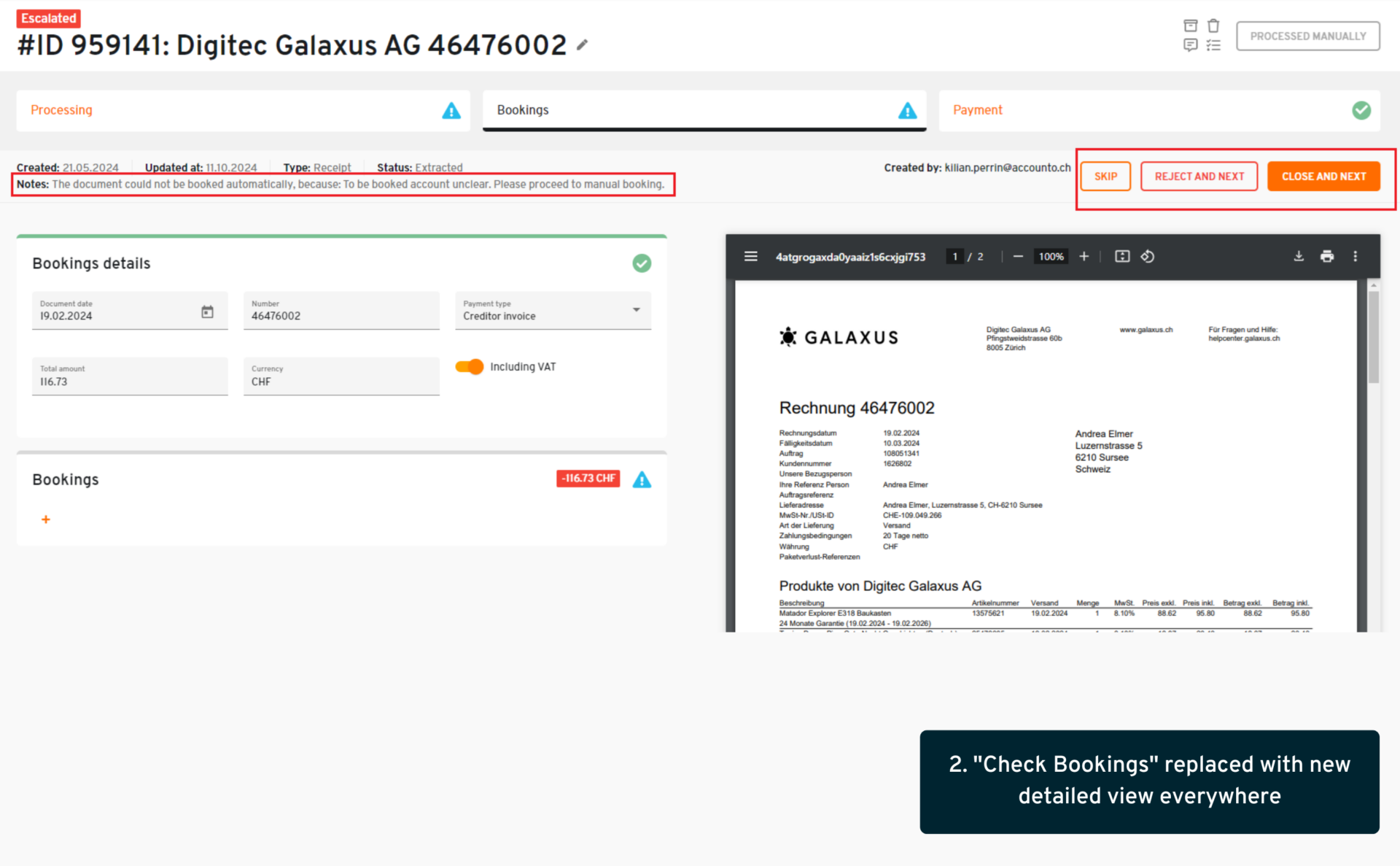

2. „Check Bookings“ replaced with new detailed view everywhere

- where: Client view > Bookkeeping > Check bookings

- changes: We have enhanced the „check bookings“ functionality by replacing the previous view with a new, streamlined document details view; allowing users to navigate seamlessly through documents using a ’next‘ button; displaying client names alongside documents for better overview by advisors; showcasing internal notes in the escalated tab

- what’s in it for me: This update ensures a more intuitive user experience, improving communication surrounding each document and optimizing operations in bookkeeping, reconciliation, and document management.

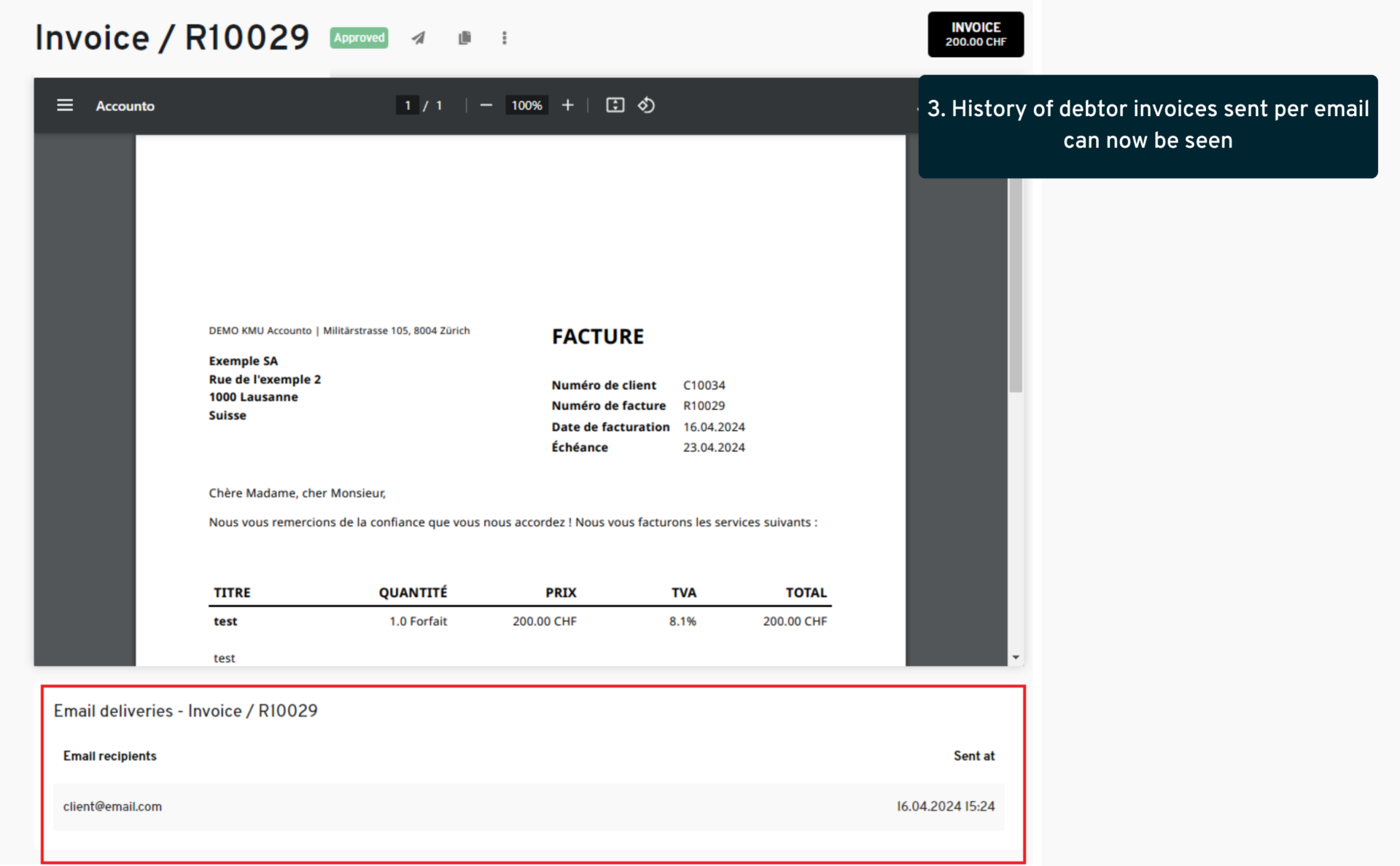

3. History of debtor invoices sent per email can now be seen

- where: Client view > Sales > Invoices

- changes: Enhanced user permissions to allow advisors, client admins, and those with sales permissions to view the email history of sent debtor invoices

- what’s in it for me: This improvement ensures greater transparency and accessibility of invoice communications across involved parties, streamlining collaboration and oversight.

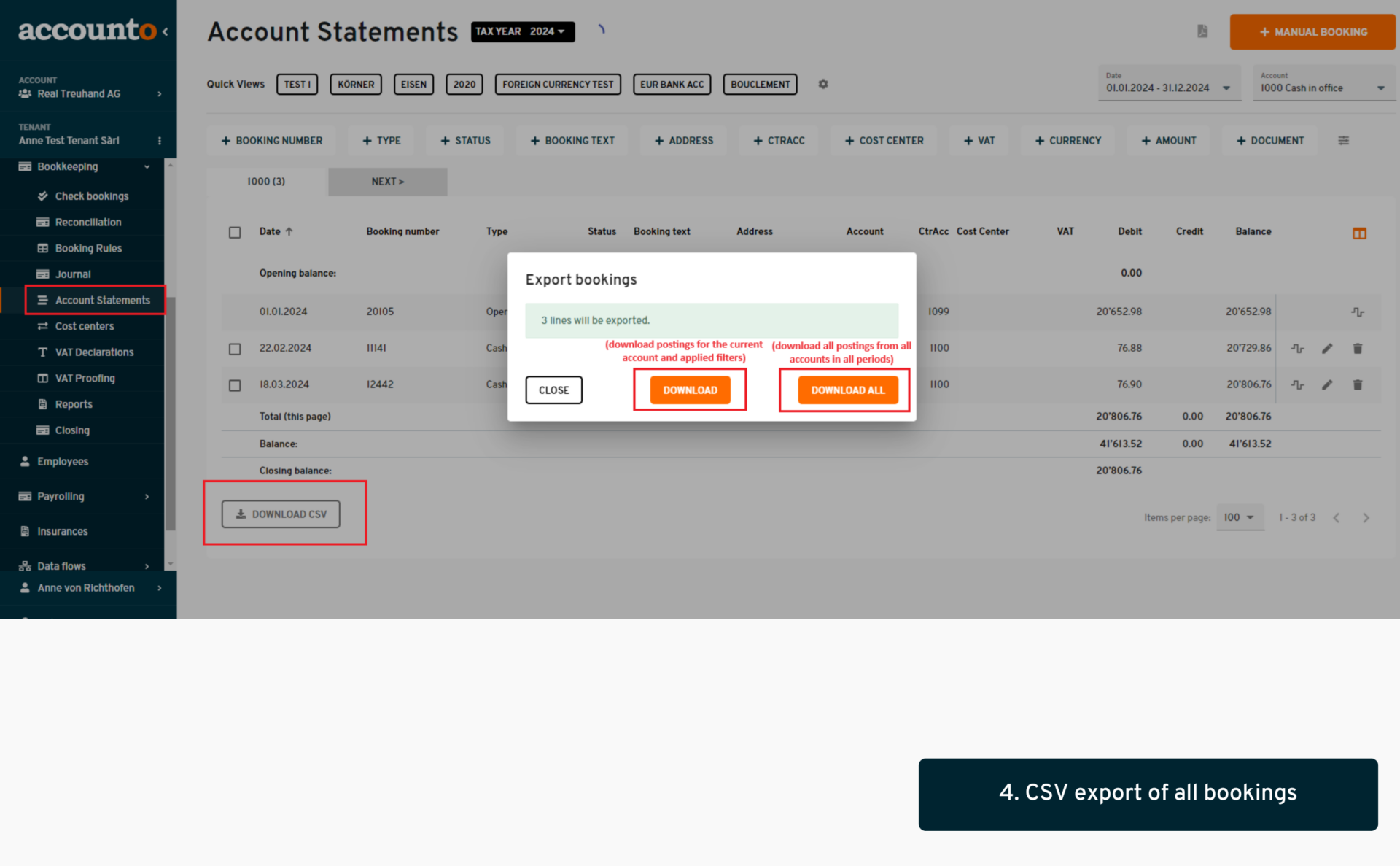

4. CSV export of all bookings

- where: Client view > Bookkeeping > Account statements

- changes: This is the latest change to a series of adaptations and improvements of our CSV exports of bookings and postings. We’ve added a new option in the Account statements view that allows users to export “all”, meaning all postings of all accounts in all periods. Thus, this export is very similar to the past CSV export of the journal postings, and can also be used as such, or it can be used for a tenant outboarding, as it contains “all” existing postings of the chosen tenant.

- what’s in it for me: Fast and easy way to download everything in 1 click.

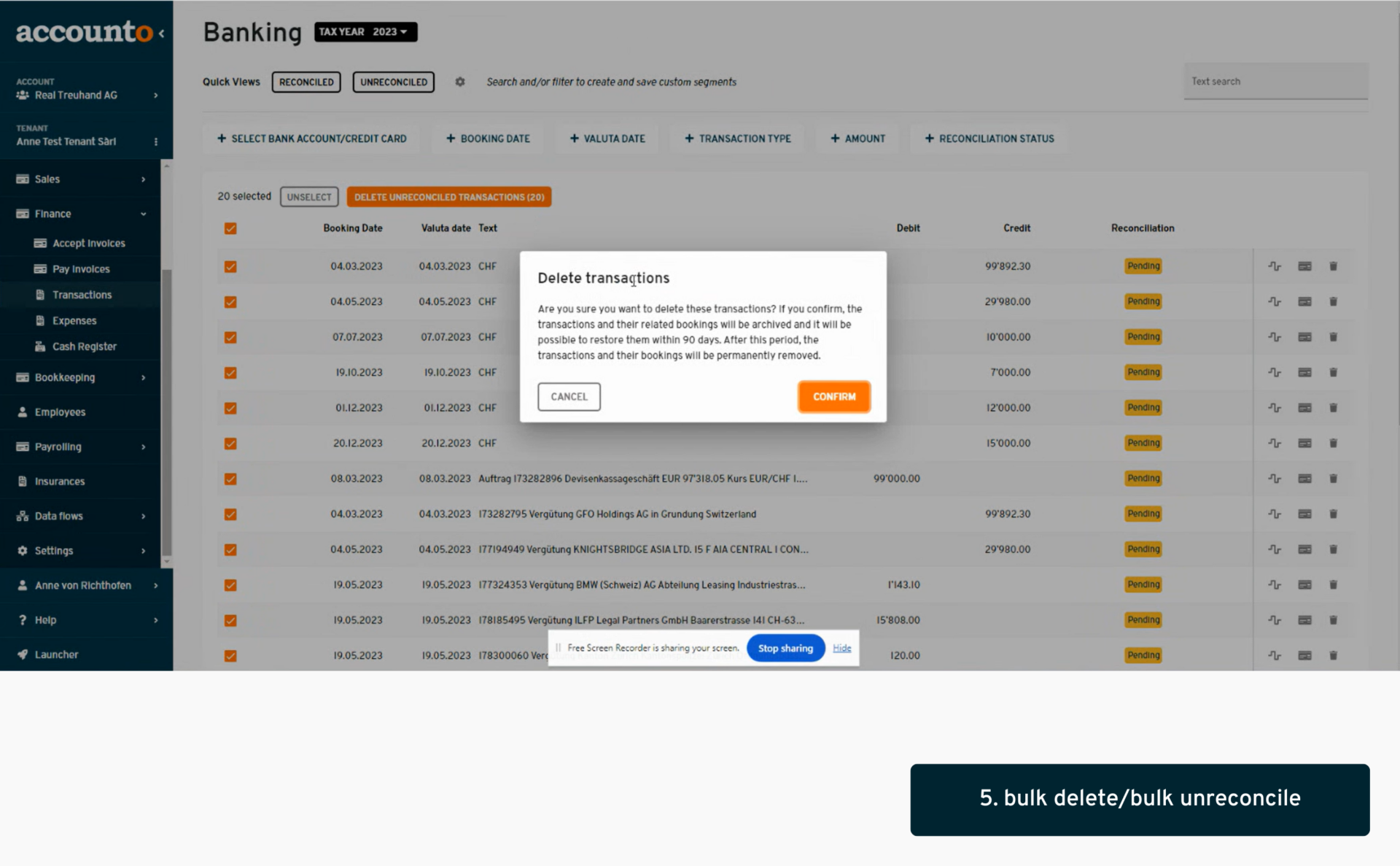

5. Bulk delete/bulk unreconcile

- where: Client view > Finance > Transactions & Internal view > Operations > Reconciliation

- changes: Transactions in pending/review status can now be selected in bulk and deleted in bulk. If a transaction is in manually/automatically (reconciled) status, it must first be unreconciled in order for the (bulk) deletion button to appear. When the user confirms the transactions’ removal, these are actually not completely removed but they are archived, and can be found by filtering by the new status “archived” (or by opening the new tab “archived” in the internal recon view). Within a period of 90 days, the archived transactions can be restored. After this period, they are permanently removed from the platform and can no longer be retrieved.

- what’s in it for me: With this function, our clients will gain complete flexibility when managing transactions on the platform, allowing users to quickly remove pending or review-status transactions while ensuring a safety net through the archiving process.

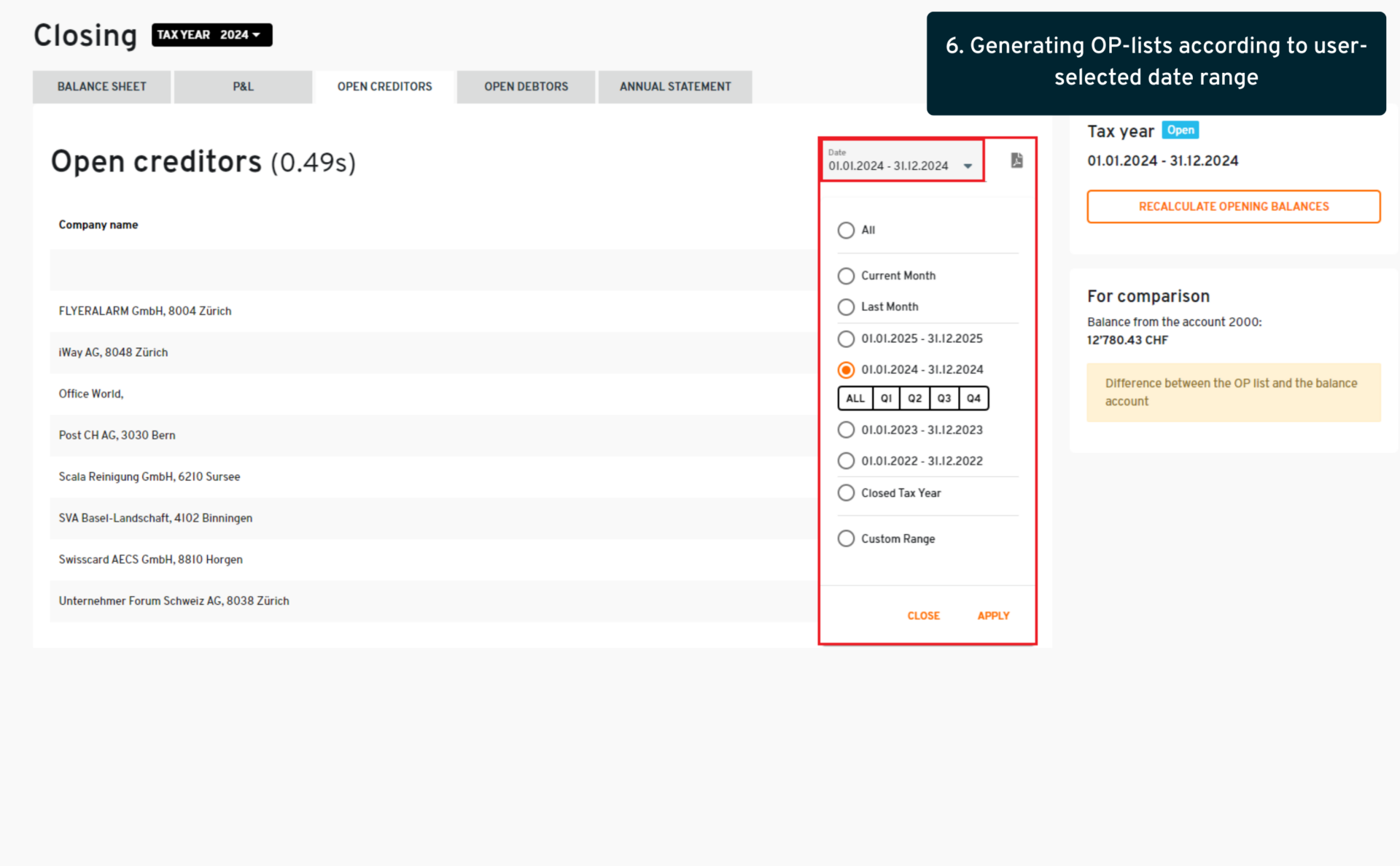

6. Generating OP-lists according to user-selected date range

- where: Client view > Bookkeeping > Closing > Open creditors / Open debtors

- changes: Introducing a customizable date filter for the Open Creditors and Open Debtors tabs, allowing users to set their own date ranges for reports, not only on the interface but also in PDF exports; the comparison view of the transit account balances and the OP lists also reflects totals only for that selected period.

