“Hey Siri, please open Accounto’s latest blog post.” You probably didn’t get to our latest blog post that way. Not yet, one would have to add. Because what was considered an entertaining gimmick some time ago is now finding its way more and more into our everyday lives. Companies are also increasingly discovering the potential of chatbots and other tools. With the help of these digital tools, simple and cost-intensive customer conversations can be automated. But are these technological possibilities also something for the extreme relationship-intensive fiduciary sector?

The sense and nonsense of digital assistants

Virtually all large companies now use chatbots to answer simple and standardised customer enquiries automatically. Intelligent voice assistants are also increasingly working through simple customer concerns. For example, the voice assistant of the St. Galler Kantonalbank can automatically answer simple queries about account balances or personal spending (even in a St. Gallen dialect!). Such success stories are increasingly tempting companies to invest even more in the automation of customer dialogues.

What appears to be perfectly logical for many large companies with a broad client base is not likely to be particularly effective for the fiduciary sector. Because chatbots & co. are still relatively stupid today. They may be able to solve a specific problem from a customer, but they do not yet recognise potential cross-selling and up-selling opportunities, for example. But it is precisely the seizing of such business opportunities that distinguishes a client-centred and, above all, successful fiduciary company.

Digital tools should therefore primarily support fiduciaries in being able to focus on the really relevant client discussions. Consequently, the aim is to automate or simplify meaningless customer dialogues. If used in a targeted manner, technological options can provide a remedy here. But as a small fiduciary office, investing vast amounts of money in individual applications such as chatbots hardly makes business sense. Instead, an all-in-one solution is sought with which processes and customer interactions can be cleverly automated or simplified.

What are important client dialogues in the fiduciary business anyway?

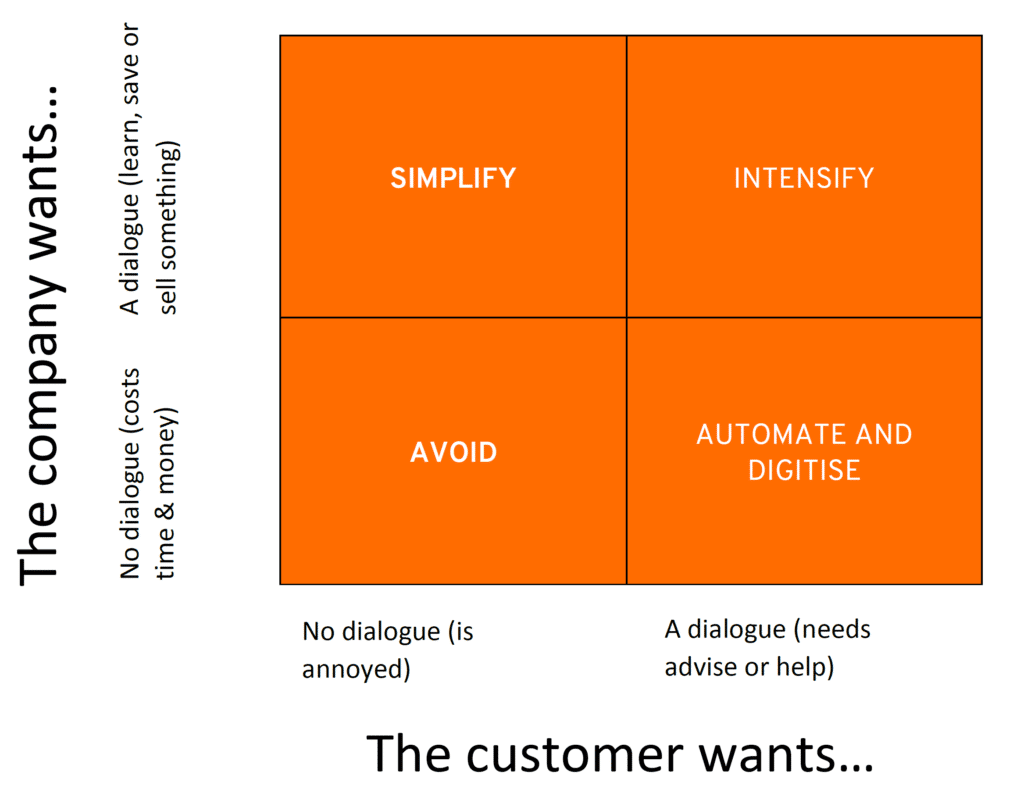

You may now be asking yourself how you can distinguish between meaningless and value-adding customer dialogues. This differentiation is extremely trivial. Because only those who recognise the important customer conversations can also optimally automate or simplify them. The analysis tool recommended for this purpose is Bill Price’s Value-Irritant Matrix. With the matrix, all customer dialogues can be classified into four quadrants, from which you can ultimately derive four strategies. The figure below shows the corresponding matrix with the four proposed action strategies.