- what’s in it for me: We have enhanced this module to improve both accuracy and usability in our financial reporting.

7. Reversal bookings on balancing accounts

- where: Client view > Bookkeeping > Journal / Account statements / Cost centers

- changes: We now allow users to create reversal bookings even on accounts with the activated balancing function; this removes previous restrictions and ensures that reversal bookings occur in the proper sequence relative to balancing and opening balance bookings.

- what’s in it for me: These changes enhance flexibility and accuracy in financial reporting, making it easier for users to manage complex transactions.

8. Special calculation for social security when reached the retirement age

- where: Client view > Payrolling > Payroll runs

- changes: A new feature has been introduced to streamline payroll calculations for employees who have reached retirement age. Effective from the month after an employee turns 65 (men) or 64 (women), the system automatically exempts the first CHF 1,400 of their monthly salary from AHV contributions, only calculating AHV on any salary exceeding this threshold. Additionally, ALV deductions will no longer apply.

- what’s in it for me: This enhancement simplifies compliance with pension contribution regulations, ensuring accurate payroll processing and reducing the manual intervention of advisors.

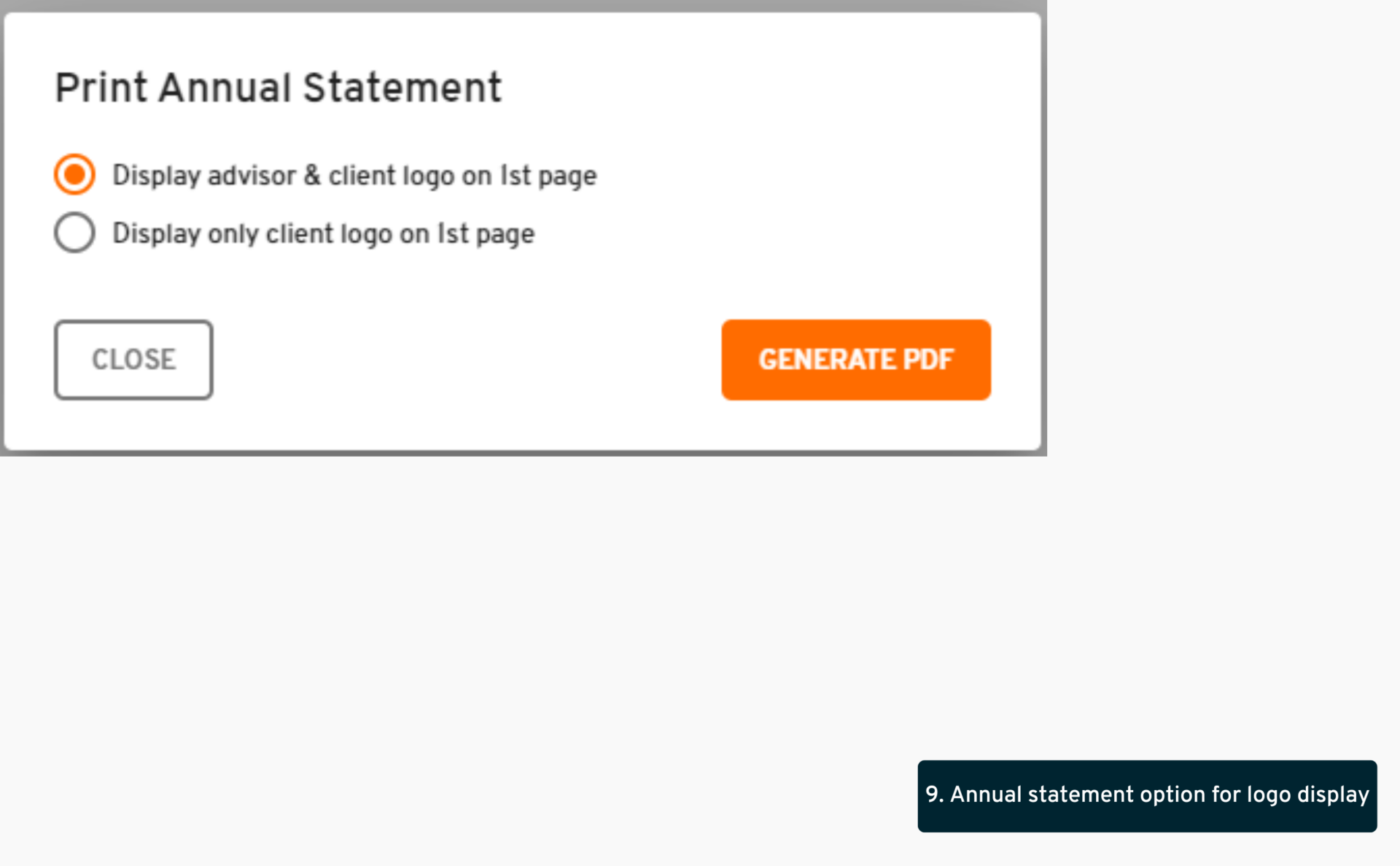

9. Annual statement option for logo display

- where: Client view > Bookkeeping > Closing > Annual statement

- changes: The recent update enhances the annual statement PDF generation by introducing a new customizable feature that allows users to choose how logos are displayed on the first page. Users can now select between two options: displaying both the advisor and tenant logos at designated positions or opting for a standalone view that features only the tenant’s logo and address.

- what’s in it for me: This flexibility is designed to better accommodate the diverse needs of our tenants, ensuring a more tailored presentation of their annual statements.

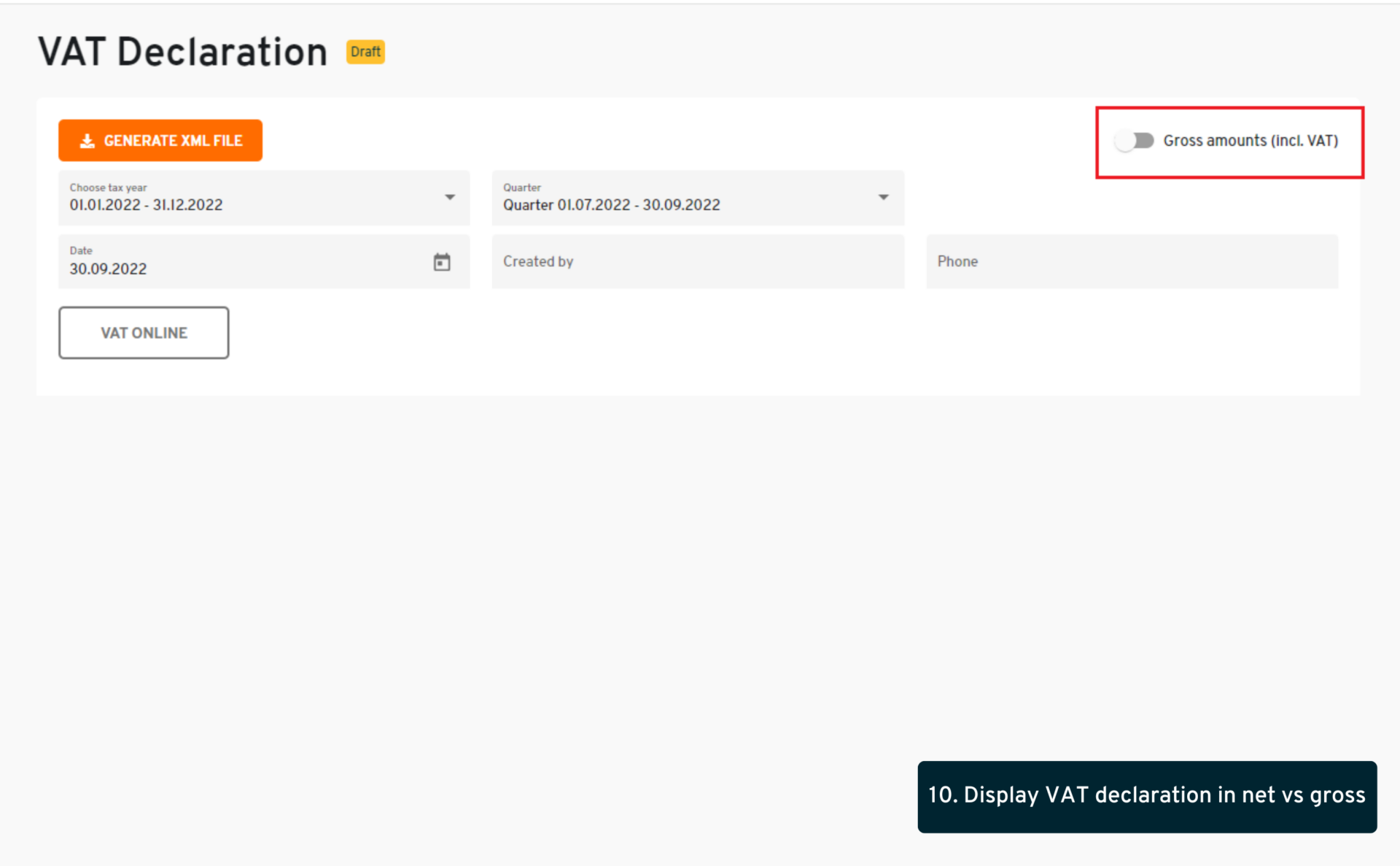

10. Display VAT declaration in net vs gross

- where: Client view > Bookkeeping > VAT declarations

- changes: This feature in our VAT declaration module allows clients to choose between viewing amounts in gross or net values. A convenient toggle has been added at the top of the declaration view, which, when activated, displays net amounts for turnover and supplies, catering to the preferences of our Swiss clients. The default setting remains gross values for ease of use.

- what’s in it for me: This improvement aims to enhance flexibility in VAT reporting for our users, catering to their specific preferences and practices.

11. The maximum salary for the BU employer deduction is taken account

- where: Client view > Payrolling > Payroll settings / Payroll runs

- changes: We have introduced a critical update that ensures the calculation of the BU employer deduction now automatically takes into account the maximum salary limit of CHF 12’350.

- what’s in it for me: Users can now expect accurate automatic deduction calculations for the BU, resulting in reduces manual interventions, more reliable payroll reports and enhanced financial compliance.

12. Saving changes on Employee certificates and displaying them in the employee access

- where: Payrolling > Reports > Employee certificates

- changes: Until now, manual changes on the employee certificates could only be downloaded but not saved in the platform. A new solution has been implemented to allow these changes to be saved directly in the platform, along with a new status system (certificates in ”draft” status can be edited and saved into “done”). Once a certificate is “done”, the concerned employee will be able to see and download the file directly from their employee access, without having to wait for the admin to send it to them.

- what’s in it for me: This series of improvements in the employee certificate function will provide much more flexibility and comfort for our clients as well as a more direct access for the companies’ employees.

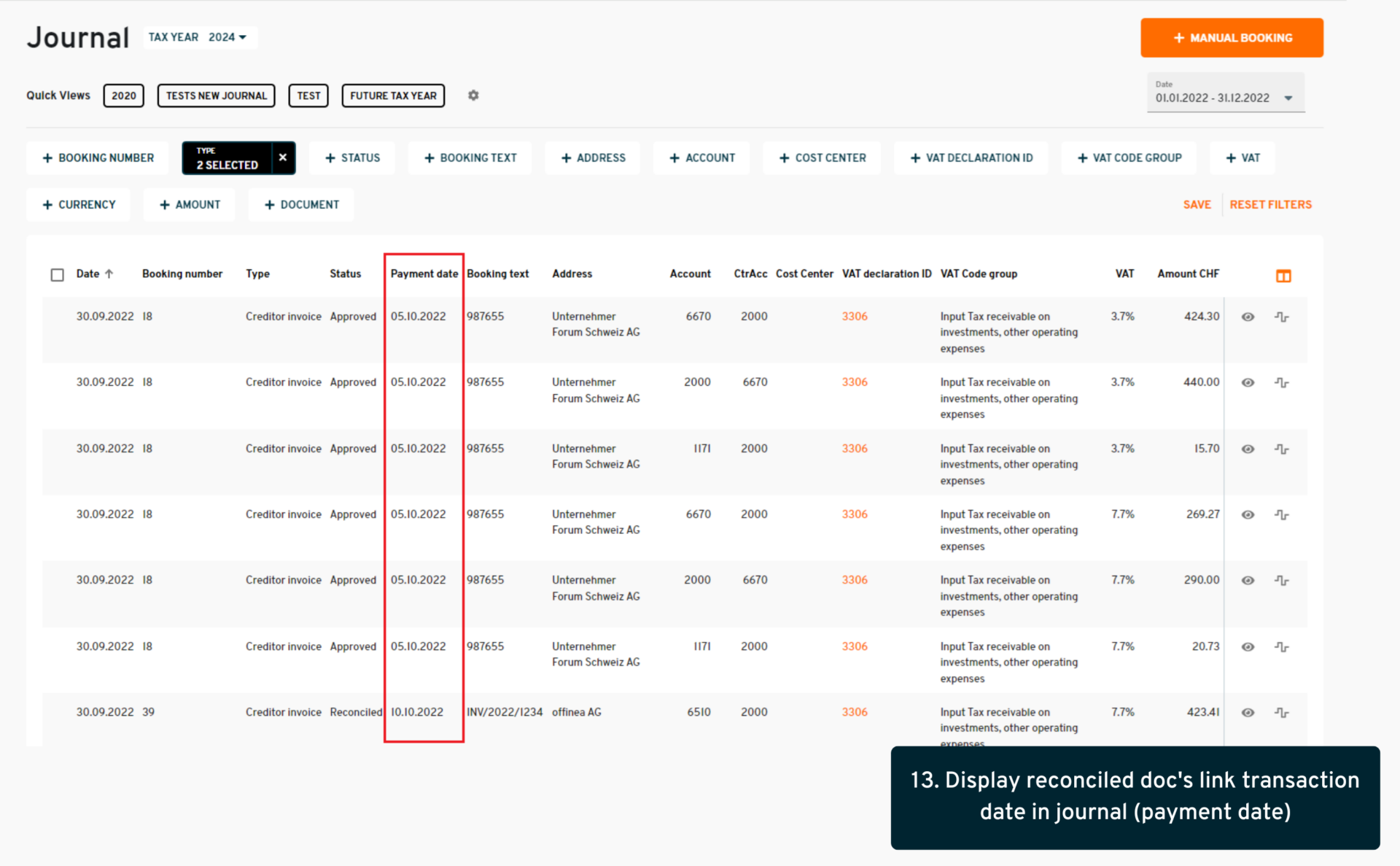

13. Display reconciled doc’s link transaction date in journal (payment date)

- where: Client view > Bookkeeping > Journal / Account statements / Cost centers

- changes: We’ve enhanced our system by adding a new column to the Journal, Account Statements, and Cost Center modules that displays the transaction date for reconciled documents, as well as the payment date for all other relevant booking types.

- what’s in it for me: This feature allows for better visibility and tracking of reconciliation activities, as well as verifying which bookings will be included in a given VAT declaration, improving your financial oversight and record-keeping efficiency.

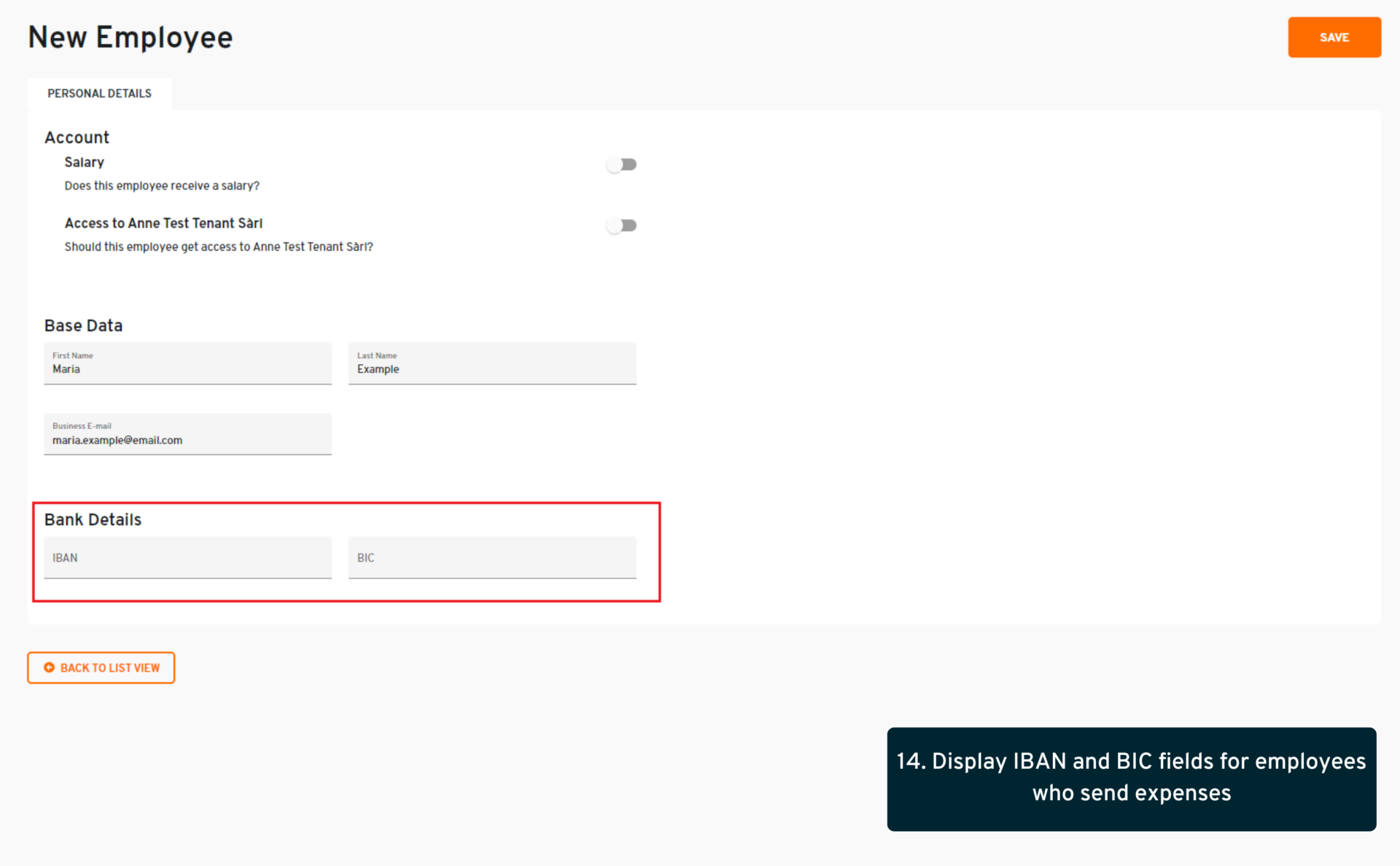

14. Display IBAN and BIC fields for employees who send expenses

- where: Client view >Client view > Employees

- changes: Admins can now easily input employee’s IBAN and BIC details without them having any salary configured, ensuring an easier reimbursement process. The two fields are now displayed directly in the basic employee set-up page, without being dependent upon other functions such as registering to the platform or setting up the salary. Additionally, employees with configured IBANs can now be selected in various document views, streamlining the approval and processing of expenses.

- what’s in it for me: With this change, we’ve introduced a significant improvement to enhance expense management for employees without a salary; this feature aims to improve user experience, efficiency, and accuracy in managing expenses.

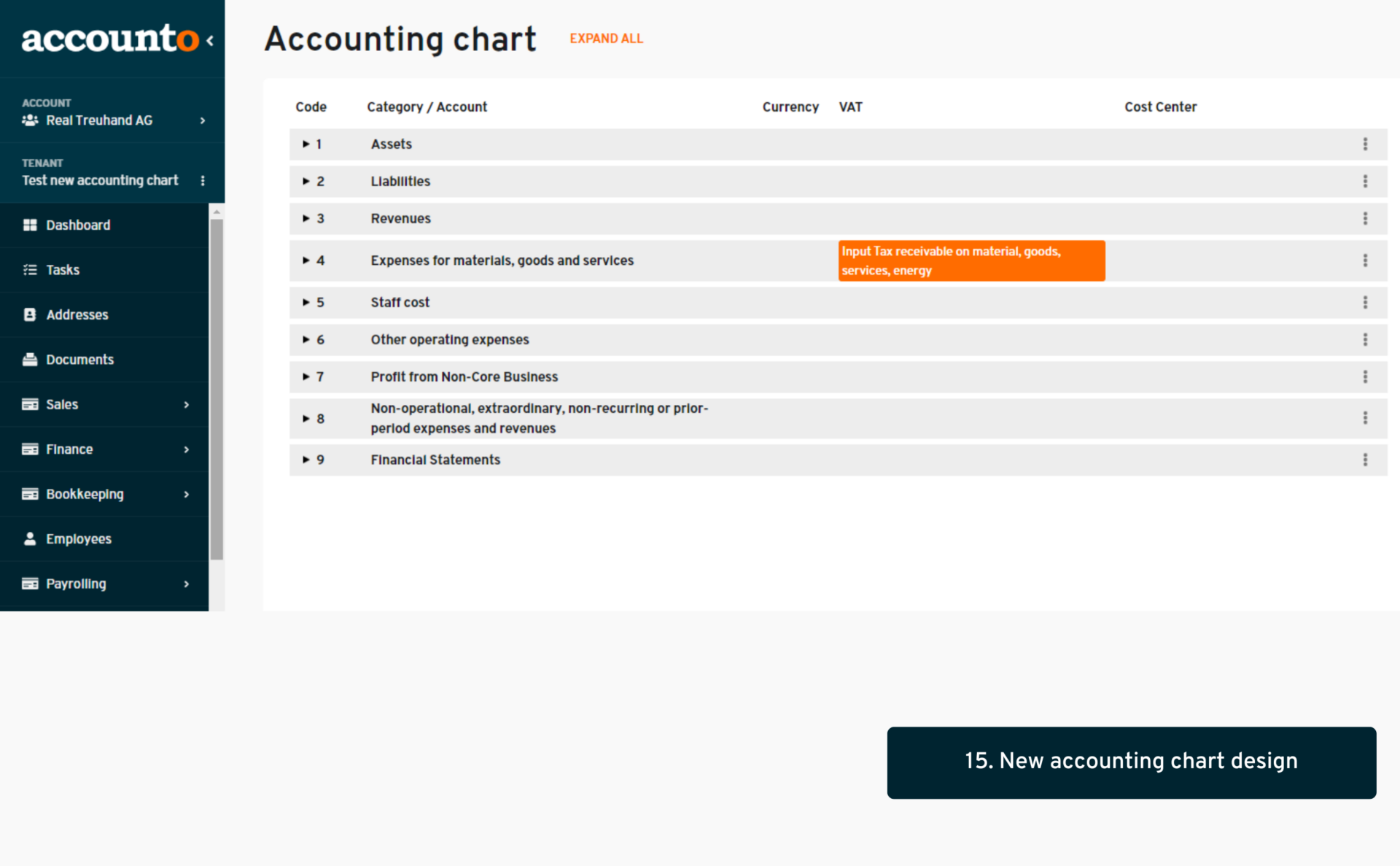

15. New accounting chart design

- where: Client view > Settings > Accounting chart & Opening balance (new menu)

- changes: we’ve greatly improved the performance (loading time) of the page

- both the balance and p&l are on 1 single page.

- We’ve removed the “expenses” main category to bring forth its sub-categories (expenses for materials, staff cost, etc.), to better match the official SME accounting chart. Categories are collapsable in a practical way and have codes, which are freely editable if needed.

- Moving categories, subcategories and their accounts is much easier (you can do it via drag-and-drop or directly by editing the category/account). It is possible to edit accounts even if they already have bookings

- it is possible to activate the balancing function even if the account already has bookings. Users can add, move and remove subtotals as they wish. We’ve moved the opening balance function onto a separate menu for a more convenient use

- what’s in it for me: The many changes mentioned above present a huge advantage to our clients, the past difficulties linked to slow loading time have been removed, the different barriers to editing and moving accounts and categories have been eliminated, so our clients can now effortlessly and efficiently manage their accounting charts with complete freedom.

June/July

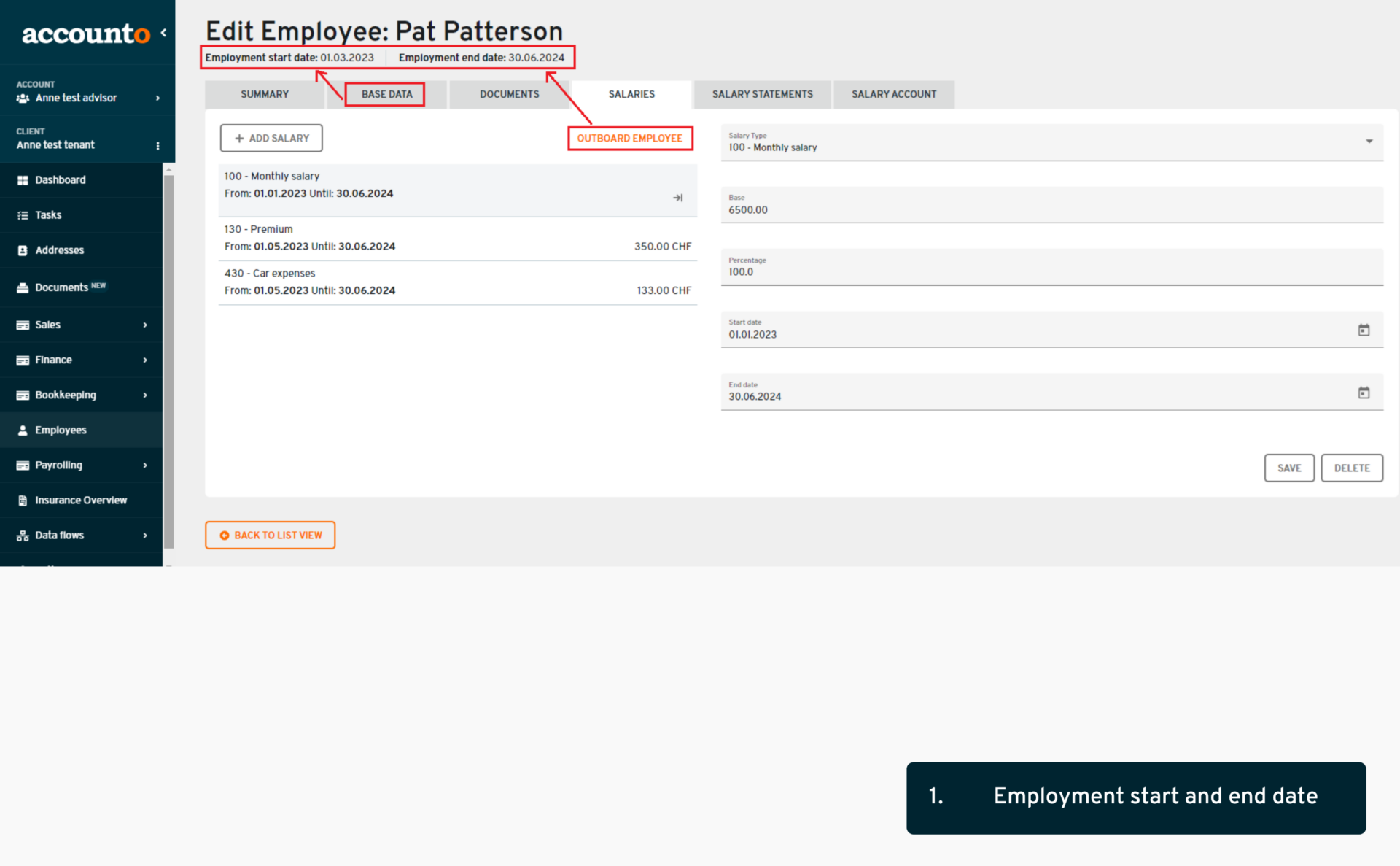

1. Employment start and end date

- where: Client view > Employees > Edit employee > Salaries

- changes: On the employee profile, we now have a mention about their employment start and end date. The start date is an information that can be set manually via the “base data” tab, and the end date is set in the “salaries” tab via the “outboard employee” function.

- what’s in it for me: This function provides a fast overview for our users regarding their employees’ employment dates. While the start date is informational, the end date is linked to an automated processes (this date is set on all active salary types as well as in the employee certificate)

2. Global release of the new document list and detailed view

- where: Client view > Documents menu

- changes: The new document module, which was previously available for Beta testing, has now been released to all our clients (with an option to switch back to the old module if needed). We have optimized this solution with the help of the feedback received from testers, and made an adjustment in the types of documents included in this menu: We have gone back to displaying solely uploaded documents, leaving documents generated in other modules (e.g. salary statements and sales invoices) separate in their respective menus.

- what’s in it for me: This new version of the documents module provides a full flexibility an many advantages for documents management and booking.

3. Displaying all positions including zero and negative amounts in payroll runs

- where: Client view > Payrolling > Payroll runs

- changes: Previously, employee salary statements that had a negative or zero total amount weren’t possible. This has now been changed in order to include all results and generate salary statements for employees even with a zero or negative total amount.

- what’s in it for me: With this addition, we are making sure that even exceptions and corrections can be handled in the salary statements

4. Salary recapitulation CSV export update

- where: Client view > Payrolling > Reports > Recapitulation

- changes: We have updated the salary recapitulation CSV export to better reflect the presentation on the interface (the salaries, employee deductions, employer deductions and bases are now separated into distinct sections in the CSV) and to provide a more complete view when selecting “all” employees (each employee is now listed separately in the CSV followed by total amounts).

- what’s in it for me: This update forms part of an effort to increase the overall efficiency and usability of the Payolling module.

5. Enabling decimals in deduction share for salary configuration

- where: Client view > Payrolling > Payroll settings > Salary type > Edit salary type (deduction)

- changes: A small change has been made in the form when editing a deduction salary type, to enable the use of decimals in the deduction share fields, as well as to include such changed percentages in all subsequent automatic salary calculations and bookings.

- what’s in it for me: This is a legal requirement as such decimals in the deduction shares can be prescribed by certain insurances.

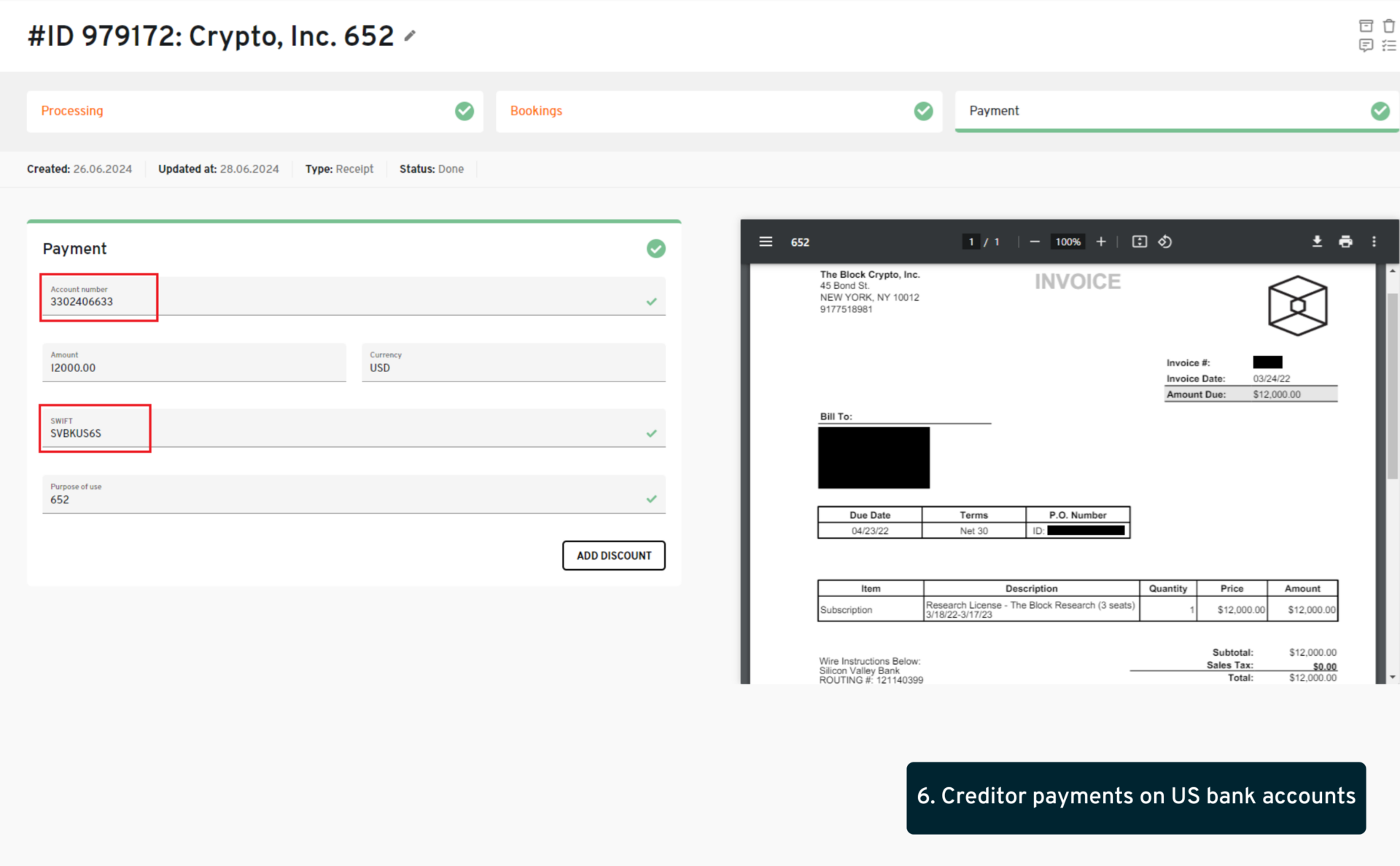

6. Creditor payments on USA bank accounts

- where: Client view > Finance > Pay invoices

- changes: Until now, only payments to Swiss or European (type IBAN) bank accounts were allowed when generating a creditor payment xml file to upload into the tenant’s e-banking. We have extended this feature to make payments to USA bank accounts possible, including the possibility in the document’s “Payment” tab to input the correct US account and SWIFT number, allowing the generation of the corresponding xml file format for US bank payments.

- what’s in it for me: This represents a substantial evolution for our creditor payment tool and will greatly facilitate foreign payments to US firms for our clients.

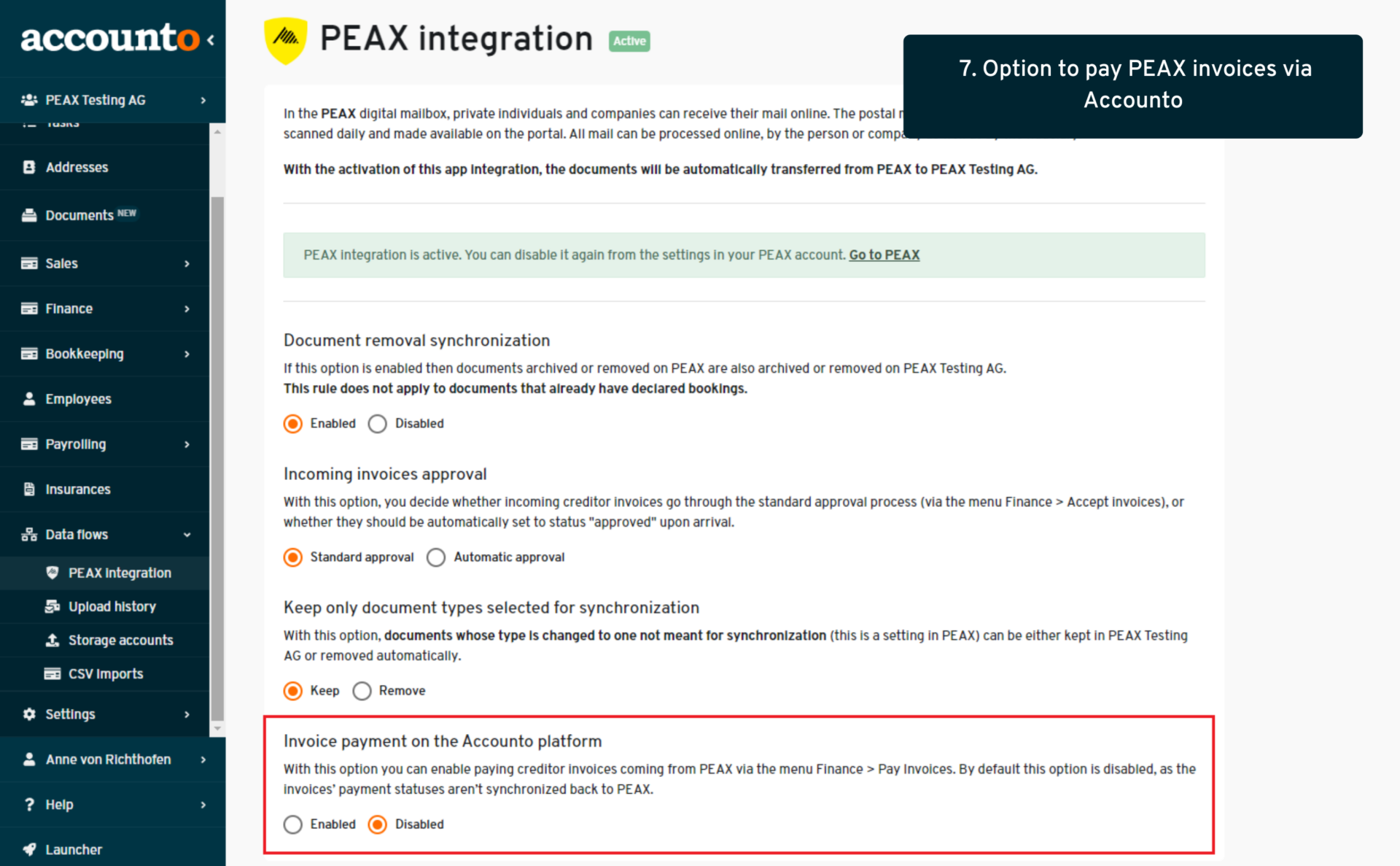

7. Option to pay PEAX invoices via Accounto

- where: Client view > Data flows > PEAX integration

- changes: Previously, invoices coming into our platform via the PEAX integration couldn’t be paid from Accounto (via Finance > Pay invoices menu) as paying from PEAX was the privileged process. We have now provided an additional level of flexibility, by implementing a new setting in the PEAX integration menu on our platform, allowing users to choose whether to allow paying PEAX invoices via Accounto or not.