As you can see from the figure, the model takes into account both the customer and the company perspective. The vertical axis represents the company’s point of view. Companies are therefore always interested in a customer dialogue if they can learn something about the customer or sell something to him. The needs of the customers are mapped on the horizontal axis. As a result, the customer wants to interact with the company when they need help or advice.

The multi-perspective approach is considered a great strength of the matrix, as it paves the way for customer-centred and at the same time cost-oriented measures. In principle, the model can be applied to any industry, which means that the fiduciary industry can also benefit from it. Let’s test this briefly with a few examples.

Avoid telephone calls due to missing receipts

You are booking the expense report from your client and suddenly realise the following: the hotel bill for the seminar attended in Paris is missing. For proper bookkeeping and correct VAT accounting, you absolutely need this receipt. That’s why you probably can’t avoid asking your customer directly. The customer, however, is likely to be only partially happy about the call. After all, who likes looking for receipts that have disappeared during working hours? Probably nobody.

Such conversations are not pleasant for you or the customer. If such interactions accumulate, this has a negative impact on the customer experience and ultimately on customer loyalty. So you would do well to proactively avoid unnecessary dialogue. Intelligent Software products like those from Accounto can support you here. SMEs submit their receipts digitally and promptly using the application. This reduces queries to an absolute minimum and optimises the overall customer experience.

Automate the retrieval of bank holdings

You have a client like that. He actually calls you ten times a month to check his current account balance. Of course, you have to log in to e-banking each time to be able to communicate the relevant information. That costs time. Valuable time, but you can hardly charge the customer for it. But how do you get such a customer to adjust his behaviour? This probably only succeeds if the alternative seems easier and faster to him.

At Accounto, we are working to fully automate the response to simple customer queries. This means you no longer have to worry about mundane customer enquiries and can focus entirely on your core business. Thanks to optimal interface processes, SMEs can, for example, already view the current balances of their bank accounts directly in the Accounto app retrieve.

Simplify work for the annual financial statement

While many sectors start the new year at a leisurely pace, you’re in the thick of things at the turn of the year. Graduations are just around the corner and with them many unanswered questions. How many employees does the company have now? Were there any events after the balance sheet date? And are the transitory items actually complete? All questions that probably sound familiar to you and are absolutely justified.

Of course, most customers understand all the questions (after all, you want a clean deal). But recurring phone calls and emails cost a lot of time, which is why this could annoy customers. The primary goal is to simplify this important dialogue for your customers. Digital task lists offer a possible approach here.

With digital to-do lists, you can coordinate your final tasks and complete them efficiently. You enter the required information in a digital list. If the customer has a free minute, he can work through the open items on the list and also ask questions as the situation requires. In addition, the client always has an overview of the work progress, which increases transparency and thus fiduciary.

Intensify value-added advisory services

In the three previous practical examples, customer dialogue was optimised thanks to technological support. This means that your fiduciary can now focus fully on those discussions in which both parties have an interest. These dialogues take on a central role, as they offer an extremely large Potential lies in them.

At a final meeting, you learn, for example, that the client wants to open a branch office in French-speaking Switzerland. If you react correctly now and advise the customer competently, you can soon look forward to an interesting and, above all, lucrative order. With Accounto, you have the necessary capacities to explicitly focus on such profitable orders and conversations.

You no longer use your energy and time for pointless email ping-pong, but for high-quality advisory services. This increases customer satisfaction and ultimately customer loyalty. For SMEs, this means that you increasingly slip into the role of an external CFO who accompanies his clientele in all business management issues. We will go into more detail about this CFO advisory approach in the next blog post – so stay tuned!

The bottom line on digital client dialogue in the fiduciary industry

To close the loop for today, I ask Siri again: “What do we learn from this blog post?”. With the Accounto’s solution, you can digitalise the customer experience in a targeted manner without wasting valuable resources on chatbots & co. You automate and simplify where it actually makes sense for your clients and your fiduciary company. This allows you to focus on value-added counselling sessions, which strengthens your position in the market.

If you would like to learn more about us and our product, then be sure to contact us! We look forward to getting to know you better very soon. For the latest news about Accounto, subscribe to our monthly newsletter. Interested in more exciting topics about the fiduciary industry of the future? In our Blog you will find everything about the digital fiduciary company.