- what’s in it for me: This is an added level of flexibility wished by our clients, thus providing them all the available options to suit their different creditor payment workflows.

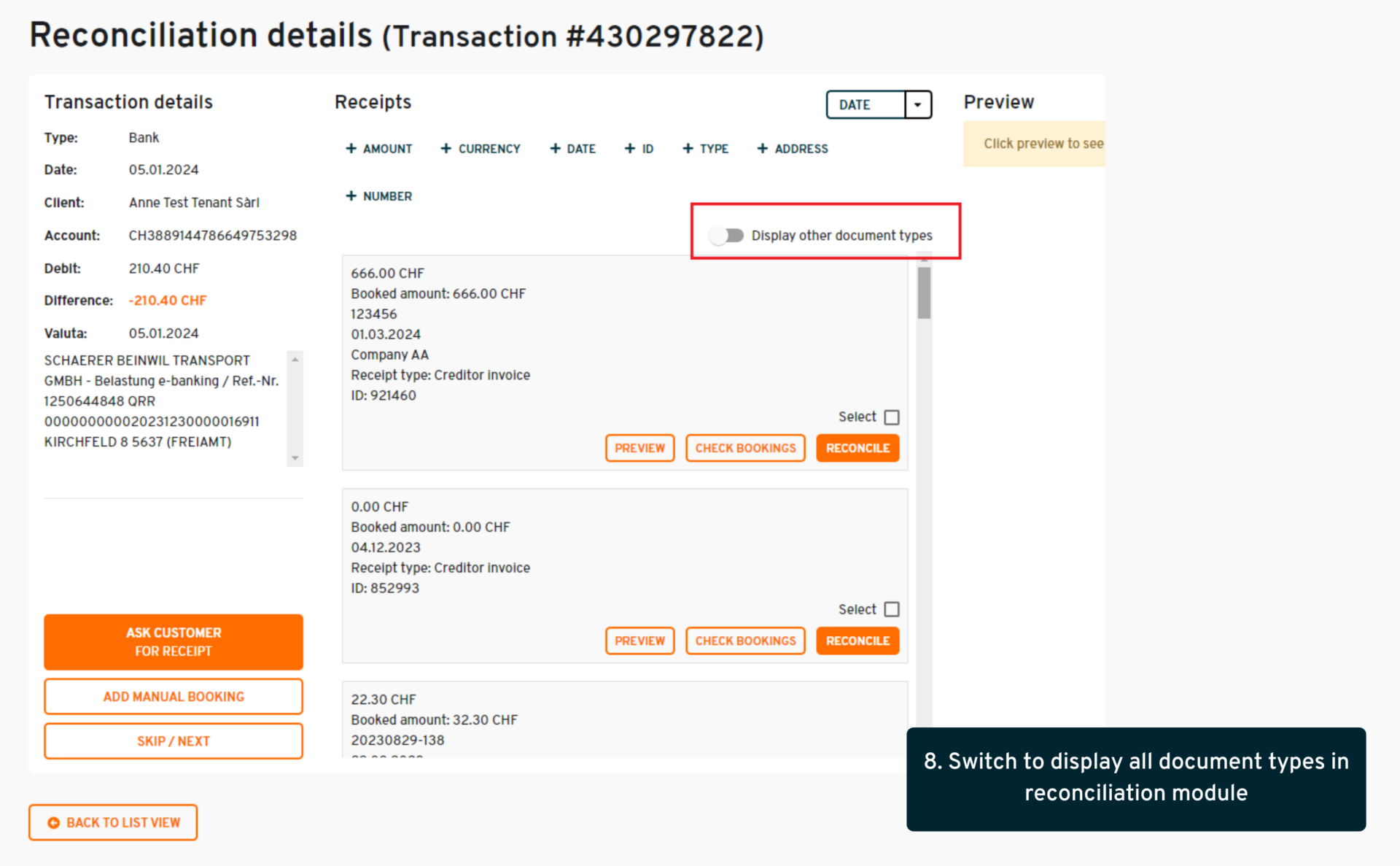

8. Switch to display all document types in the reconciliation module

- where: Client view > Bookkeeping > Reconciliation

- changes: A new switch has been implemented in the manual reconciliation module: Activating this switch will display absolutely all documents existing on the tenant, regardless of their type, payment type, whether they have bookings, or on which “side” (debit/credit) they are. Users are thus free to search for their document in case it didn’t appear in the standard list, but must make the relevant amendments for successful reconciliation (e.g. correcting the payment type and transit account if needed)

- what’s in it for me: This function allows for maximum flexibility in the reconciliation module, and provides a clear guidance on the rules of reconciliation, ensuring a smooth and clear reconciliation workflow for all our users.

May 24

1. Displaying zero and negative positions in payroll runs

- where: Payrolling > Payroll runs

- changes: The payroll runs were updated to include positions with zero or negative amounts, as well as the PDFs of the salary statement to display the totals including these numbers. Bookings resulting from the paid payroll runs will reflect these positions as well.

- what’s in it for me: This function was added to our existing payrolling system, providing our clients another step of improvement of this feature.

2. BVG report update

- where: Payrolling > Reports > Insurances

- changes: A tickbox was added to the form for editing a salary type in the payrolling settings, to mark salary types for the BVG report. The resulting BVG report will contain employees that had salary types with this tickbox active.

- what’s in it for me: This is an improvement of the existing report, providing our users the flexibility to select exactly what should be included in the report.

3. Pre-filling the contact email when sending out a debtor invoice

- where: Sales > Invoices

- changes: When creating a debtor invoice via the system, if a contact person is selected together with the address, afterwards when sending out the invoice via email, the contact person’s email is automatically filled in the email form.

- what’s in it for me: This improves the experience for this feature and makes our users gain some time when sending out their invoices via email.

4. Pre-fill manual reconciliation form for credit card transactions

- where: Bookkeeping > Reconciliation

- changes: When reconciling a credit card transaction with a document and the amounts don’t match, not only does the system pre-fill most fields according to the corresponding document (this was previously implemented), but the system inputs as well the respective credit card account, thus fully completing the process for the user.

- what’s in it for me: This is another gain in efficiency and speed when reconciling (credit card) transactions, also helping to reduce the risk of errors.

5. Salary recapitulation CSV export improvement

- where: Payrolling > Reports > Recapitulation

- changes: The CSV export of the salary recapitulation has been adapted to better reflect the elements displayed on the interface.

- what’s in it for me: This improves the efficiency of this report and makes the CSV version more practical and complete for external use

April 24

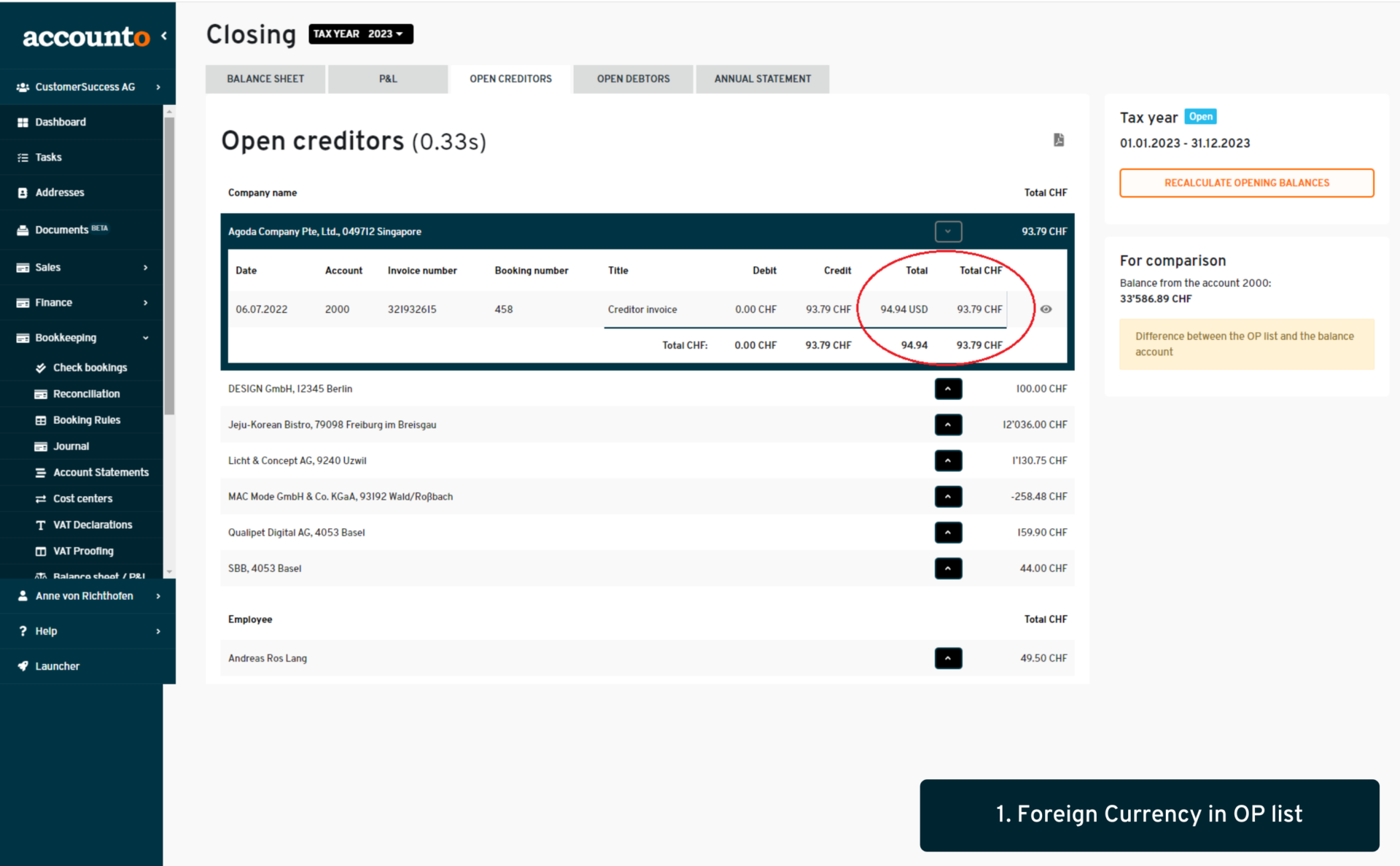

1. Foreign currency in OP lists displayed in the single invoice view

- where: Bookkeeping > Closing > Open creditors/debtors

- changes: We’ve added a new column in the detailed view of open positions, displaying the original currency of the single invoices

- what’s in it for me: When it comes to reconciling a tenant with lots of different currencies, displaying the foreign currency directly the single invoice view (additionally to the already existing totals at the bottom) simplifies the process

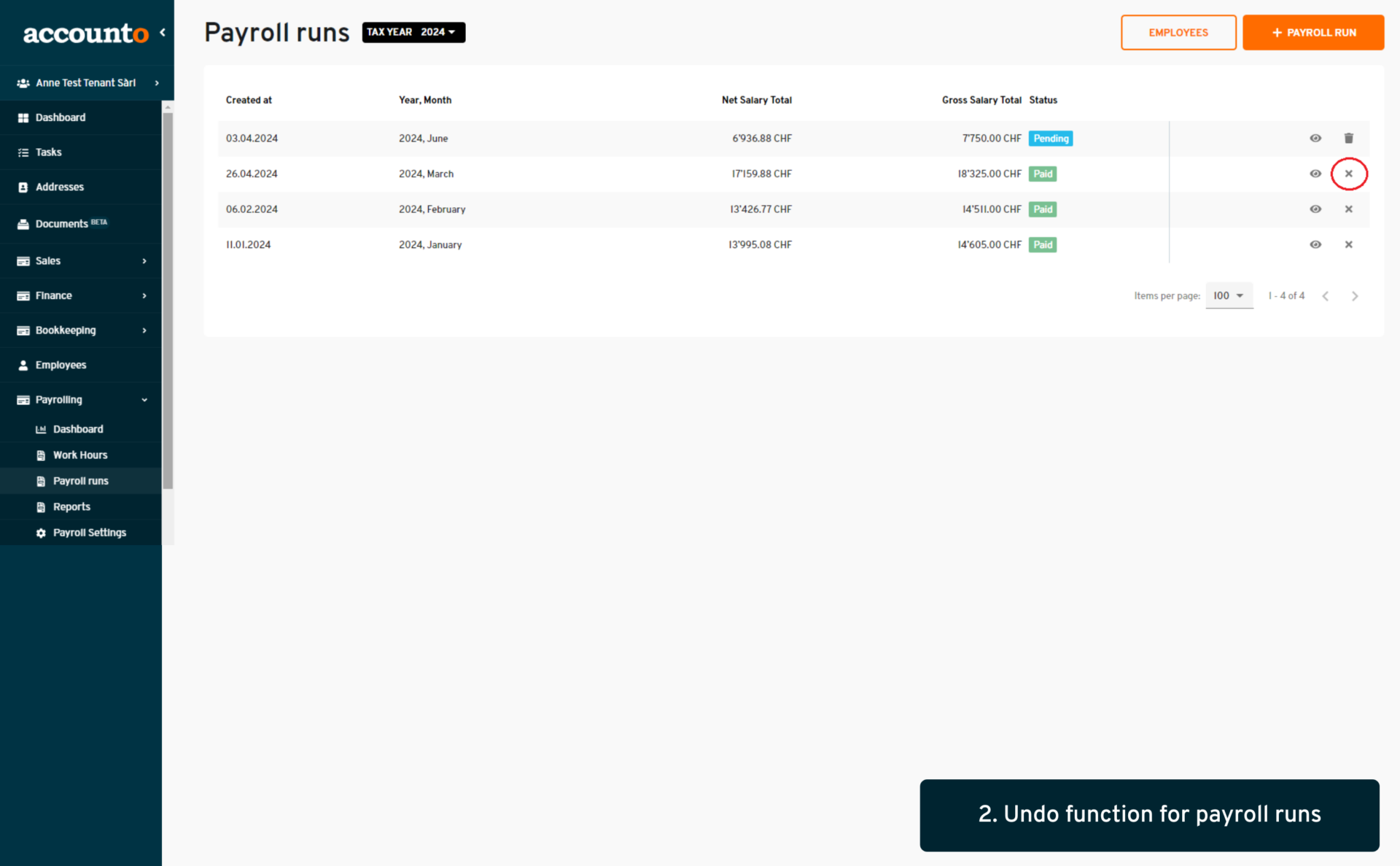

2. “Undo” function for payroll runs

- where: Payrolling > Payroll runs

- changes: Payroll runs can now be set back to the draft status. This action removes the bookings but keeps the manual changes previously made on the payroll runs, enabling users to make only the changes needed and proceed again.

- what’s in it for me: This is a much expected feature for our clients, thus gaining the liberty to edit paid payroll runs independently at any time they choose

3. Pre-fill manual reconciliation form for difference bookings

- where: Bookkeeping > Reconciliation

- changes: When reconciling a transaction with a document and the amounts don’t match, the system now pre-fills most fields in the subsequent manual booking form. The side (credit/debit) for the transfer account also changes according to the type of difference (win or loss).

- what’s in it for me: This will help our clients gain a great deal of speed when adding manual bookings in the reconciliation process, and it will reduce the risk of errors.

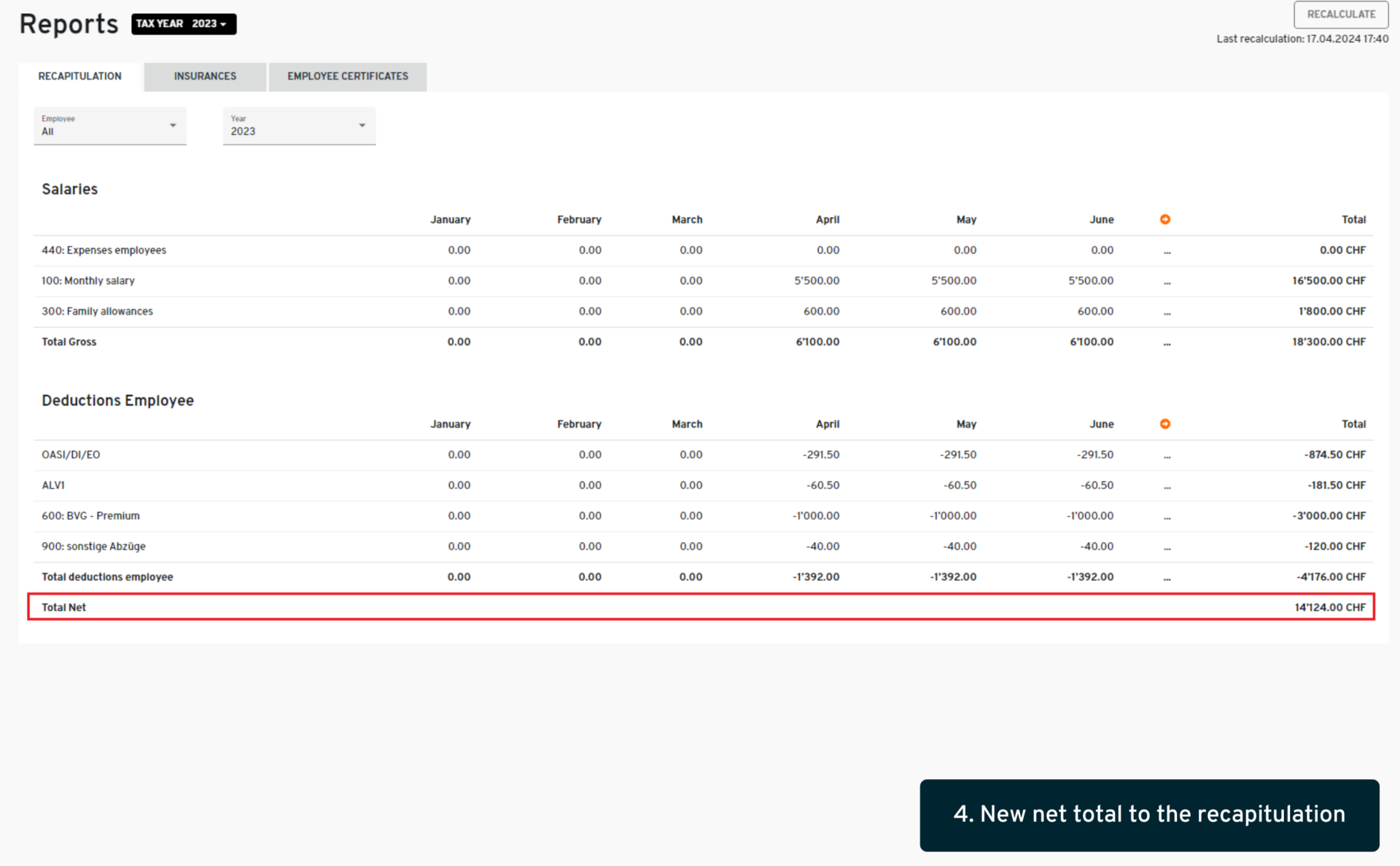

4. New net total to the recapitulation

- where: Payrolling > Reports > Recapitulation

- changes: A new subtotal was added to complete this salary report: “Total Net” (sum of the total gross + deductions employee). Note: This new total is only available for 2023 salaries and later. To display it the first time, please click on the “recalculate” button.

- what’s in it for me: This element completes the salary recapitulation and brings more clarity and usability to this report for our clients.

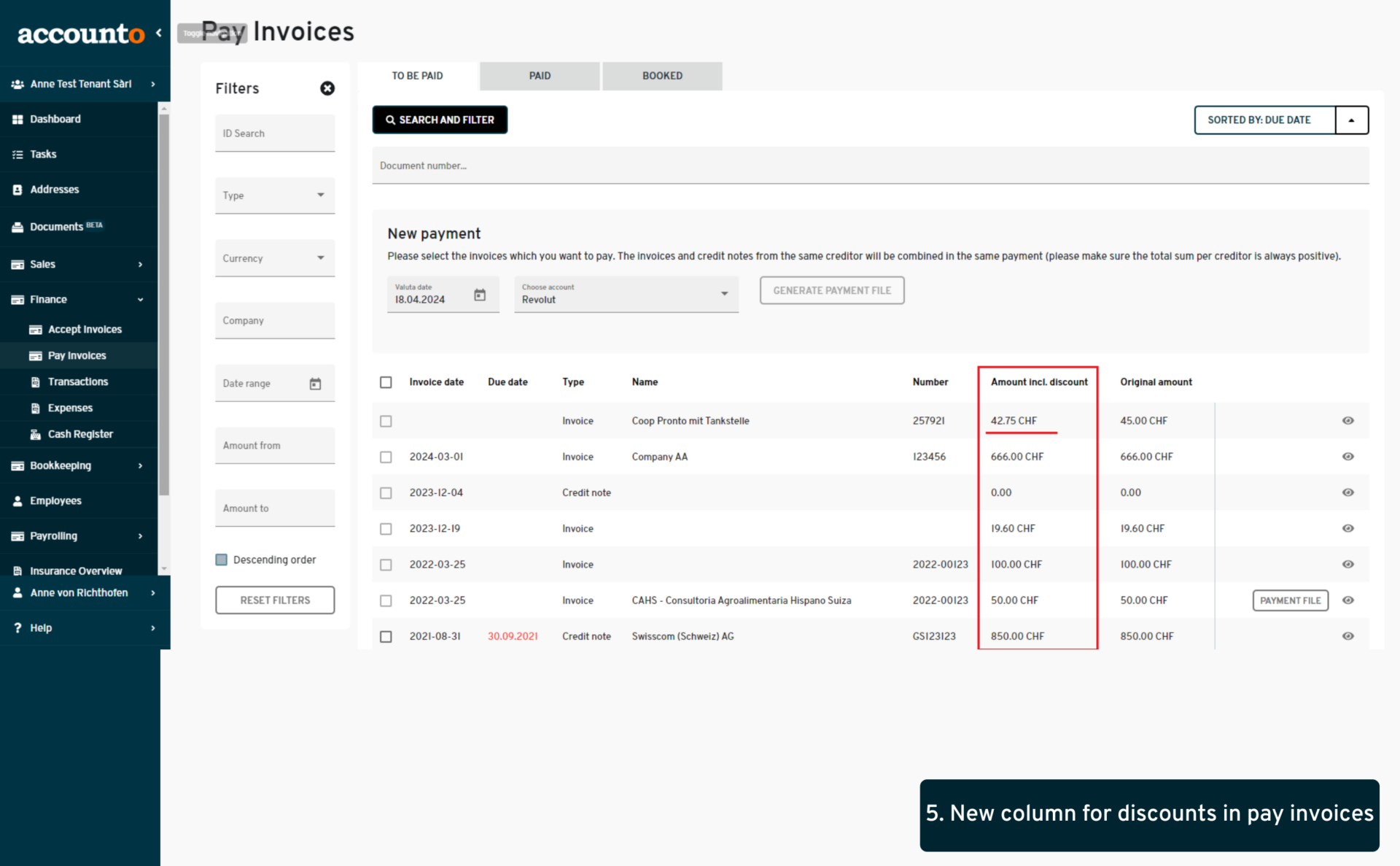

5. New column for discounts in pay invoices menu

- where: Finance > Pay invoices

- changes: A new column has been added, displaying the invoices’ amounts including discounts, calculated according to the different discount options on the invoice and the valuta date of the payment file.

- what’s in it for me: This makes it easier for users to have an overview what amount they will finally be paying for each individual invoice.

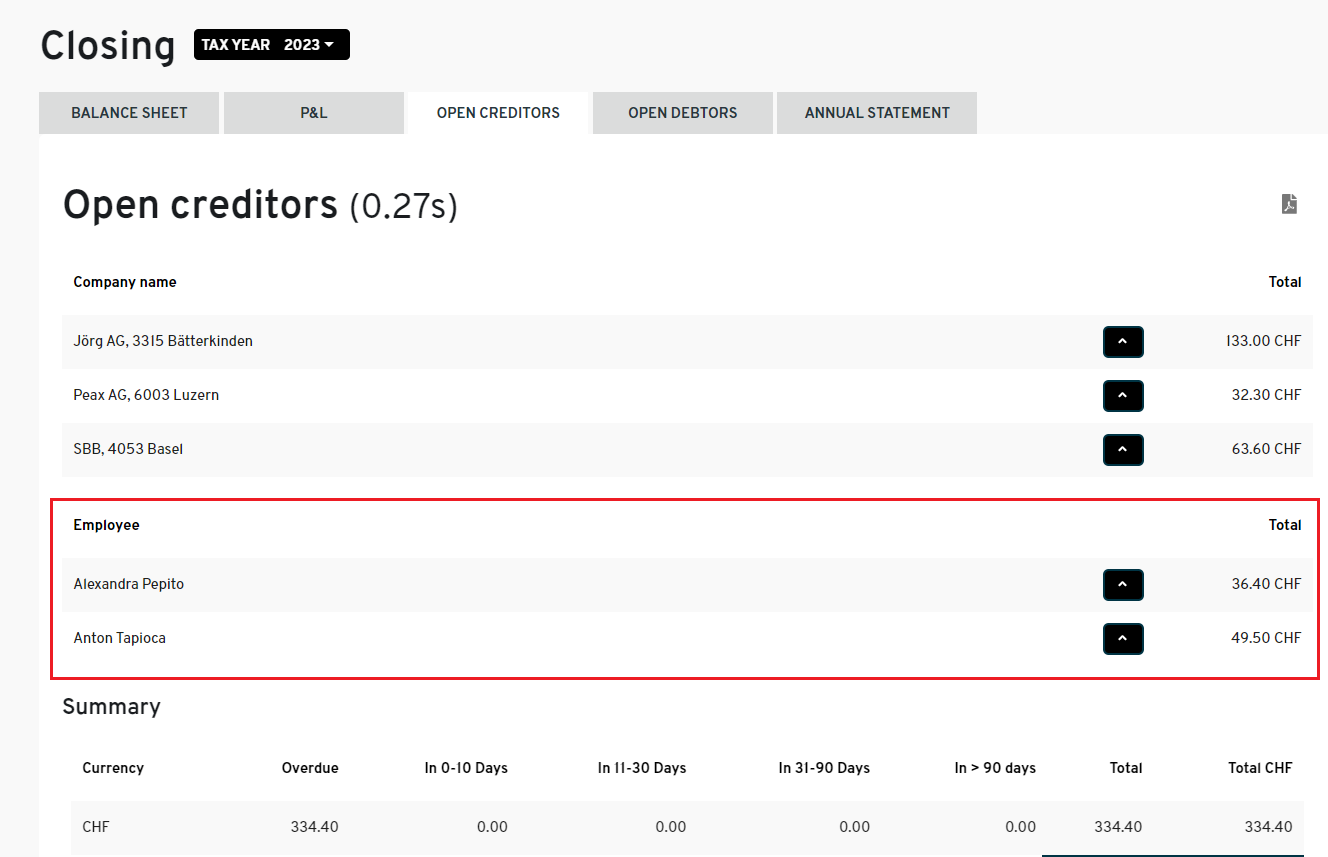

1. Expenses displayed under employee name in OP list

- Where:

- bookkeeping > closing > open creditors

- Changes:

- Expenses are now displayed under the employee’s name instead of the original creditor’s address

- Expenses are now displayed under the employee’s name instead of the original creditor’s address

- What is in it for me:

- This change provides a clearer and more structured view of the OP list

2. New option “employee outboarded” to add end date to all salary types

- Where:

- employees > edit employee > salaries

- Changes:

- A new button “outboard employee” is visible when an employee still has active salary types. When users click this button, they can select a date which will be set as end date for all the salary types which don’t have an end date or whose end date is after this chosen date

- A new button “outboard employee” is visible when an employee still has active salary types. When users click this button, they can select a date which will be set as end date for all the salary types which don’t have an end date or whose end date is after this chosen date

- What is in it for me:

- This makes it much easier to outboard an employee when it comes to salary set up, and reduces the risk of mistakes (forgetting to set the end date on specific salary types)

February/March 24

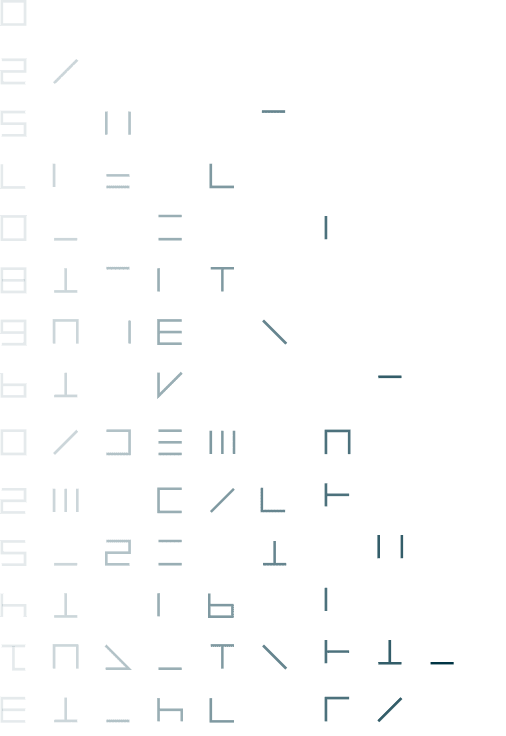

1. Filter by currency in Pay invoices menu

- Where:

- Finance > Pay invoices

- Changes:

- In order to generate payment files for creditor invoices and expenses, users must select only invoices from the same currency, so we introduced a new filter to search for items by currency.

- In order to generate payment files for creditor invoices and expenses, users must select only invoices from the same currency, so we introduced a new filter to search for items by currency.

- What is in it for me:

- Invoices/Expense payment is facilitated, manual/individual verification of the invoices’ currency is no longer needed.

2. UVG Report extension

- Where:

- Payrolling module > Reports

- Changes:

- The UVG report was changed to include the NBUV information (at the bottom of the report PDF), and the NBUV base was also added to the Recapitulation table at the bottom to complete this overview.

- The UVG report was changed to include the NBUV information (at the bottom of the report PDF), and the NBUV base was also added to the Recapitulation table at the bottom to complete this overview.

- What is in it for me:

- The UVG report as well as the recapitulation are now complete.

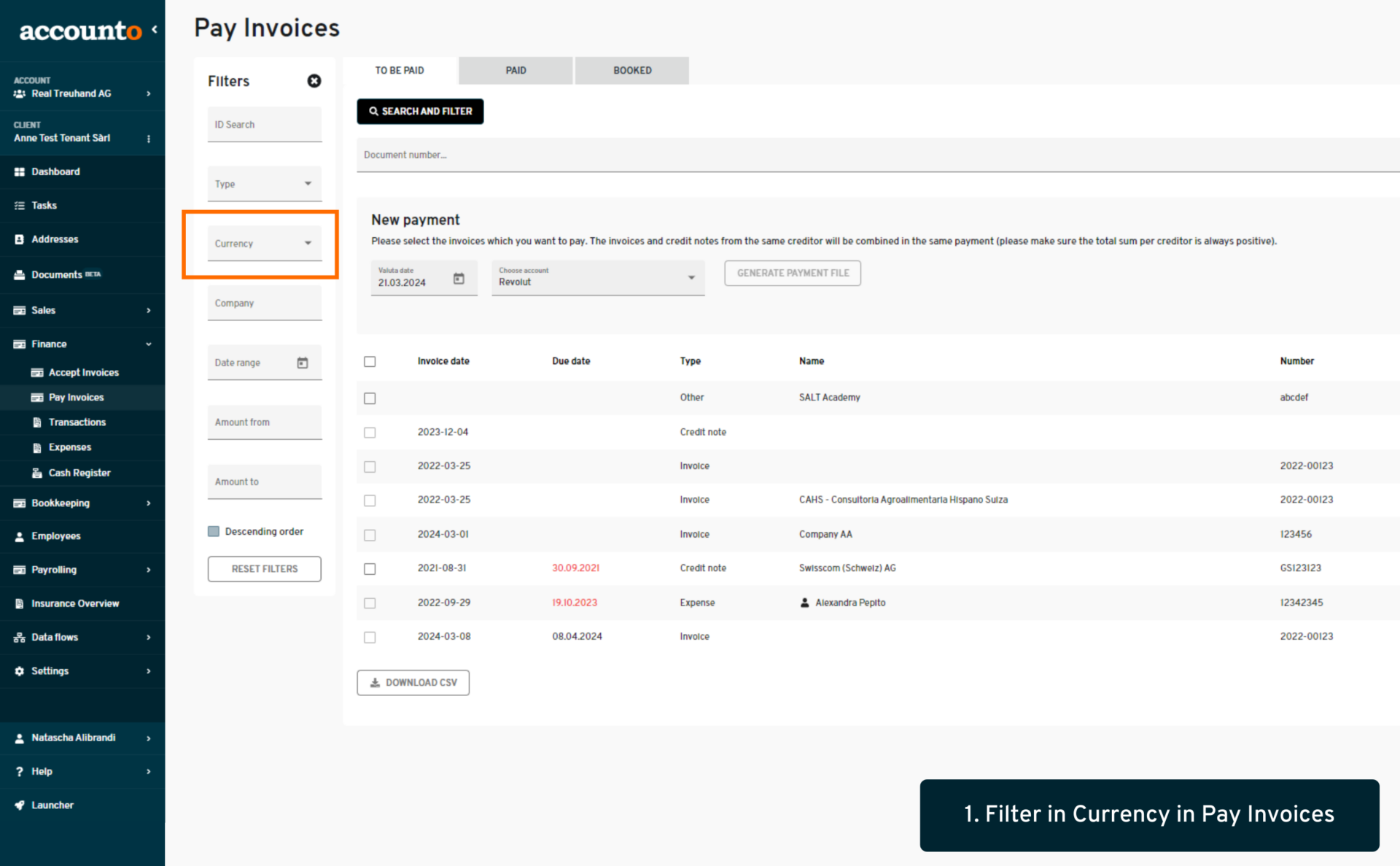

3. Button to copy user invitation link

- Where:

- Tenant > employees / Advisor > settings > users

- Changes:

- After inviting a new user to a tenant or an advisor, there is now an icon to copy the invitation link, so that if the invitation e-mail doesn’t arrive or is blocked in the user’s mailbox, the admin can simply copy the link and pass it to the new user directly.

- After inviting a new user to a tenant or an advisor, there is now an icon to copy the invitation link, so that if the invitation e-mail doesn’t arrive or is blocked in the user’s mailbox, the admin can simply copy the link and pass it to the new user directly.

- What is in it for me:

- This will empower admins in case the invited user’s mailbox is blocking incoming emails from Accounto.

4. Use Zefix API search to autofill new address modal

- Where:

- New documents detailed view

- Changes:

- When inputting a new address in the document detailed view, our connexion to the Zefix database automatically pre-fills the fields.

- When inputting a new address in the document detailed view, our connexion to the Zefix database automatically pre-fills the fields.

- What is in it for me:

- Increased efficiency as well as less risk of error when inputting an address.

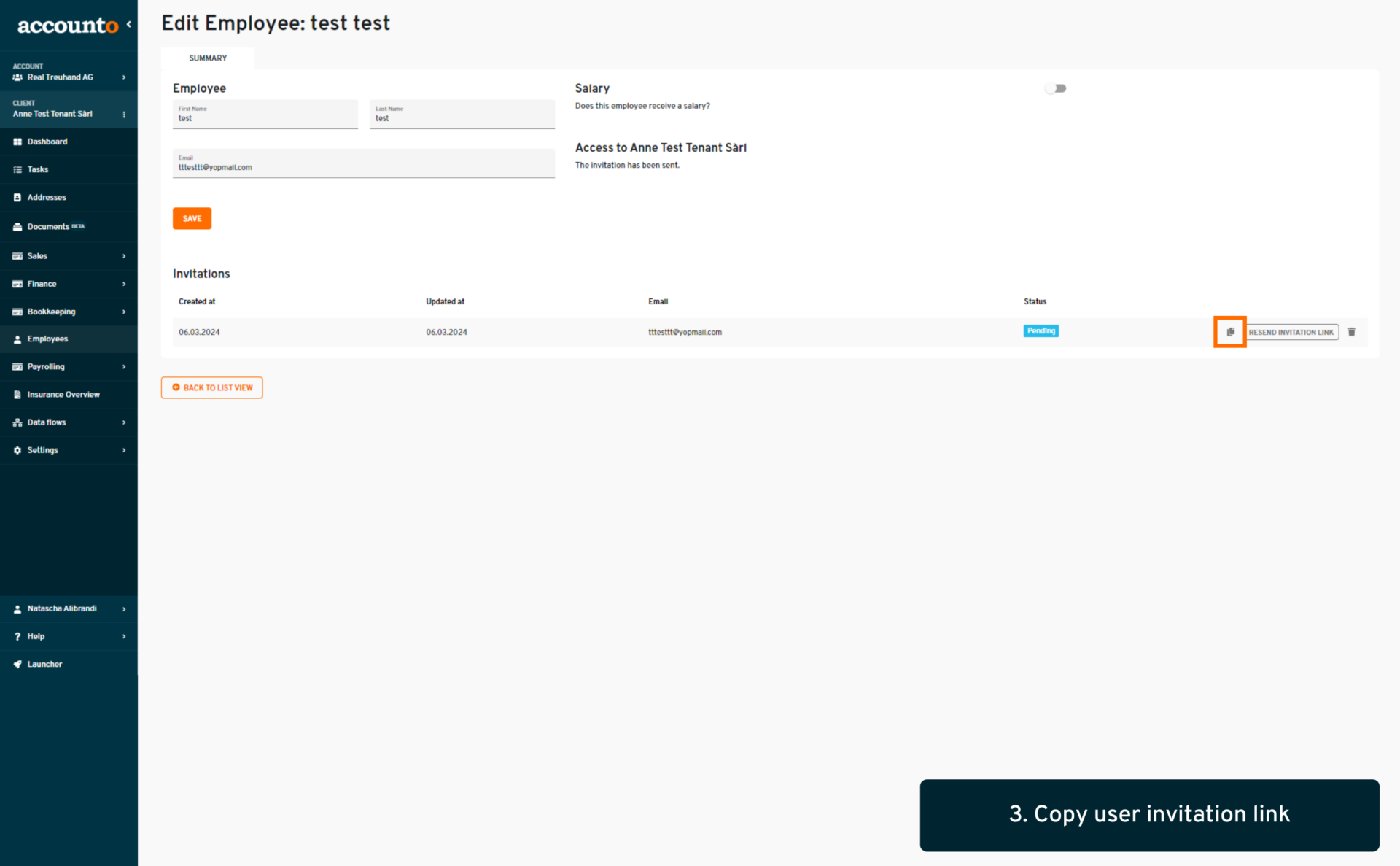

5. PEAX Integration – New setting for handling document type changes

- Where:

- Tenant > data flows > PEAX integration (for clients with active integration)

- Changes:

- There is a new setting which provides the option to have documents whose type has been changed to one that shouldn’t be synchronized through the API (e.g. changing from “receipt” to “other”, which shouldn’t be synced), either remain on Accounto or be automatically removed.

- There is a new setting which provides the option to have documents whose type has been changed to one that shouldn’t be synchronized through the API (e.g. changing from “receipt” to “other”, which shouldn’t be synced), either remain on Accounto or be automatically removed.

- What is in it for me:

- More options to adapt the workflow with PEAX to the tenant’s specific needs.

6. PEAX Integration – New setting for creditor approval

- Where:

- Tenant > data flows > PEAX integration (for clients with active integration)

- Changes:

- There is a new setting allowing clients to choose whether creditor invoices incoming via PEAX should go through the regular approval process (via “Accept invoices” menu) or be automatically approved.

- There is a new setting allowing clients to choose whether creditor invoices incoming via PEAX should go through the regular approval process (via “Accept invoices” menu) or be automatically approved.

- What is in it for me:

- Flexibility to adapt the PEAX workflow to the tenant’s specific needs.

January 24

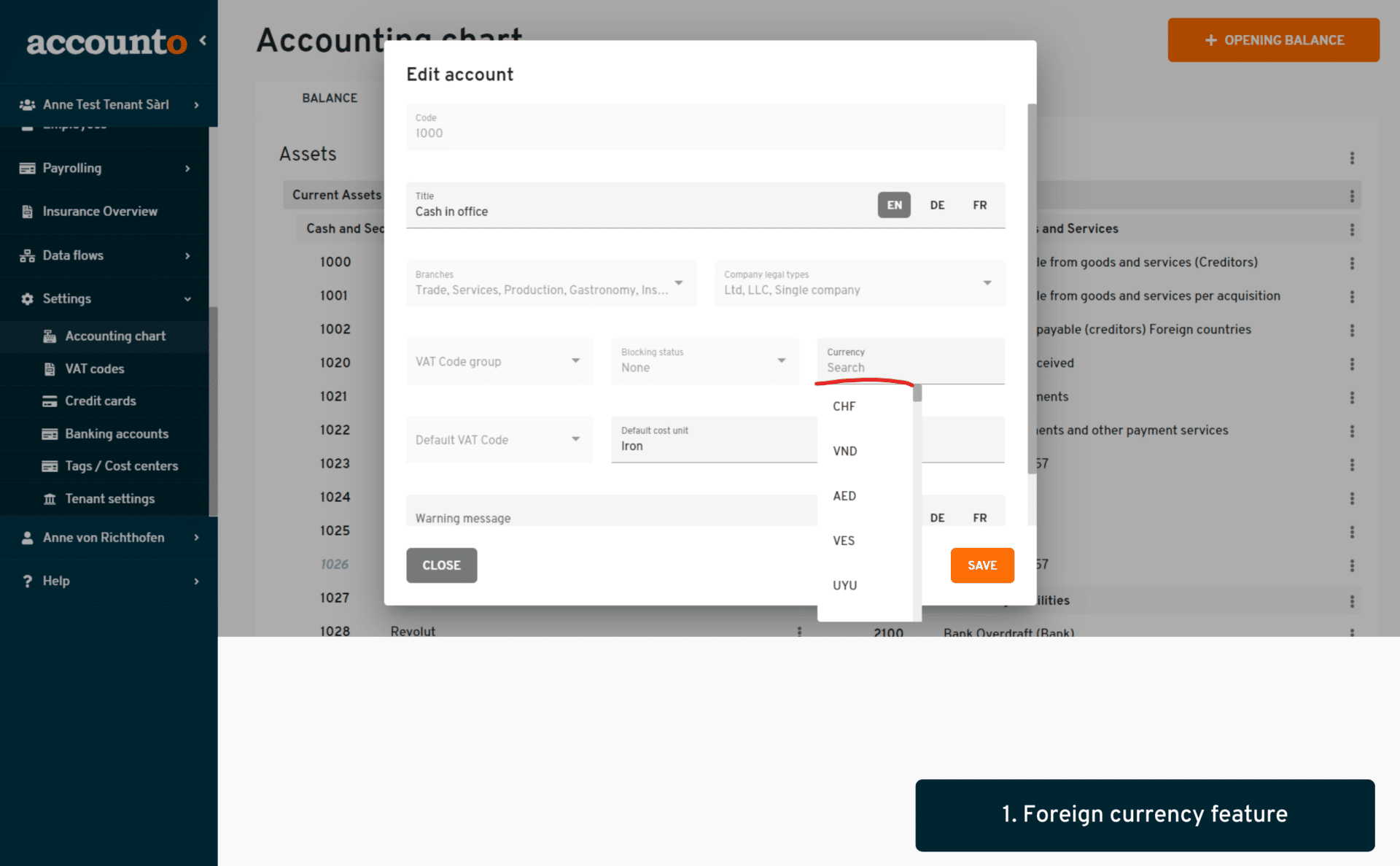

1. Forreign currency feature – accounting plan, opening balances and financial reports

- Where:

- Tenant settings > Accounting chart, and the entire Bookkeeping module.

- Changes:

- 1. When adding a new account or editing an existing account in the accounting chart, there is now a new field to choose the account’s currency.

- 2. When inputting the first opening balance within the accounting chart, users will have to input the balance in foreign currency (FC) as well as CHF for the FC accounts. Also, the accounts automatically created from bank accounts will also take that bank account’s currency as basis.

- 3. The account statements already display amounts in foreign currencies, but in addition the closing balances, the financial reports (balance and P&L) now calculate the numbers in the original currency as well.

- What is in it for me:

- This new feature enables clients and accountants to handle accounts in their original currency from the start, ensuring the rest of the operations related to these foreign currency accounts run smoothly.

2. 5th period VAT declaration

- Where:

- Bookkeeping > VAT declarations.

- Changes:

- The 5th period (or correction) VAT declaration is a new feature which enables advisors to do an overall yearly correction declaration after all 4 quarters (or 2 semesters) have been finalized. When this condition is met, a new button appears in the VAT declaration menu to add a correction declaration, this will take any not-yet-declared booking throughout the whole year to make a final declaration.

- The 5th period (or correction) VAT declaration is a new feature which enables advisors to do an overall yearly correction declaration after all 4 quarters (or 2 semesters) have been finalized. When this condition is met, a new button appears in the VAT declaration menu to add a correction declaration, this will take any not-yet-declared booking throughout the whole year to make a final declaration.

- What is in it for me:

- This is a necessary procedure as part of year-end closing operations, which we are making easy and simple to do through this new feature.

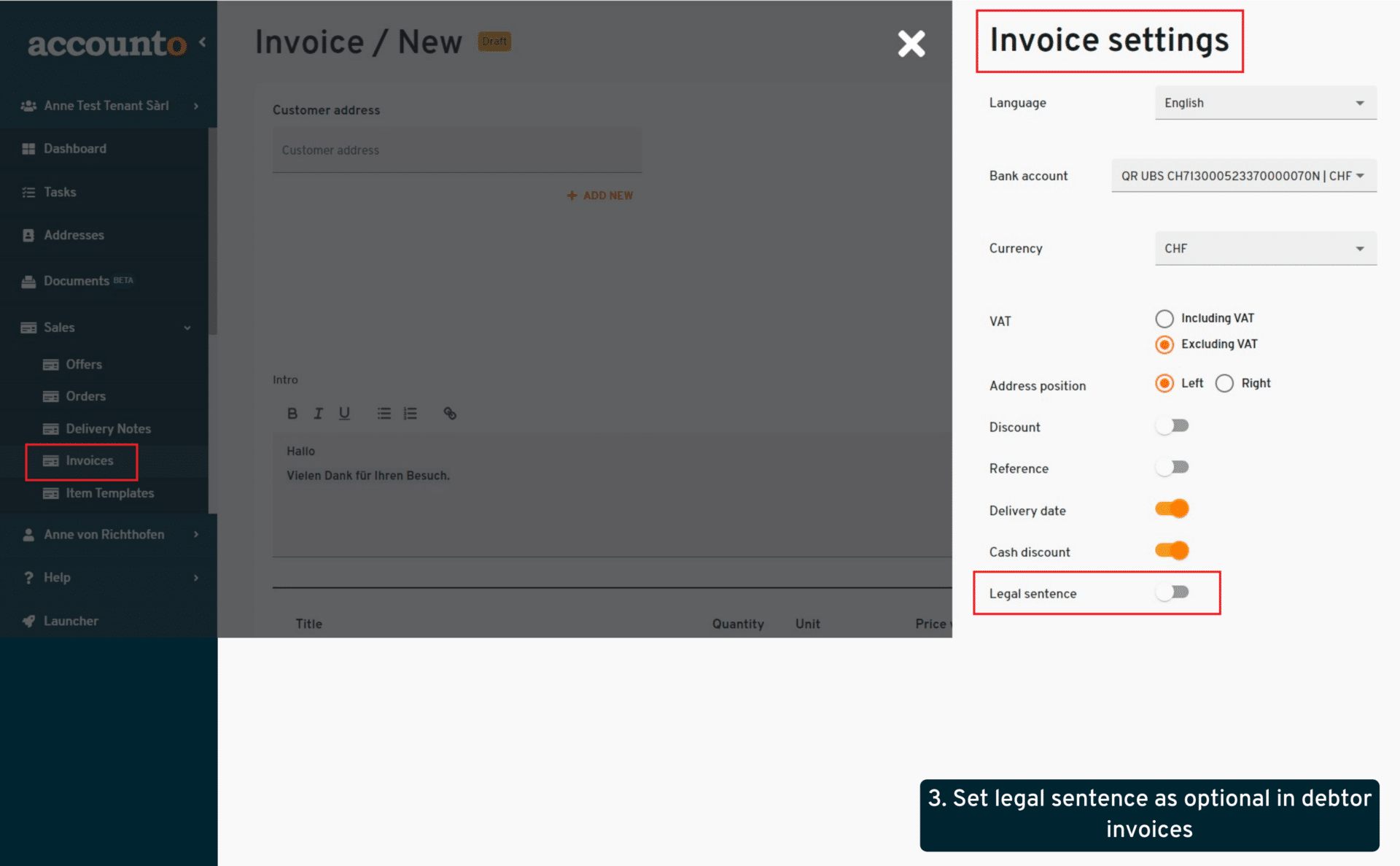

3. Set legal sentence as optional in debtor invoices

- Where:

- Sales > invoices.

- Changes:

- On debtor invoices generated via the Sales module, the legal sentence “The delivery date corresponds to the invoice date, if not specifically stated” is not optional, no longer mandatory. This option can be enabled or disabled via the invoice settings.

- On debtor invoices generated via the Sales module, the legal sentence “The delivery date corresponds to the invoice date, if not specifically stated” is not optional, no longer mandatory. This option can be enabled or disabled via the invoice settings.

- What is in it for me:

- Clients who don’t need this legal sentence for their business now have the freedom to remove or keep it based on their business’ specificities.

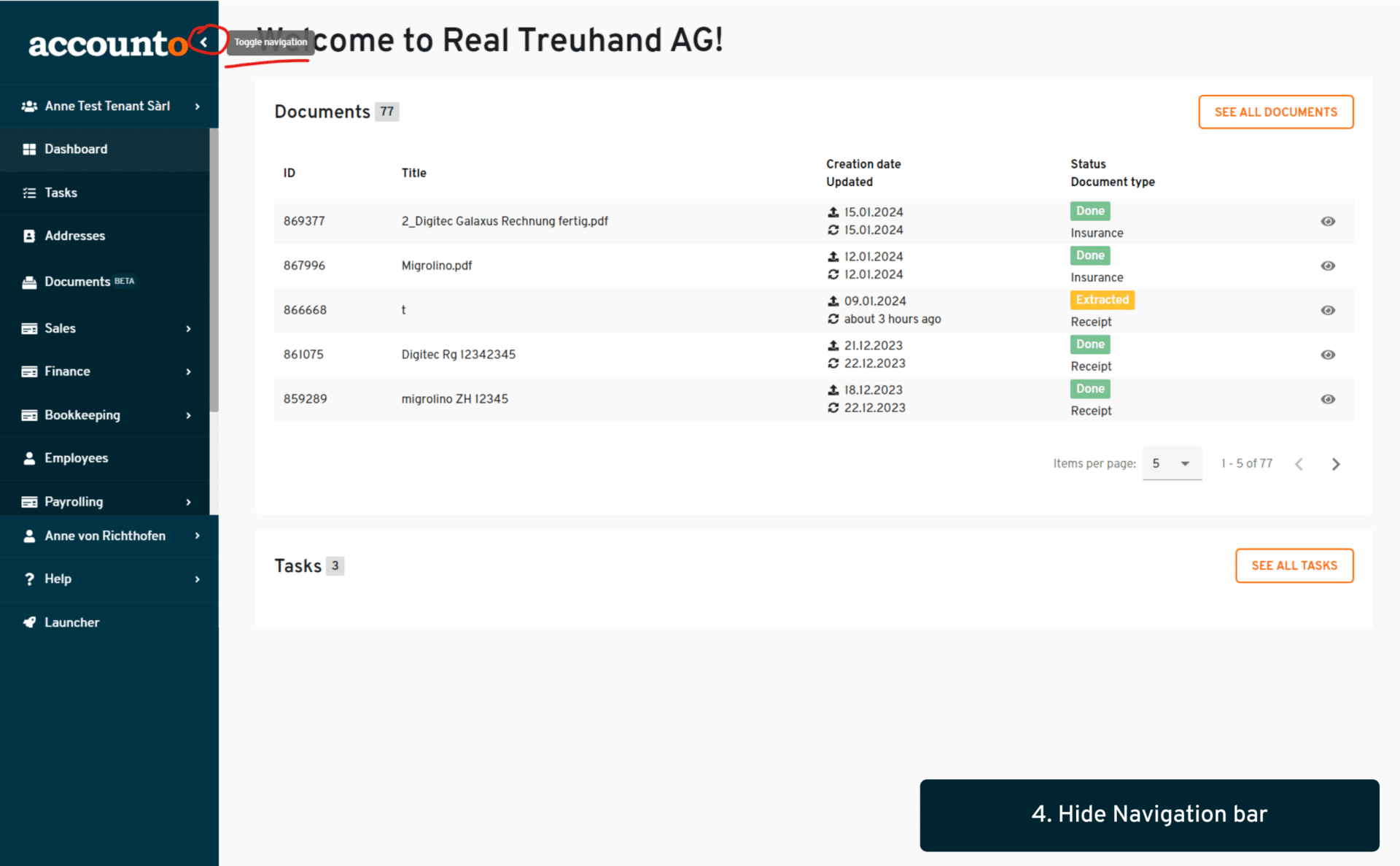

4. Hiding navigation bar

- Where:

- Allthrough the plattform.

- Changes:

- Users can now hide the entire navigation bar on the left side, through a new toggle button.

- Users can now hide the entire navigation bar on the left side, through a new toggle button.

- What is in it for me:

- The view is more convenient if a user has a small screen or wants to compare several windows next to each other.

Product releases in 2023

Week 50

1. Cost center navigation

- Where:

- Bookkeeping > cost centers (new menu)

- Changes:

- A brand new menu has been created, working similarly to the Account statements but filtering per Cost center instead of per Account. Users can navigate through the cost centers and do the appropriate operations and verifications.

- What is in it for me:

- As a user I now have a clear overview of my company’s or client’s analytical bookkeeping and can manage bookings efficiently with this dedicated menu.

2. Tab support in search autocomplete

- Where:

- All forms that have dropdown options throughout the platform (e.g. manual booking form)

- Changes:

- The function was added so that users can select options from a dropdown field by pressing the “tab” key on their keyboard after doing a search.

- What is in it for me:

- This is one step further in augmenting our client’s efficiency, one step more for our “keyboard-only” users.

Week 49

New authentication service

- Where:

- User login and registration

- Changes:

- To further increase security when working with Accounto, we are introducing a new authentication method from mid-December and switching to Auth0. From then on, the 2nd factor authentication (passcode sent via e-mail) will be mandatory for all users.

- What is in it for me:

- Auth0 is a proven solution for identity management that offers an optimal balance between security and user-friendliness. The new authentication system will improve customer experience through seamless sign-on, offering the right balance between user convenience, privacy and security.

Week 47

1. Advisor permissions on specific tenants – new option to select all

- Where:

- Advisor view > tenants list / Advisor > settings > users

- Changes:

- Small addition to the existing advisor permissions. Now instead of activating permissions individually, an “all” option enables all tenants (or all users) to be selected or unselected in 1 click.

- What is in it for me:

- Gaining much time especially when there are many tenants and/or many users to manage.

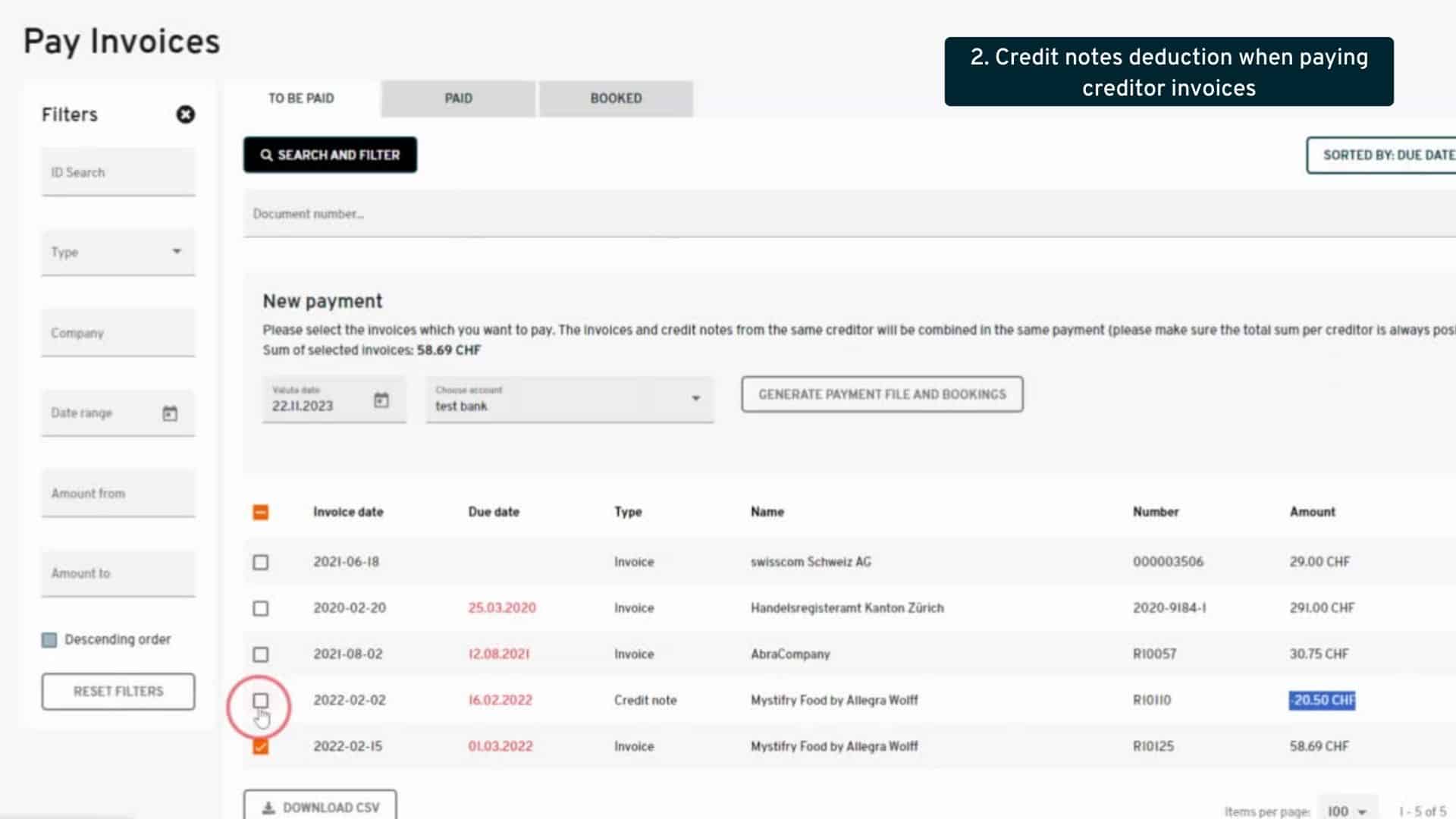

2. Credit notes deduction when paying creditor invoices

- Where:

Client view > Finance menu > Pay invoices

Changes:

Credit note amounts are now automatically deducted from invoice amounts from the same creditor, and creditor invoices from the same creditor are also combined together within the same payment.

What is in it for me:

This is a further step in automating our client’s processes, making invoice payment and credit note management seamless and efficient.

Week 45

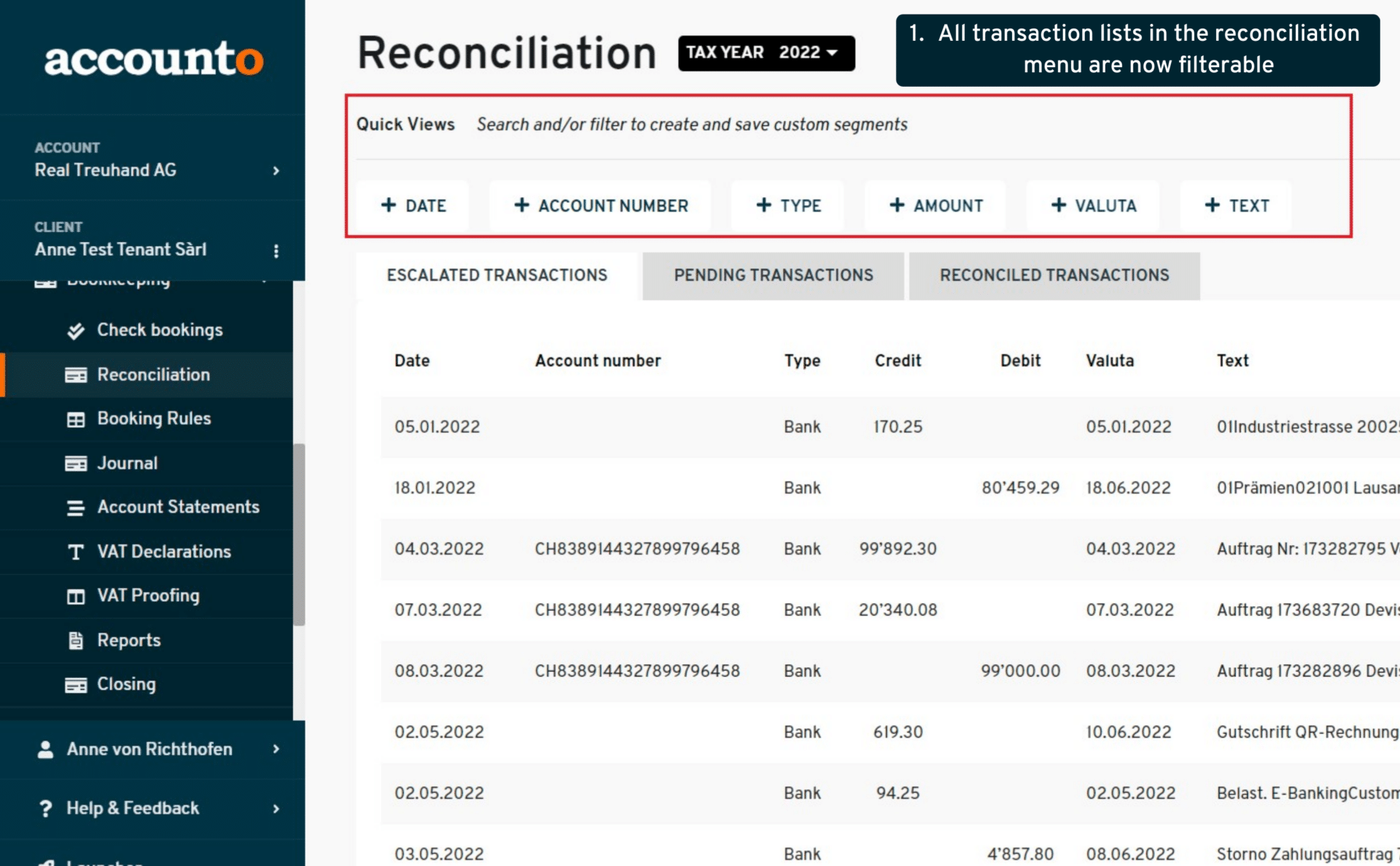

1. All transaction lists in the reconciliation menu are now filterable

- Where:

- Bookkeeping > Reconciliation

- Changes:

- In the reconciliation menu, all 3 tabs (escalated, pending and reconciled transactions) now have new filtering options and quick views.

- What is in it for me:

- As a user I am now able to search efficiently for transactions and order them according to my work habits by saving filters as “quick views”.

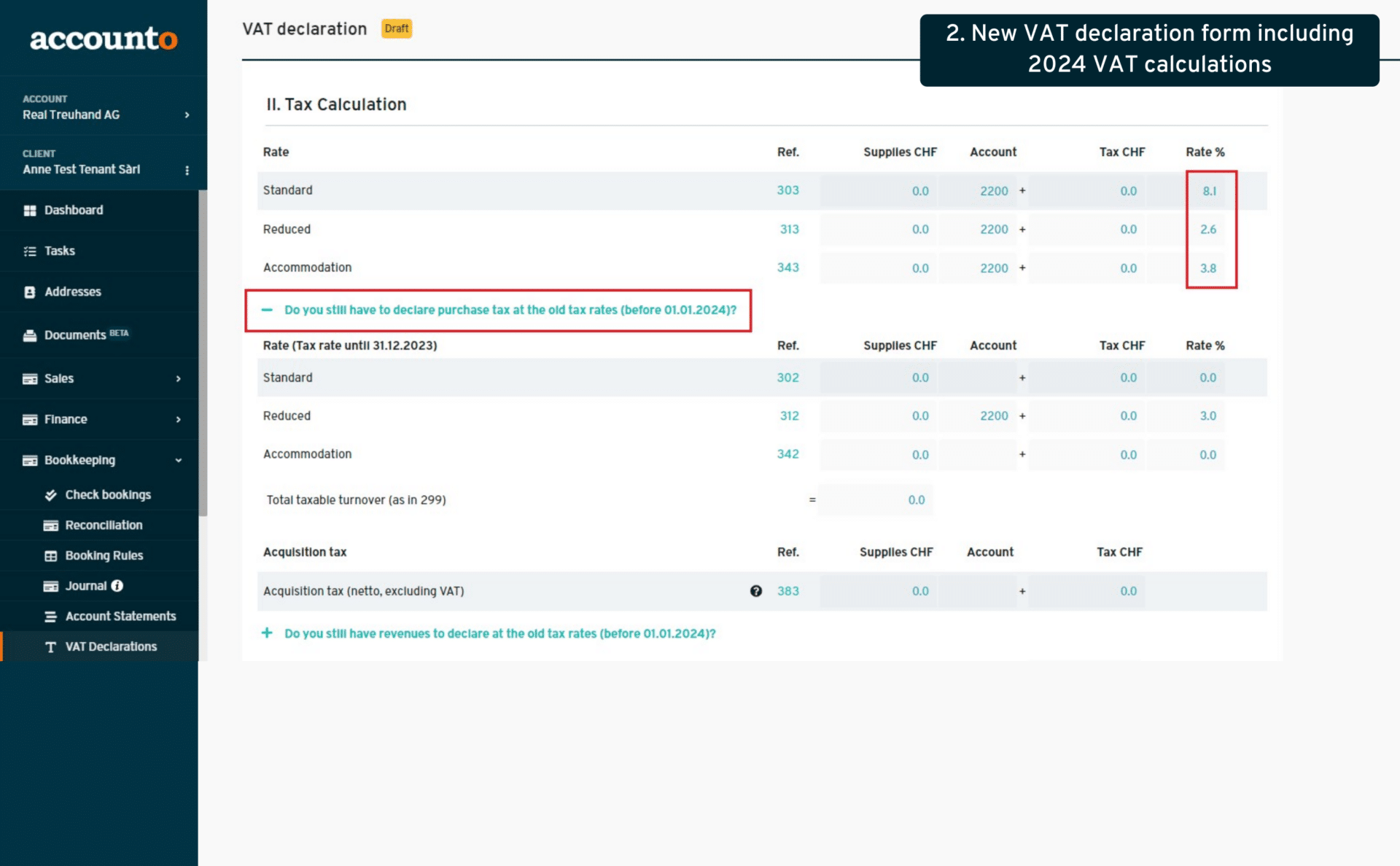

2. New VAT declaration form including 2024 VAT calculations

- Where:

- Bookkeeping > VAT declarations

- Changes:

- The new 2024 VAT codes (8.1%, 2.6% and 3.8%) are now taken into the VAT declaration form automatically according to the selected period.

- What is in it for me:

- As a user I can now proceed with doing my VAT declarations automatically in the Accounto system from Q4 2023/S2 2023.

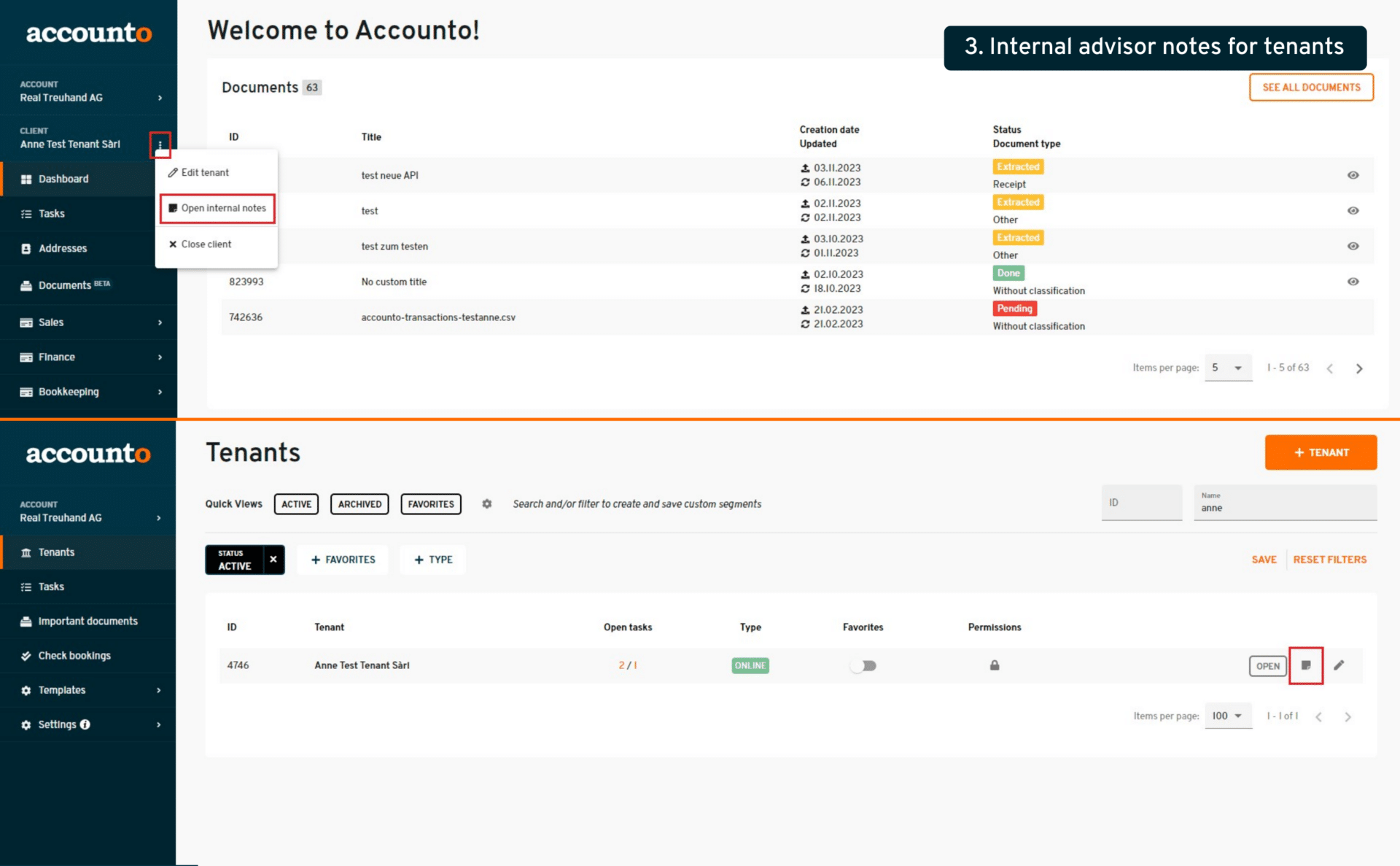

3. Internal advisor notes for tenants

- Where:

- Advisor level > Tenants list view / Tenant level > Dashboard

- Changes:

- In both places there is now a new option to edit an internal note (can only be seen by the advisors, not the SME users). There is 1 note per tenant.

- What is in it for me:

- As an advisor I now have a place where I can save my client’s specificities in terms of accounting / mandate management, so that others within the fiduciary company can also have easy access to this information. Note: This isn’t visible to clients, only to fiduciary users.

Week 40

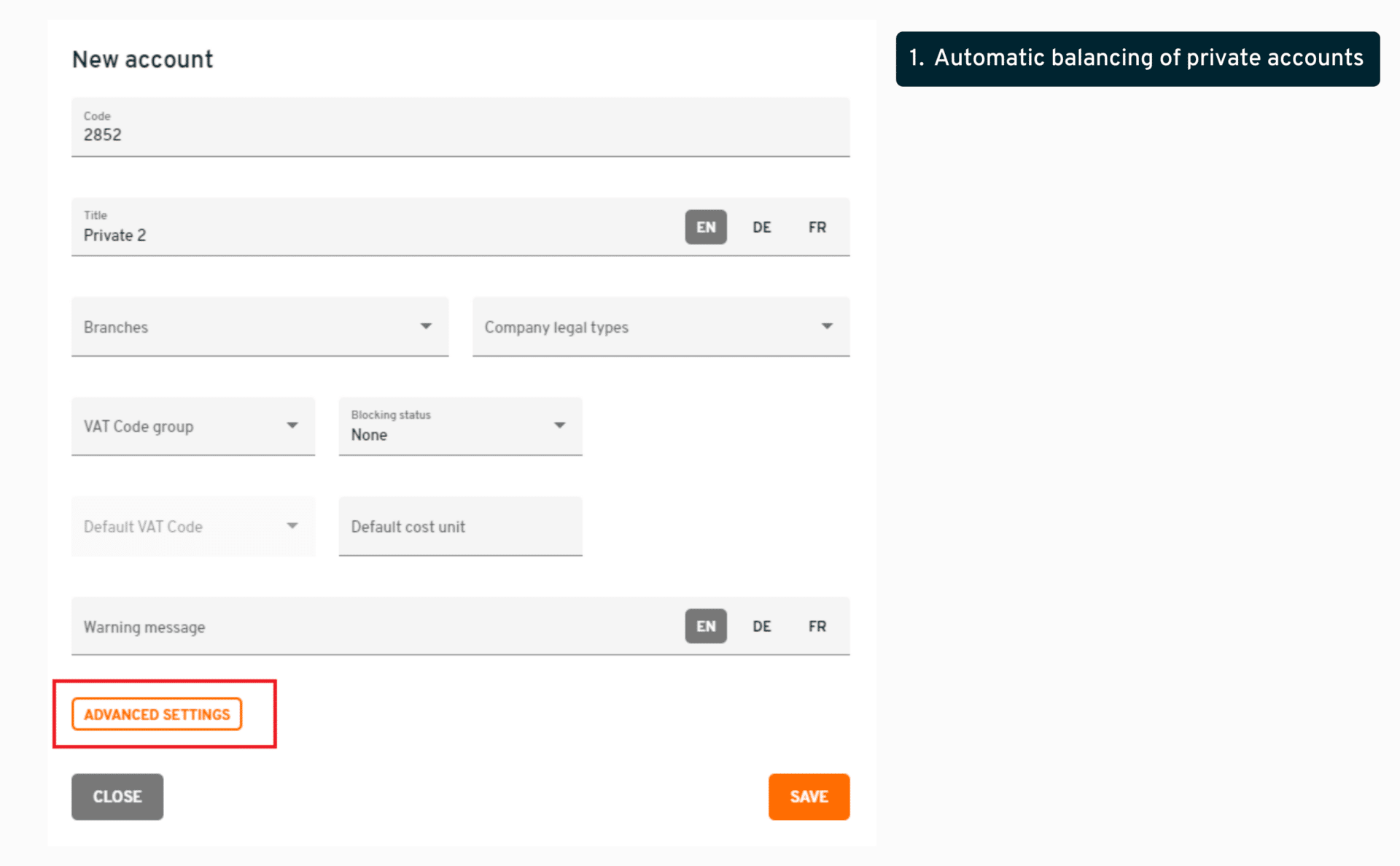

Automatic balancing of private accounts

- Where:

- Client settings > Accounting chart

- Changes:

- A new function is available, to automatically balance designated (private) accounts at the end of the year. To use the function, accounts need to have the setting “Balancing” activated from the accounting chart

- How to activate it:

- Go to > Settings > Accounting chart, under the “Equity” category (28’s accounts), either create a new account or edit an existing account (it must be empty of bookings). Click on the button “Advanced settings”, there you can set-up the balancing function. The account will thus be balanced automatically with every change (adding, updating or removing bookings).

- What is in it for me:

- As an advisor, this function will make me gain precious time when doing end-of-year closing operations. Accounto makes repeated operations automatic for our client’s greater comfort and efficiency!

Week 37

1. New way of presenting documents in the reconciliation module

- Where:

- Bookkeeping > Reconciliation > Manual reconciliation of transactions

- Changes:

- In the list of possible matching documents for a transaction, the “details” button has been renamed to “check bookings” and when clicking it, now a pop-up window opens where the document’s bookings are visible and editable.

- What is in it for me:

- As a user I can now modify the document’s bookings directly from the reconciliation module if needed, this provides me with more flexibility and a faster workflow.

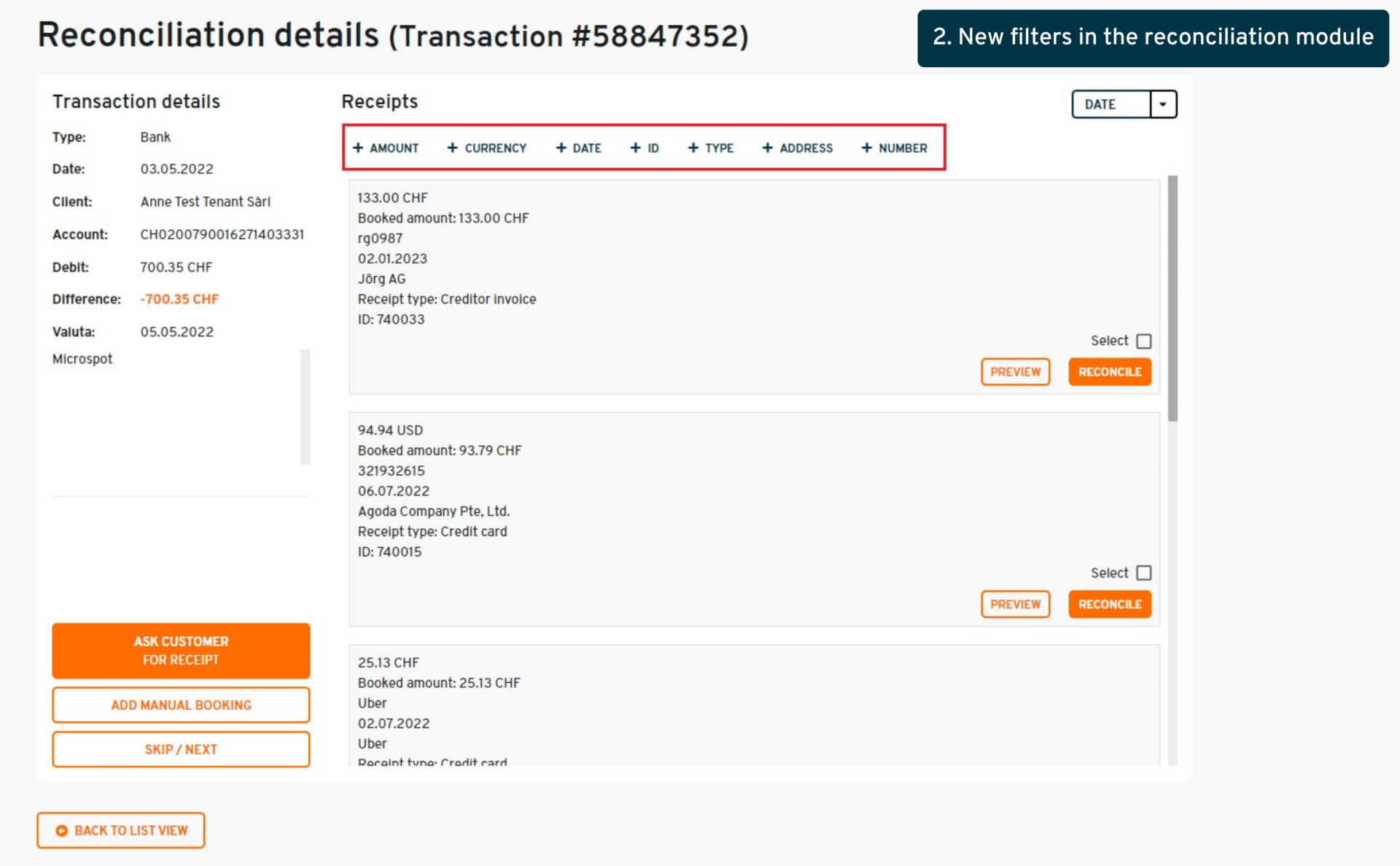

2. New filters in the reconciliation module

- Where:

- Bookkeeping > Reconciliation > Manual reconciliation of transactions

- Changes:

- The manual transaction reconciliation module now has many filters (amount, date, document ID or type, text search, etc.) to efficiently search for the corresponding document.

What is in it for me: - As a user I now have many tools to help me find the correct documents when manually reconciling a transaction, this helps me gain time and efficiency.

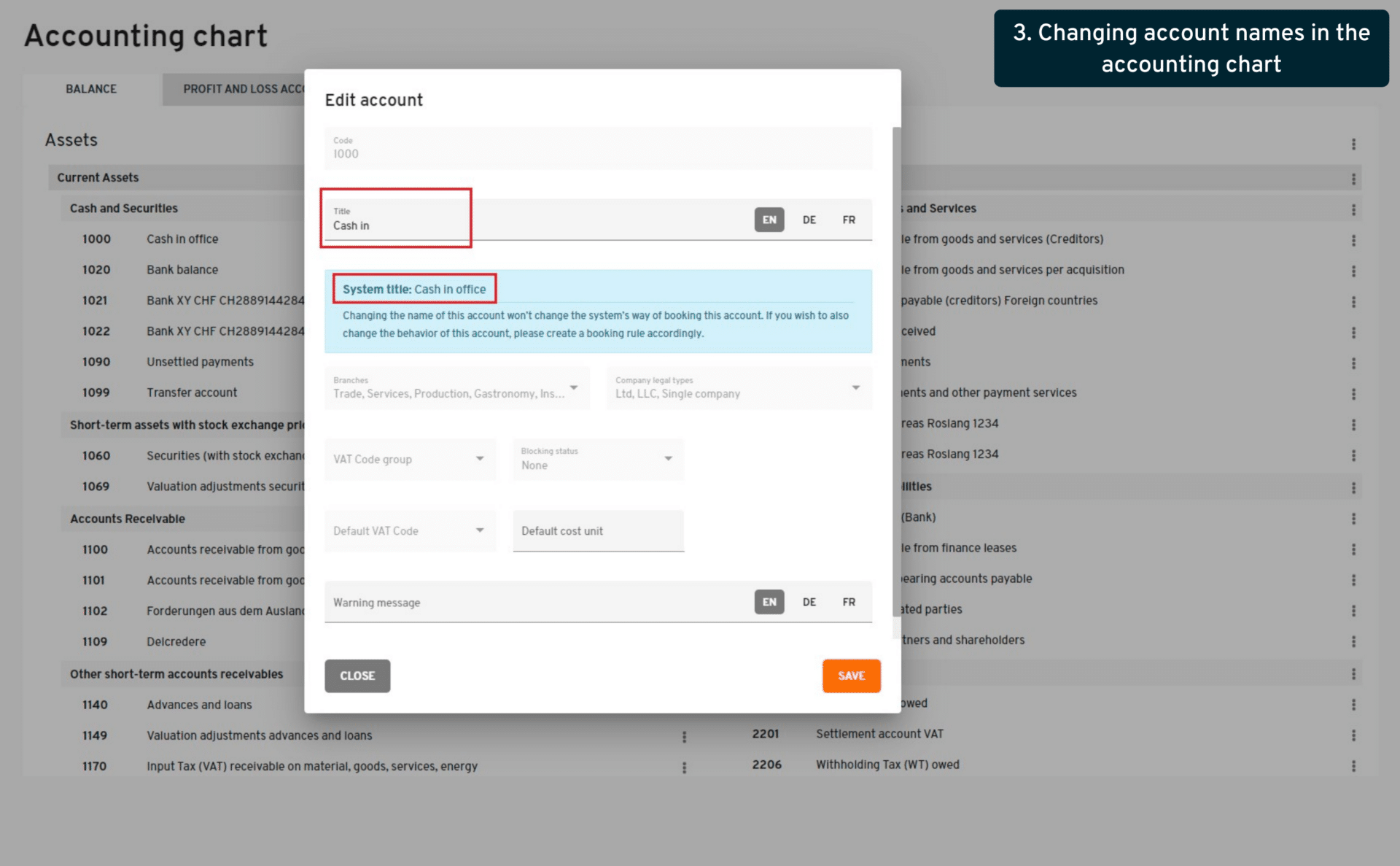

3. Changing account names in the accounting chart

- Where:

- Settings → Accounting chart → Edit account

- Changes:

- It is possible to rename system accounts and give them custom names. When doing so, all the reports (balance, P&L, etc.) will have this new name. In the “Edit account” view, the original account name is still displayed for information.

- What is in it for me:

- As a user I can now manage my firm’s accounting chart more freely, change any account’s name and still see the original account name, as the system will still book automatically the same way as before.

Week 36

1. Booking rules tooltips

- Where:

- Bookkeeping > booking rules

- Changes:

- The booking rule interface now has now more explanations and examples to make its use and possibilities clearer

- What is in it for me:

- As a user I am now able to understand each button and function and I can create booking rules in an easier and more efficient way

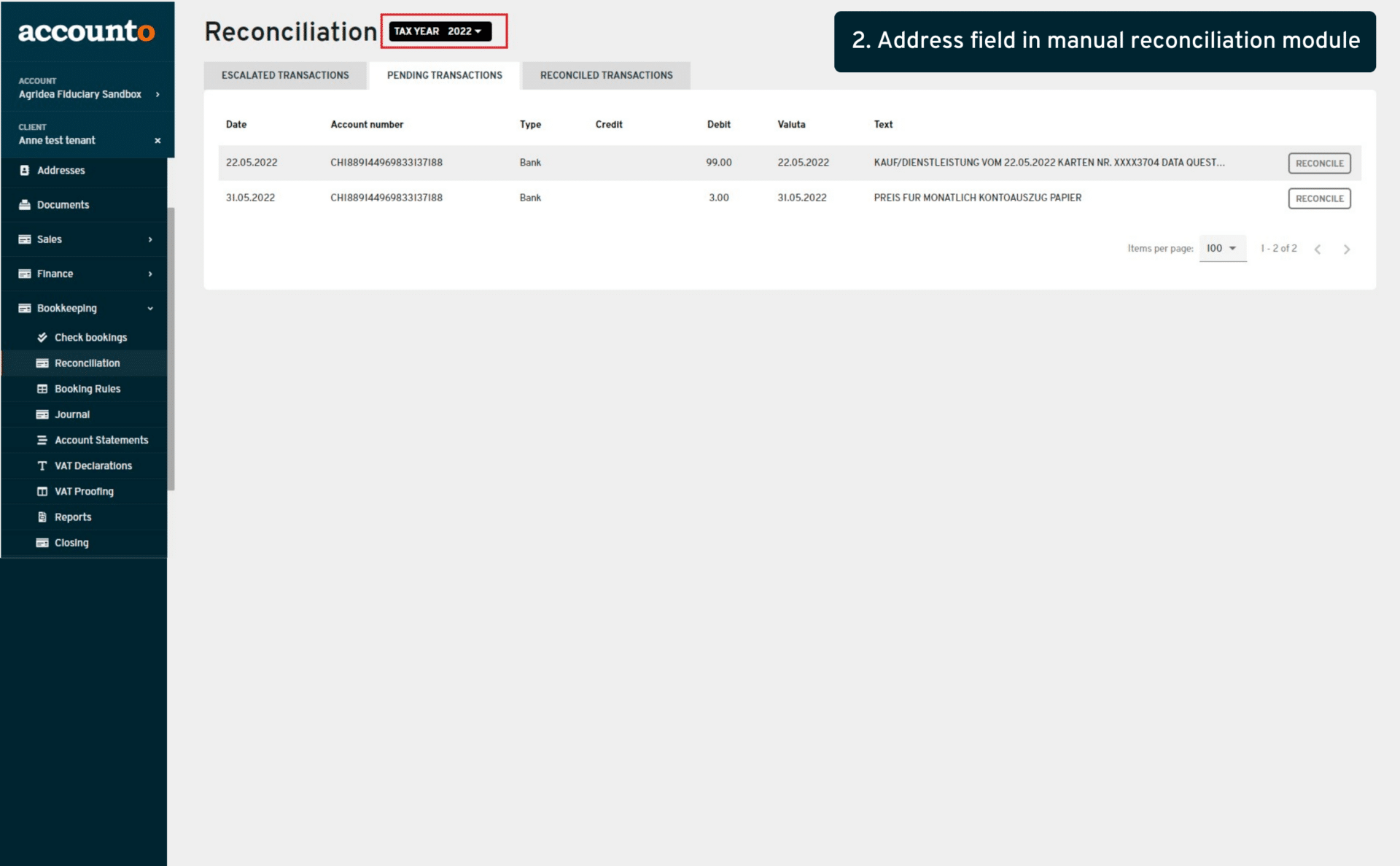

2. Address field in manual reconciliation module

- Where:

- Bookkeeping > reconciliation

- Changes:

- When manually reconciling a transaction without a document (creating the booking directly), users can now attribute an address to the booking

- What is in it for me:

- As a user I am now able to consistently attribute addresses in all relevant places including transaction bookings, and I can filter by them in the journal, account statement, and manage them efficiently

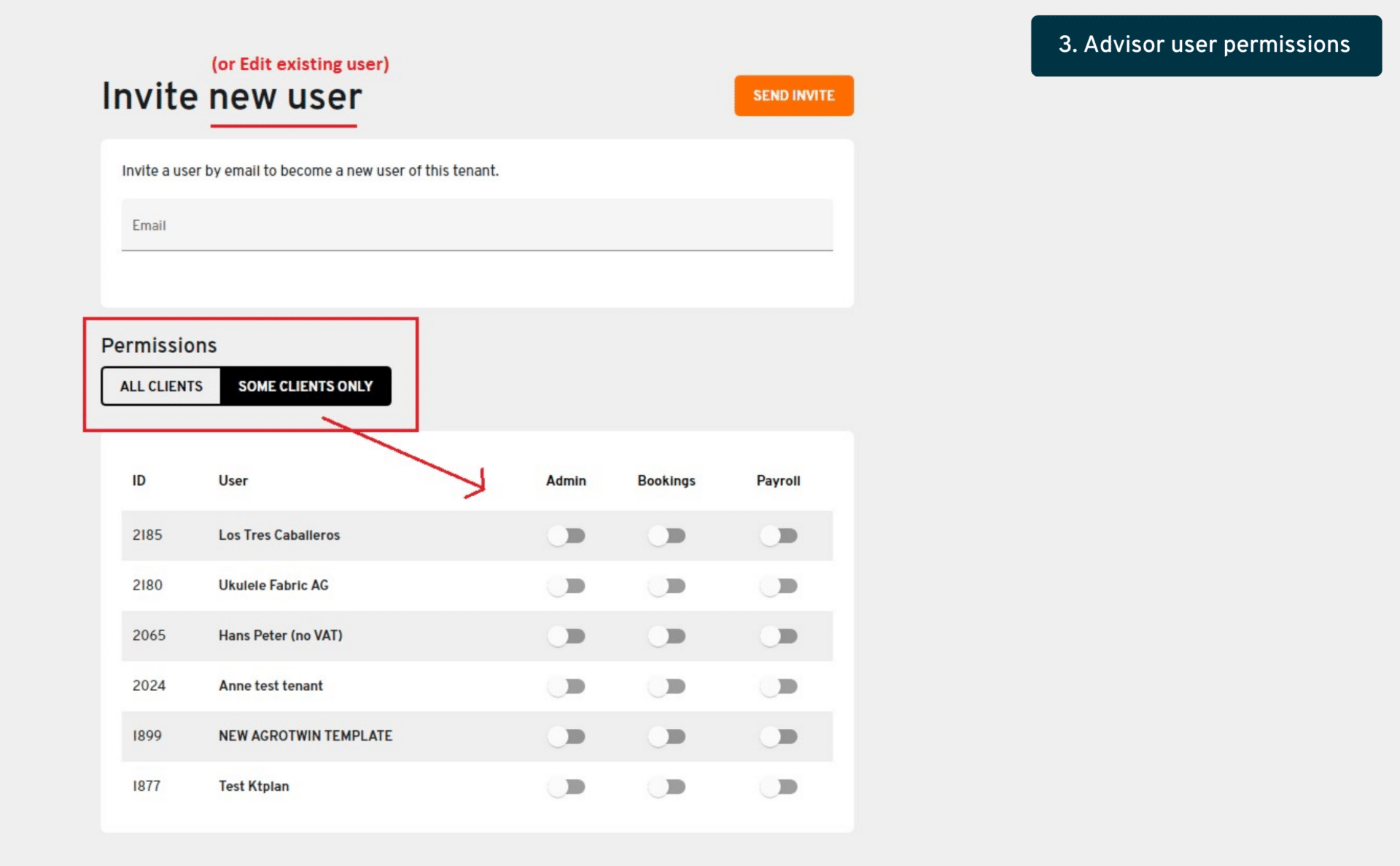

3. Advisor user permissions

- Where:

- Advisor suite > settings > users

- Changes:

- Advisor admins can now attribute much more specific rights to their users (seeing only certain modules), and restrict their access to specific tenants

- What is in it for me:

- As an advisor admin user, I am now able to manage my employee’s rights to which clients they should see or should not see, and restrict their access to certain modules only, if I wish. Thus I am more flexible in my client and confidentiality management.

4. Global tax year selector

- Where:

- Many menus (wherever there are dates involved, e.g. transactions, journal, payroll runs…) on the client level

- Changes:

- Now there is a global filter for the tax year, which is saved for each user according to their usage (e.g. I was working on 2022, so all filters will be set on 2022 automatically for me). Note that this global filter does not replace the old filters, they can still be used if needed, the global filter would be deactivated in this case.

- What is in it for me:

- As a user I gain efficiently by having all my views consistently adapted to the same tax year, following automatically my preferred parameters

Week 35

1. Transitory actives and passives

- Where:

- Journal and account statements

- Changes:

- New function (”accrual” button), now visible in the manual booking form, which will create an automatic reversal of the booking on given date

2. Journal adjustment display of postings

- Where:

- Journal

- Changes:

- Instead of the “debit account” and “credit account” columns, we are now displaying accounts the same as in the account statements, with “account” and “counter account” and postings accounts are now correctly displayed

3. Cost center/tag settings renaming

- Where:

- Settings > tags

- Changes:

- We have renamed this menu from “tags” to “tags/cost centers” and added tooltips so it is now clear that this section is used both for setting up tags and cost centers

4. Display document ID in the reconciliation

- Where:

- Reconciliation menu

- Changes:

- We have added the information about the document/invoice ID in the reconciliation menu

5. New VAT rates 2024

- Where:

- Settings > VAT codes (and all places related to VAT)

- Changes:

- The new VAT rates for 2024 (meaning 2.6%, 3.8% and 8.1%) are now available in our tenant templates and will be synchronized shortly onto all existing tenants

Until week 35

1. Some changes in tab names

- Where:

- Bookkeeping menu

- Changes:

- Some of the tabs names are now more clear for users

2. Annual statement system templates synchronization

- Where:

- Advisor suite/annual statement

- Changes:

- Now when enabling the feature flag “advisor annual statement”, our 23 system templates directly appear in the advisor’s template menu

3. VAT codes removal in booking rules

- Where:

- Booking rules

- Changes:

- Now there is an option (tickbox) to remove the VAT rate (before you could only change to a different VAT rate but not remove completely)

4. Open debtors/creditors more information

- Where:

- Closing > open debtors / open creditors

- Changes:

- Now the list shows booking numbers of the open positions, as well as the “eye” icon to be able to see the document, doc ID and change bookings if needed

5. Display of VAT calculation rate in several views

- Where:

- Journal, account statements, manual bookings (among other places)

- Changes:

- If a booking has a VAT rate whose declaration rate is not the same (e.g. 0% VAT rate and 7.7% declaration rate), both are now displayed in the relevant views

6. Unreconciling transactions change & bulk unreconcile

- Where:

- Finances > transactions

- Changes:

- Instead of the “trash can” icon, now there’s a button “unreconcile” to unreconcile single transactions, as well as a tickbox to select several transactions and unreconcile them in bulk (please note that more changes will come later on)

7. Reconciliation assistance: matching document at top of the list

- Where:

- Reconciliation

- Changes:

- Now the matching document (highlighted in orange) is displayed on top of the list

8. Reconciliation assistance: if document is an expense, display employee name

- Where:

- Reconciliation

- Changes:

- In the documents list in the recon, when a document is of type “expense”, we now display the employee’s name